Daily Comment (August 19, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning on the 30-year anniversary of the Soviet coup. Risk markets continue to slump this morning. Equities and commodities are lower, and Treasuries prices are higher. The combination of tighter policy signaling and rising pandemic concerns are weighing on risk markets. Our coverage begins with the Fed minutes; reducing QE appears to be coming. There is an update on the situation in Afghanistan. A brief comment on La Niña follows. Next, we cover economics and policy, China news, and our international roundup. We close with pandemic news.

Fed minutes: It appears the FOMC will begin slowing its asset purchase program by early next year. That doesn’t mean that rate hikes will follow, but it is reasonable to expect that rate hikes will be the next step toward policy normalization. Equity markets didn’t take the news well; we saw over a 1% decline in the S&P 500 yesterday.

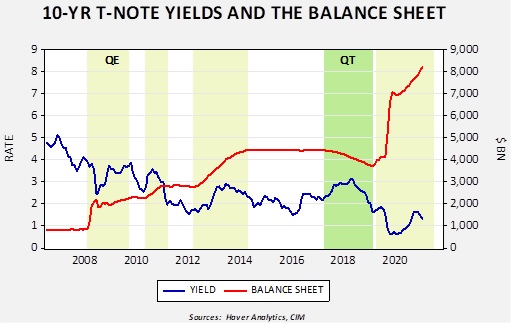

Asset purchases remain controversial. We still don’t know for sure how they work. The argument for using them was that it lowers long-term interest rates. However, that effect is ambiguous.

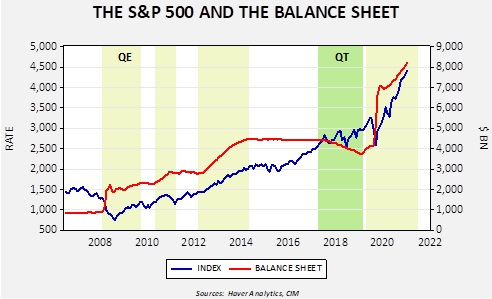

There are episodes where expanding the balance sheet clearly led to falling yields; in other times, expanding the balance sheet had the opposite effect. With equities, it appears the presence of QE is bullish, but the absence isn’t necessarily bearish.

This behavior has raised the idea that the apparent positive correlation is spurious. We are not sure that’s the case. The rise in equities in 2016, despite a flat then declining balance sheet, may have been due to the anticipation of corporate tax cuts. However, since March 2020, the relationship between the balance sheet and the index is pretty clear. So, concerns about slowing the expansion of the balance sheet are causing obvious concern about future equity values.

Is the Fed making a mistake by reducing accommodation? We suspect the answer depends on what constitutes a mistake. If tapering raises unemployment, then it’s probably a mistake. It could reduce asset values. Some members of the FOMC don’t think this is a problem. Several have consistently expressed concerns, especially about housing prices. Reducing the expansion of the balance sheet is potentially a negative factor for equities; thus, yesterday’s reaction bears watching.

On a couple of related notes, the market isn’t projecting anything of substance from the annual Jackson Hole meeting. Although we agree with this sentiment, it creates conditions for a surprise. The Roosevelt Institute, a left-leaning think tank, has issued a very favorable paper on Chair Powell’s policies. There have been rumblings from left-wing populists in Congress opposing Powell, but this paper may quell some of these concerns.

Afghanistan: Here is what we are following:

- The Taliban takeover is likely to create a refugee problem. Iran has responded by closing its border with Afghanistan. Meanwhile, the EU is sending mixed signals about its willingness to accept Afghans. Some nations in the bloc are still keen to deport Afghans living in Europe. Greece’s migration minister, Notis Mitarachi, remarked that it was okay for Greece to deport Afghans to Turkey. Needless to say, Ankara didn’t agree. The EU Commission is meeting on the issue and is trying to plan in advance regarding what will certainly be a wave of asylum seekers. However, the EU always faces the collective action problem. It’s better for an individual nation to avoid taking refugees if others do instead. With elections looming in Germany, another refugee crisis has EU leaders concerned.

- The West is rapidly moving to deny funds to the new Taliban government in a bid to gain some leverage over the group. The U.S. has frozen accounts and pressed the IMF to stop disbursements, essentially shutting down the central bank. In the short run, these actions will create serious problems for the new government. Around 80% of the ousted government’s budget came from foreign aid, representing about 43% of GDP. At first blush, these numbers suggest the economy will collapse. However, this situation is more like a cash crunch rather than a serious threat to the economy. The Taliban will likely rely on two sources of income. The first is opium. Poppy field cultivation has increased since the U.S. incursion and will remain a potent source of funds. The second source is minerals, including valuable rare earths. We note China has made overtures to the Taliban, and we would not be surprised to see Beijing move to exploit rare earths. After all, China is the world’s largest processor of these metals. In addition to these two sources, the Taliban has been a moneymaking operation for some time, engaging in extortion and other similar activities. It is estimated the group has earned around $400 million per year since 2011 but has been making much more money recently as its grip on the country widened. Our take is that denying official funds will hurt in the short run, but the leverage value is limited.

- The Taliban has apparently fired on protestors. We were a bit surprised to see protests emerge, but it is clear the Taliban isn’t interested in allowing them. There were at least three killed in the protests.

- The ousted president of Afghanistan, Ashraf Ghani, has ended up in the UAE. And, members of the Afghan military apparently used U.S. supplied aircraft to flee to Uzbekistan.

- Meanwhile, the handling of the U.S. military exit is seriously undermining the creditability of the U.S. and likely marks the end of the Biden administration’s policy momentum. Reports of stranded Afghans who allied with the U.S. efforts and are now exposed to the tender mercies of the new government in Afghanistan are unsettling. The lack of planning for a mass evacuation is stunning. It appears U.S. troops will remain in Afghanistan after the end of August.

- China is moving quickly to take advantage of the debacle, calling the collapse a failure not just for the U.S. but for Western civilization as a whole. Beijing noted Taiwan should take notice of the reliability of U.S. security support. At the same time, however, Beijing knows Afghanistan represents a security threat, and at some point, the Taliban will no longer be a drain on U.S. resources that can be redirected against China. Both China and Russia will try to fill the vacuum created by the U.S. exit, but it won’t be easy.

La Niña: NOAA is projecting that La Niña conditions could develop soon and likely last into winter, although it will likely be a weak event. La Niña events can have an adverse effect on crop yields and could lead to higher grain prices. As if the area needed it, La Niña events can lead to dry winters for the Southwest. The Northwest, on the other hand, may receive much-needed rain. The upper Midwest tends to be colder and snowier than normal.

Economics and policy: Firms continue to order aggressively to secure supplies, and the government crackdown on crypto expands.

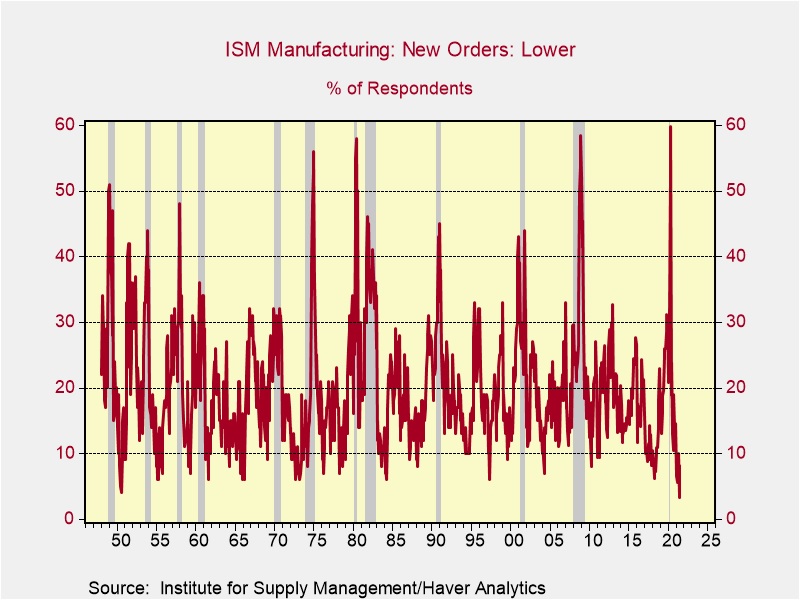

- As continued reports of tight shipping conditions persist, we are seeing firms aggressively order goods. In the ISM Manufacturing Index, only 3.3% of purchasing managers are placing fewer orders, the lowest in history.

Meanwhile, 56.3% of purchasing managers see their customer inventories as “too low,” also the highest in history. This combination of characteristics could lead firms to aggressively overorder for fears of supply shortages. At some point, we could see a major inventory imbalance.

- The crypto industry is still reeling from the adverse policy ideas that emerged from the Senate in the budget and infrastructure bill. Although the industry is attempting to respond, it looks to us that, at best, they are merely managing greater regulatory action. The SEC appears to be leading the charge to regulate the industry.

- In response to regulatory threats, Coinbase (COIN, USD, 244.39) claims it has built up a $4.0 billion cash hoard.

- A crypto firm called Helix, which provides “mixer” services (a way to hide transactions) has pled guilty to conspiring to launder money and will pay $200 million in bitcoin, and its principal may go to prison.

- As we watch the economy adapt to the post-pandemic world, the service industry is reviewing the services it provides and how they are provided. For example, hotels are moving to à la carte pricing, meaning that if there are services you don’t use, you can get a price break or some other service. For example, for a two-day stay, you might forgo another round of sheets on the second day for a free drink at the bar.

- A judge has blocked Alaska oil permits on grounds of inadequate environmental impact studies.

- Toyota (TM, USD, 175.73) announced it would cut global auto production by 40% due to supply chain problems.

- China is reducing its crude steel output to cut emissions and is pressing the industry to make more steel from scrap. This action is detrimental to iron ore prices.

China: Beijing continues to move against inequality.

- General Secretary Xi spoke at the 10th meeting of the Central Committee for Financial and Economic Affairs. He continues to press on addressing inequality and is specifically targeting the wealthy. The turn of phrase is “common prosperity.” China became quite unequal during its development. Although the official data suggests inequality has declined, the data are suspect. In any case, Xi is calling for direct wealth redistribution.

- We noted yesterday that Beijing is taking direct investment in large companies, acquiring a “golden share” that gives the government a large say in the governance of the firm. Interestingly enough, this idea has been around at least since 2017. The investment is giving fodder to U.S. policymakers looking to further restrict U.S. investment in Chinese equities. We also note that the government is taking steps to direct the wage policies of some firms.

- The closure of the Chinese tutoring industry has tutors (often Americans) and families scrambling to make informal contacts.

- As noted above, China is insinuating to Taiwan that the U.S. is unreliable; after making these comments, the PLA held aggressive exercises around the island.

International roundup: The German conservatives are in trouble, and Lithuania is securing its border.

- Chancellor Merkel is on her way to Moscow to discuss Afghanistan and Ukraine with President Putin. Meanwhile, the selected successor, Armin Laschet, continues his party’s lackluster poll performance. In fact, the previously moribund SDP has now risen to the second-best party in recent polls. Green Party leader Baerbock is working to prepare for a push into the elections. There is a chance the next government will exclude the CDU/CSU. Odds still favor the conservative bloc, but the risks are rising.

- Lithuania, facing a surge of refugees being funneled from Belarus, has put up a temporary border wall.

- Brexit has reduced the number of immigrants in the U.K. That has apparently also reduced workers in chicken processing plants, leading to a shortage of chicken meat.

COVID-19: The number of reported cases is 209,489,010, with 4,396,744 fatalities. In the U.S., there are 37,158,863 confirmed cases with 624,260 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 419,612,925 doses of the vaccine have been distributed, with 358,599,835 doses injected. The number receiving at least one dose is 199,325,940, while the number receiving second doses, which would grant the highest level of immunity, is 169,186,268. The FT has a page on global vaccine distribution. Here is the latest Axios state infection map.

- The U.S. is planning on offering booster shots to some groups beginning in autumn. The federal government will require nursing home staff to get vaccinated as a funding requirement.

- Steadily, governments around the world are preparing to live with COVID-19. This means that instead of dealing with a pandemic, it will be more like addressing periodic epidemics. In other words, the virus will ebb and flow over time.

- China’s “zero tolerance” policy of locking down areas with infections is exacerbating shipping bottlenecks.

- Beijing is aggressively ramping up its propaganda apparatus to deflect attention from the Wuhan lab leak theory. The attention is suggesting the U.S. was the source of the virus.

- We are watching a resurgence of infections in Israel. The country has a high vaccination rate, but the increase may suggest the immunity is not lasting very long. At the same time, Pfizer (PFE, USD, 49.31) suggests booster shots improve immunity.