Daily Comment (August 15, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment will begin by analyzing how a potential US government stake in Intel could signify a shift in economic models. We’ll then examine other critical market developments, including China’s economic slowdown, India’s push for stimulus, and the Democratic Party’s potential rebrand. We will conclude with an overview of other global and domestic factors shaping the financial landscape.

Intel State-Owned: The Trump administration is reportedly exploring a stake purchase in a struggling chipmaker — a move that comes after the president previously pressured the company’s CEO to resign over alleged ties to China. The potential investment would deliver a much-needed cash infusion as the company races to construct a new US-based semiconductor plant. This signals a notable shift in US economic policy, marking a departure from the traditional hands-off approach to private industry.

- The potential US investment reflects the government’s growing willingness to influence corporate operations, as evidenced earlier this year when the Trump administration secured a “golden share” in the Nippon-US Steel merger. That deal granted Washington veto power over key decisions, including worker layoffs, and signaled a more interventionist approach to domestic industry.

- US government investment in equities could bolster share prices, particularly in strategic industries. However, such intervention may also constrain corporate decision-making and potentially limit value-creating moves that are politically unpopular. As a result, investors are likely to scrutinize these companies more closely, ensuring they maintain operational efficiency despite political constraints.

- That said, we believe companies closely aligned with the government’s agenda could benefit from protective measures aimed at shielding them from foreign competition. Such policies may also help ensure these firms remain viable in the long run, offering domestic businesses a potential competitive advantage over time.

China Slowdown: The world’s second-largest economy is experiencing a widespread slowdown, with the effects of the trade war becoming increasingly apparent. Retail sales, factory activity, and fixed-asset investment have all decelerated, while the real estate sector has continued to decline. Additionally, unemployment has risen, increasing from 5.0% to 5.2%.

- The country’s sharp slowdown in growth suggests that the economy’s early resilience was short-lived, largely due to a temporary surge from businesses trying to get ahead of new tariffs.

- While this economic weakness could prompt further policy stimulus, there are clear signs that the Chinese economy may be in more serious trouble, especially since Beijing has reportedly told firms to resist absorbing the cost of tariffs.

India Stimulus: In his Independence Day speech, Prime Minister Narendra Modi pledged additional economic stimulus measures to bolster India’s self-reliance and insulate the economy from the impact of global tariffs. Among the proposed steps is a reduction in sales taxes on goods and services. His announcement comes as India and the US continue trade negotiations, with lingering disagreements over American farm and dairy product imports.

Rare Earths: China continues to solidify its stranglehold on global rare earths production, currently controlling approximately 90% of the world’s supply. Authorities have recently warned domestic firms that excessive stockpiling may result in reduced allocations, signaling tighter central control over these strategic resources. The irreplaceable role of these minerals in tech manufacturing strengthens China’s market control, exposing AI-dependent firms to serious supply chain risks.

Japan: Japan’s economy expanded for a second consecutive quarter, reducing fears of a potential recession. In the second quarter, real GDP grew by 0.3%, following an upward revision of the prior quarter’s growth. This stronger-than-expected performance is likely to pave the way for the Bank of Japan (BOJ) to consider a rate hike. A move toward tighter Japanese monetary policy, combined with sustained economic growth, would likely put downward pressure on the US dollar by strengthening the Japanese yen.

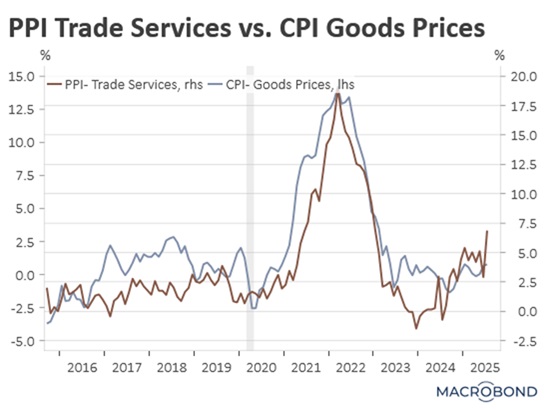

PPI Surprise: In July, supplier prices surged beyond expectations, pointing to mounting input cost pressures. The Producer Price Index (PPI) jumped to 3.3% year-over-year, up sharply from 2.3% in the prior year and significantly exceeding the 2.5% consensus forecast. A similar trend emerged in the core PPI, which climbed from 2.6% to 3.7%. The acceleration was largely fueled by trade services; excluding this category, the increase was more moderate, rising from 2.5% to 2.8%.

- Trade services are a measurement of the margins between wholesalers and retailers. They represent the change in the difference between the price that wholesalers and retailers pay for a good and the price at which they sell that same good. When this component increases, it’s a signal that wholesalers and retailers are either passing on higher input costs to their customers or widening their profit margins.

- Earlier this year, we singled out trade services as being an important indicator for understanding the “pass-through” effect of tariffs on consumers. During the pandemic, as trade services began to pick up, there was a corresponding and notable increase in consumer prices. We interpret this as firms using that period to exert their pricing power and protect profit margins in the face of rising costs.

- The biggest unknown now is whether this is a one-time event or a symptom of a longer-term problem. If trade services continue to increase, we would be very concerned that inflationary pressures could start to build, especially if households continue to show the ability to absorb them.

- That said, these surprising readings in both the PPI and employment payrolls are why we believe this is a time for prudent risk-taking as we work to understand the full impact of tariffs on the economy.

Democrat Abundance: As the party prepares for mid-term elections, a new push for deregulation is emerging as part of a broader redefinition of its platform. This shift in sentiment is partly influenced by Ezra Klein’s book, Abundance, which argues that overregulation has hindered urban progress. While not universally embraced, the book’s growing influence suggests a change in thinking, with an increasing number of policymakers advocating for less red tape. This pivot could benefit companies seeking to expand and take advantage of government programs.