Daily Comment (August 15, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with disappointing news on the Chinese economy. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including data showing Japan’s economic growth is now far surpassing that of the U.S. and China and other reports of new regulatory trends in the U.S.

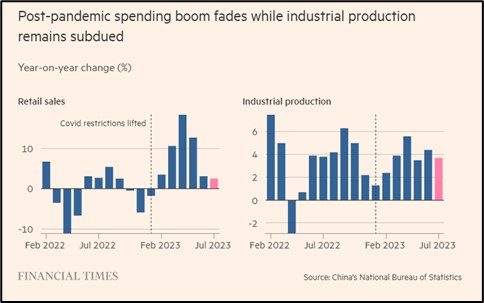

China: The National Bureau of Statistics released several data points today showing continued deterioration in the economy. For example, July industrial production was up just 3.7% from the same month one year earlier, far weaker than the expected rise of 4.6% and the increase of 4.4% in the year to June. The agency also said July retail sales were up just 2.5% year-over-year, weaker than both the anticipated rise of 4.4% and the June increase of 3.1%. The July unemployment rate rose to 5.3%, marking its first increase since February.

- In response, the People’s Bank of China cut several of its key policy interest rates. For instance, it cut the rate on its one-year medium-term lending facility to 2.50% from 2.65% previously. It also cut its rate on seven-day reverse repurchase operations to 1.80% from 1.90% and pumped the equivalent of $28.1 billion in new loans into the banking system at the new, lower rate.

- In a less helpful response, the statistics agency said it would no longer publish an unemployment rate for youth aged 16 to 24, ostensibly because that series has been distorted by the large number of students in that cohort. The new hide-the-ball tactic illustrates how the government appears to be prioritizing perception control over policies that would stabilize the economy and set it up for stronger growth again.

- So far this morning, the data and associated policy actions have served to weaken the renminbi (CNY) to a rate of 7.2848 per dollar, down 0.4%. Since the weak data bodes poorly for the global economy, many key global stock markets are trading down so far this morning. However, one exception is Japan, which has not only reported better-than-expected economic growth today, but its stocks have also been driven higher by investors fleeing the Chinese markets.

- Today’s flows out of Chinese assets exacerbate longer-term outflows. For example, Connecticut-based Bridgewater Associates, the world’s largest hedge fund, said in a regulatory filing yesterday that it liquidated almost one-third of its Chinese stock holdings in the second quarter. Even though Chinese electric vehicles have recently taken the world by storm, Bridgewater also slashed its holdings of Li Auto (LI, $39.95) and XPeng (XPEV, $16.24). The moves mark Bridgewater’s most drastic pullback from China since it dumped a number of the country’s top technology stocks one year ago. The activity is consistent with our oft-stated view that rising U.S.-China geopolitical tensions, slowing Chinese economic growth, and Beijing’s increasing intrusions into the economy have significantly raised the risks of owning Chinese assets.

Russia: Following our story in yesterday’s Comment about the weakening ruble (RUB) and how it has prompted some Russian officials to blame the central bank, the institution today held an emergency policy meeting and jacked up its benchmark interest rate to 12.0%, compared with 8.5% previously. Nevertheless, the move has given little boost to the currency, which is being pushed down in part by concerns that the war in Ukraine and Russia’s economic and political isolation will continue for the foreseeable future.

Japan: In contrast with the bad economic news out of the China/Russia bloc, the Cabinet Office today said Japanese gross domestic product expanded at an annualized rate of 6.0% in the second quarter, smashing through expectations and accelerating smartly from the growth rate of 3.7% in the first quarter. Excluding the distorted period around the coronavirus pandemic, it was Japan’s strongest economic growth since 2015. It also marked a rare quarter in which Japanese growth exceeded that of the U.S. (at 2.4%) and China (about 3.6%). The good economic performance will likely give a further boost to Japanese stocks going forward.

United Kingdom: Average total pay (including bonuses) in April through June was up 8.2% year-over-year, accelerating from the rise of 7.2% in the three months ended in May and marking the biggest annual rise ever recorded outside of the pandemic period. Excluding bonuses, regular pay in April through June was up a record 7.8% year-over-year. The strong wage growth will prompt fears of even more consumer price inflation and a need for further aggressive interest-rate hikes by the Bank of England.

U.S. Environmental Regulation: A judge in Montana has ruled the state can be sued for failing to take climate change into account when approving fossil fuel projects, based on language in the state constitution that guarantees residents “the right to a clean and healthful environment” and stipulates that the state and individuals are responsible for maintaining and improving the environment “for present and future generations.”

- The state government said it will appeal the ruling to the Montana supreme court, but there is probably still a chance that the ruling will stand. If so, it would put new responsibilities on the state and potentially set a precedent for climate-change regulation in other states.

- Only a few state constitutions have similar language related to the environment, so commentators are taking a sanguine view of the decision. Nevertheless, it’s useful to remember how the modernized state constitutions put into place in the 1960s and 1970s eventually spurred a movement which boosted education funding and channeled billions of dollars into economically disadvantaged school districts based on their broad, aspirational guarantees of an equal education. There is probably some risk that if the Montana ruling stands, activists will be more successful than expected in finding broad, aspirational language in other state constitutions that could support new climate regulations.

U.S. Financial Market Regulation: According to lawyers, the Securities and Exchange Commission has recently sent subpoenas and other document requests to several asset managers regarding their environmental, social, and governance investment marketing. The document requests point to a potential new SEC crackdown looming for ESG funds, with an apparent focus on conventional investment funds that have re-purposed themselves as sustainable funds.

U.S. Bank Regulation: In a speech yesterday, Federal Deposit Insurance Corporation Chairman Gruenberg signaled that the FDIC will soon propose a requirement that regional banks with around $100 billion or more in assets be required to file “living wills,” or plans for how they would be sold in an orderly manner if they run into a crisis. The speech offers further evidence that U.S. regional banks are heading for increased regulation similar to that of the very largest banks.

U.S. Homebuilding Industry: Warren Buffett’s Berkshire Hathaway (BRK.B, $358.48) said in a regulatory filing yesterday that it has initiated several new positions in homebuilder stocks. That’s consistent with our view that a decade of under-building after the Great Financial Crisis has left the nation’s housing inventory much too small, which will probably spur strong makeup homebuilding in the coming years. On top of that, many homeowners today are reluctant to put their existing home on the market because they’ve locked in very low interest rates with 30-year, fixed-rate mortgages. The lack of existing home inventory is producing a boom in new home construction and strong pricing for newly built houses, despite today’s high mortgage interest rates.

U.S. Critical Minerals Industry: A mining start-up backed by the U.S. government and focused on critical minerals such as nickel and lithium has raised $200 million in fresh equity, setting it up to become a “unicorn” with a valuation of more than $1 billion. The company, Dublin-based TechMet, illustrates how industrial policy funds and the government’s interest in securing critical supply chains has the potential to spawn important new companies in industries of the future.