Daily Comment (August 13, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning, all! U.S. equities appear to be headed for a higher open this morning. Our report begins with a discussion about inflation. Next, we provide a round-up of international news, including the Taliban’s advancement in Afghanistan and Bolsonaro’s attempt to undermine the electoral process in Brazil. U.S. economics and policy news are up next, including details about the latest Census survey. China news follows, and we end with our pandemic coverage.

Let’s talk about CPI: The Bureau of Labor Statistics released the latest price figures this week and it offered some reassuring news. The month-over-month rise in CPI decelerated to its slowest pace in five months. In July, headline CPI rose 0.5%, down from the previous month’s reading of 0.9%. Additionally, core CPI slowed from 0.9% in June to 0.3% in the latest report. The deceleration was led by a steep decline in the pace of price increases for used cars. The report showed that the rise in used car prices slowed from 10.5% in June to 0.2% in the following month. Despite the moderation in CPI, inflation fears may still be warranted.

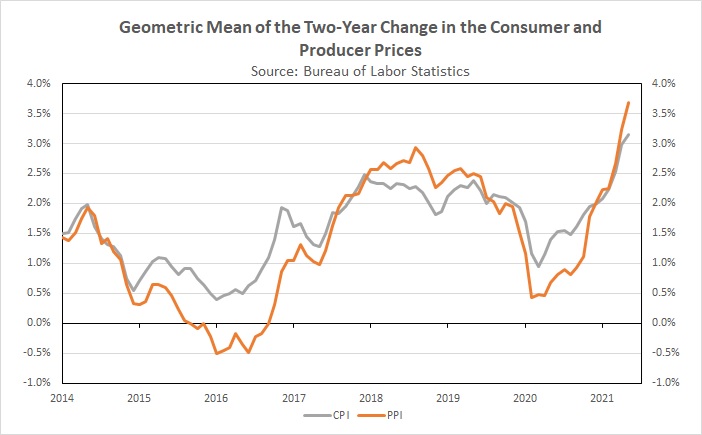

The chart above shows the geometric mean of the two-year change in the producer and consumer price indexes. This chart is designed to improve the year-over-year comparability of the indexes by averaging the change over the last two years, thereby limiting the pandemic distortions. That being said, the data suggests that despite the moderation in consumer prices in July, price pressures are still building throughout the economy. At this time, it appears that this pressure may be related to a lack of inventory. As a result of material shortages, demand for goods and services remains high as firms attempt to rebuild their inventories to meet growing demand. As of June, retail inventories for motor vehicles and clothes are still well below their pre-pandemic levels, while sales appear to be very strong. Over time, we believe as production capacity expands inventories will return to their normal level and this should relieve the economy of some inflationary pressure. Therefore, the most recent report has not changed our view that inflation is likely transitory.

International news:

- The Venezuelan government and its opposition will meet in Mexico City on Friday to discuss how to resolve their differences. The discussion will be mediated by international observers such as Norway. At this time, there are no expectations of a breakthrough.

- On Sunday, Canadian Prime Minister Justin Trudeau is expected to announce a snap election on September 20 as he attempts to gain approval for his COVID-19 response. PM Trudeau is currently working with a minority government and relies on smaller parties to get legislation passed.

- Brazilian Supreme Court Justice Alexandre de Moraes opened a probe into President Jair Bolsonaro for posting documents from a sealed investigation. Bolsonaro has been trying to undermine the integrity of the election as he remains widely unpopular within the country. The documents that he posted were related to an investigation into the hacking of a federal election court. Over the last few months, he has been spreading unsubstantiated claims about election machines being targeted by foreign hackers. Bolsonaro’s behavior suggests that he may not accept the results of the election if he were to lose. Given the country’s history and Bolsonaro’s recent comments, we would not be surprised to see another military takeover in Brazil following the election. In this event, it would likely be very bad for Brazilian equities as Brazil would be hit by sanctions from the U.S. and Europe. However, in the long run we think conditions could become more favorable for stocks.

- The Taliban has edged closer to taking over the country of Afghanistan. The rebel group has taken several major cities throughout the country at a much faster pace than originally anticipated. On Thursday, it took control of its 10th provincial capital as it edges closer to surrounding Kabul, the capital of Afghanistan. In response to the Taliban’s advancement, EU Foreign Policy Chief Josep Borrell suggested that the Afghan government should attempt to reach a settlement with the group. The U.S. and U.K. have deployed troops in Afghanistan in order to expedite the evacuation of staff from embassies within Kabul.

Economics and policy:

- Details from the latest Census survey were released on Thursday. Here are a few takeaways from the report:

- Over the last decade, the population grew 7.4%, the slowest pace since the Great Depression.

- For the first time in history, the number of people who identify as White decreased.

- People identifying as being more than one race were the fastest growing group. This change was partially due to adjustments made by the Census Bureau.

- Additionally, almost half of the country’s children are nonwhite, suggesting the country will become more diverse over time.

- Lastly, it appears more people have left rural areas in favor of cities. The change in demographics may have an impact on the makeup of Congress. An increase in urbanization generally favors Republicans’ ability to win more seats in the Senate.

- Bill Gates announced that a fund run by his investment firm will commit $1.5 billion to the Department of Energy if Congress enacts a program aimed at developing technologies that cut carbon emissions. The initiative is meant to attract other investors to raise an additional $15 billion.

- Home prices have risen in almost every part of the country according to the National Association of Realtors. The rise in home prices has likely been spurred by low interest rates.

- The Supreme Court lifted a ban on New York State’s eviction moratorium as litigation over the dispute continues.

China:

- Several provincial cities in China have declared a red alert following floods throughout the country.

- The population in Hong Kong declined at its fastest pace ever in 2020 as many people left the region following the passage of the national security law.

- A combination of the pandemic and worsening U.S./China relations have made Chinese students more hesitant to study at American universities.

COVID-19: The number of reported cases is 205,462,557 with 4,335,111 fatalities. In the U.S., there are 36,306,917 confirmed cases with 619,093 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 411,253,925 doses of the vaccine have been distributed with 353,859,894 doses injected. The number receiving at least one dose is 196,505,543, while the number receiving second doses, which would grant the highest level of immunity, is 167,354,729. The FT has a page on global vaccine distribution.

- On Thursday, Supreme Court Justice Amy Coney Barrett turned down a challenge to Indiana University’s vaccine mandate. The school requires that all students be vaccinated unless they have a religious or medical exemption. Students who are not vaccinated would have to submit to testing. The students that sued the school in order to block the mandate argued that it violated their constitutional rights. This was the first vaccine mandate-related suit to be turned down by the Supreme Court.

- The Food and Drug Administration expanded the emergency use of the COVID-19 vaccine to include a third dose for certain immunocompromised people. Although the third dose has yet to be expanded to the broader population, the country’s leading infectious expert, Dr. Anthony Fauci, stated that people will eventually need to receive the third dose.

- Rising COVID-19 cases in China have led to a closure of shipping ports at the Yantian Port and Ningbo-Zhoushan Port. The port closures could exacerbate price pressures as it will be harder for firms to maintain inventories.

- More job postings are requiring applicants to be vaccinated. The push for vaccination highlights growing fears about the spread of the delta variant.