Daily Comment (August 11, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a slew of items on China’s politics and economy. We next review several other international and US developments with the potential to affect the financial markets today, including a new Australia-India deal that aims to boost the latter’s rare-earths industry and an important statement by a Federal Reserve policymaker calling for aggressive interest-rate cuts through the end of the year.

Chinese Politics: Reports yesterday said Chinese authorities have detained Liu Jianchao, a senior Chinese diplomat widely seen as a potential future foreign minister. As of this writing, no further details have been made available. However, Liu could be just the latest in a long series of military, diplomatic, and industry officials who have been arrested by General Secretary Xi’s government on allegations of corruption. In at least some cases, the “corruption” may have involved ties to foreign intelligence services.

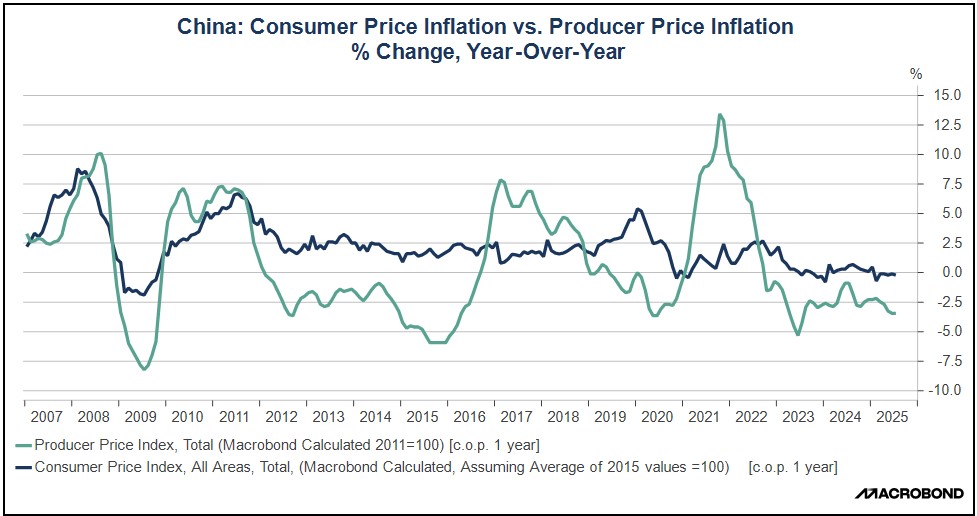

Chinese Price Inflation: In a report Saturday, the July consumer price index was unchanged from one year ago, a bit weaker than expectations that CPI inflation would remain at June’s rate of 0.1%. Even more concerning, the July producer price index was down 3.6% on the year, for the 34th straight month of deflation in business-to-business prices. The figures reflect China’s worsening excess capacity and production coupled with weak consumer demand, which is weighing on prices, hurting corporate profits, and pushing firms to dump exports abroad.

Chinese Industrial Policy: CATL, the world’s largest maker of batteries for electric vehicles, said today that it will suspend operations at one of its key lithium mines in China. Against the backdrop of China’s massive excess capacity, cutthroat competition, and falling prices, CATL’s move is being taken as a sign that Beijing may be starting to take steps to rein in the country’s excess production. In response, Chinese lithium prices have risen modestly today, while share prices for global lithium miners have surged.

Australia-India: The South China Morning Post yesterday said Australia and India have launched a program to cooperatively ramp up their output of rare-earth minerals. Under the program, Australia’s relatively advanced rare-earth miners and processors will boost their investment in India so that country can better leverage its big reserves of the critical minerals. The program shows how officials around the world are reacting after belatedly realizing their vulnerability to China’s near monopoly on rare earths.

- Ever since China clamped down on its rare-earth exports to retaliate against the US’s new trade and technology policies, the US and other key governments have been working feverishly to develop their own mines and processing facilities.

- Those efforts are likely to create interesting investment opportunities in the rare-earth mining and processing space going forward.

United States-China: The Financial Times yesterday scooped that in return for the right to sell its H20 artificial-intelligence computer chips to China, semiconductor giant Nvidia agreed to pay 15% of the associated revenues to the US government. The report said AMD has also agreed to pay 15% of its AI-chip revenue in China to the US government. The payments, which are essentially an export tariff, suggest the administration could impose similar payments on other exporters in return for looking away from the national security implications of their sales.

United States-Brazil: The US administration is reportedly preparing further sanctions on Brazil for its persecution of the country’s former right-wing populist president, Jair Bolsonaro, who is under trial for conspiring to overthrow the democracy. Coming on top of the US’s punitive 50% tariff against Brazilian imports, the new sanctions will reportedly be focused on judges involved with the Bolsonaro trial. However, the US’s readiness to impose further penalties probably raises the risk of new sanctions on the broader economy as well.

US Monetary Policy: In a speech on Saturday, Fed board member Michelle Bowman said the recent downward revisions to US payroll counts suggest the central bank should be cutting interest rates. Indeed, Bowman said that she expects to support a rate cut at each of the Fed’s three remaining policy meetings this year. Despite President Trump’s anger at the revised payroll data, Bowman’s comments illustrate how signs of a weakening labor market support the president’s call for the Fed to cut rates more aggressively.

US Economy: The Financial Times carries an article today highlighting how smaller businesses in St. Louis have begun to sharply hike prices in response to the US’s new import tariffs. The article is consistent with other recent data showing that price inflation is picking up for goods more exposed to imports and that smaller firms are more apt to be hiking prices, probably because they have less market power and financial flexibility to absorb the higher tariff costs. What isn’t clear is how long those price hikes will continue and how much they’ll broaden.

Global Rice Market: Export prices for Thai 5% broken white rice, the global benchmark, have dropped to $372.50 per metric ton in recent days, reaching their lowest level since 2017. Prices are now down some 26% since late last year and 13% for 2025 to date, reflecting both bumper harvests and India’s recent move to start lifting export curbs. Coupled with today’s low prices for crude oil, wheat, and corn, the low rice prices could help keep a lid on consumer price inflation around the world, despite concerns about price hikes from the US’s new import tariffs.