Daily Comment (August 11, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Today’s Comment discusses the following key topics: why the Federal Reserve may be closer to reaching its 2% inflation target than investors realize, our concerns about the regional banking system, and how rising crime in South America complicates U.S. efforts to build closer ties in the region.

It Gets Better: Thursday’s CPI report not only reinforced investors’ views that the Fed may be nearing the end of its hiking cycle, but also suggests that monetary policy may need to ease next year.

- The Consumer Price Index (CPI) increased 3.2% in July from the previous year, according to the Bureau of Labor Statistics. The reading was above the previous month’s increase of 3.0% but below consensus estimates of 3.3%. Core inflation numbers were also impressive, declining from 4.8% to 4.7%. The reacceleration in the headline inflation number is likely due to base effect changes, which may not carry over to the next month. Meanwhile, the core CPI continues to be propped up by reporting lags in shelter data.

- Despite both price gauges being well above the Fed’s inflation target of 2.0%, there is growing optimism that the Federal Reserve may not need to raise rates again this year. The monthly reading shows that headline inflation rose at an annual rate consistent with 2.3%, while core inflation rose at a pace consistent with 1.9%. The market took the CPI report positively as traders loaded up on bets that the central bank was going to pause in September. The CME FedWatch Tool shows that there is over a 90% chance that policymakers will leave rates unchanged at their next meeting.

- Inflation is falling more quickly than most people realize. The July report shows that consumer prices have only risen 2.5% from the previous year after removing shelter, which accounts for over a third of the index weight, from core CPI. This discrepancy may continue going into next year, as it typically takes about 12-18 months for housing data to make its way into the CPI index. Additionally, if the San Francisco Fed is correct that shelter prices will fall into negative territory in 2024, it could mean that central bank policymakers may need to cut rates to avoid deflation.

Regional Bank Troubles: Nearly five months after the collapse of Silicon Valley Bank (SIVBQ, $0.15), small and midsized banks are still struggling to stand on their own.

- Moody’s has downgraded the credit ratings of several regional lenders following a review of their financial positions. The credit rating agency justified its decision by citing several factors, including slowing deposit growth, rising funding costs, and deteriorating asset quality, particularly in real estate. Although the banks maintained their investment-grade ratings, the weak valuations suggest that the banking system still poses a threat to the economy. So far, banks have been able to cling to life by relying on loans from the Federal Home Loan Banks and the new Fed loan facility.

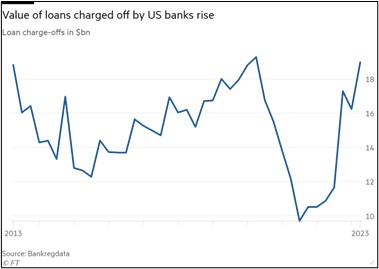

- The latest Senior Loan Officer Opinion Survey (SLOOS) revealed that banks are more cautious than ever about lending. The net percentage of domestic banks tightening their lending standards rose to 50.8% in the third quarter of 2023, the highest reading in the post-pandemic era. This decision to restrict lending is related to the rising risks that banks are having to absorb when lending at higher rates. Many U.S. banks have accumulated heavy losses on their books, and it has reached the point where lenders have been offloading property loans at fire sale prices.

- Regional banks will continue to struggle as long as the Federal Reserve keeps interest rates in restrictive territory. This is because higher interest rates force banks to increase the amount they pay for deposits, which lowers their net interest margins. As a result, banks are not able to lend at the same levels, which could lead to slower economic growth. However, if the Fed commits to offering banks liquidity, it is unlikely that there will be a financial crisis any time soon. That said, regional banks’ inability to offer attractive savings rates to maintain deposits will leave them vulnerable to disintermediation.

Southern Uncertainty: Rising crime in South America is making it more difficult for the United States to build alliances with countries in the region that share its belief in democracy.

- A surge in gang violence has added to concerns about a societal breakdown in South America. On Thursday, Ecuadorian presidential candidate Fernando Villavicencio was assassinated at a campaign event. Once considered a relatively peaceful and stable country, Ecuador has emerged as a hot spot for criminal activity in recent years. Homicides have risen by more than 86% just between 2021 and 2022, as criminal groups use violent tactics to intimidate locals and further their political goals. The recent killing of Villavicencio, an outspoken critic of organized crime, is a stark reminder of how gang activity is spilling over into politics.

- The rise of gang violence in South America is likely to pave the way for more authoritarian leaders like Nayib Bukele, the president of El Salvador. Bukele has consolidated power by removing term limits, purging the Supreme Court, and replacing the attorney general with an ally. Despite these actions, he remains widely popular throughout South America. A recent poll found that he has an approval rating of 87% in his home country. He is also more popular than the pope in Chile, Venezuela, Ecuador, Guatemala, and Honduras. Bukele is hardly an anomaly, as it appears that Venezuelan President Nicolás Maduro, once considered a pariah on the continent, is now on the brink of a comeback.

- Rising violence within South America complicates the Biden administration’s efforts to expand its regional influence. President Biden has made “democracy versus autocracy” the organizing principle of his foreign policy, and his administration has made it clear that it will not support countries that backslide from democratic norms. This is likely why Biden refused to invite Cuba, Nicaragua, and Venezuela to the recent Summit of the Americas. As a result, the Biden administration is at risk of losing influence in the region to China, which has been more willing to overlook human rights abuses in order to expand its economic and political reach.