Daily Comment (August 10, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment will focus on three key topics: the growing rift between the U.S. and China over semiconductors, possible threats to the European energy markets, and the White House’s latest attempt to mediate ties between Saudi Arabia and Israel.

Another Salvo in the Chip War: The U.S.-China rivalry in artificial intelligence (AI) took a new turn after the U.S. government announced investment restrictions on Chinese tech companies.

- The White House issued an executive order that will restrict U.S. investment in Chinese companies developing quantum computing, advanced chips, and artificial intelligence. It will largely affect private equity and venture capital firms and will not take effect until January 1, 2024. This measure is the latest in a series of attempts by Washington to prevent China’s military from advancing its technology ambitions. In 2017, the People’s Republic of China declared that becoming a world leader in artificial intelligence by 2030 is a national priority. After the restrictions were released, China announced that it was considering retaliation.

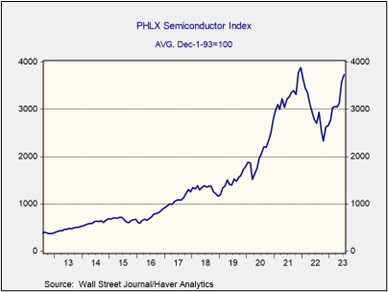

- The tit-for-tat between the U.S. and China sent tech stocks tumbling on Wednesday, with the Philadelphia Stock Exchange Semiconductor Index (SOX) falling nearly 2%. Investors are concerned that the rivalry will hurt profitability as the U.S. looks to close ranks with other Western countries in a bid to contain China’s technological ambitions. The move by both the U.S. and China to restrict semiconductor exports will add to the headwinds for chipmakers, who are already working their way through a supply glut that is not expected to be resolved until later this year or early next. However, Chinese internet giants have already begun stockpiling chips in anticipation of future restrictions, which should lead to a temporary bump in sales.

- Despite recent moves by the Biden administration to “de-risk” the relationship between the United States and China, the process is likely to be slow and arduous. China accounts for the largest share of the revenue for companies in the S&P 500 outside of North America, and Beijing’s shift toward deleveraging means that it is becoming more reliant on foreign investment for capital. As a result, there are strong incentives for both countries to keep the relationship going, even as tensions rise. Thus, these actions by the Biden administration are steps toward the long-term trajectory of the relationship, but it is unlikely to have a substantial impact on companies in the short- to medium-term.

Eurozone Energy Concerns: After narrowly avoiding a recession in the last quarter, high energy prices are likely to put the eurozone economy back in focus for investors.

- Earth’s hottest month on known record was July 2023, with global temperatures averaging 62.51 F, six-tenths of a degree higher than the previous record set in July 2019. This was largely due to El Niño conditions, which cause warmer ocean temperatures and more extreme weather events. The effects of El Niño on Europe are less consistent than in other regions, but northern countries could experience colder temperatures during the winter months, while southern countries in the region may experience wetter conditions. Potentially hazardous weather conditions could lead to a rise in energy demands.

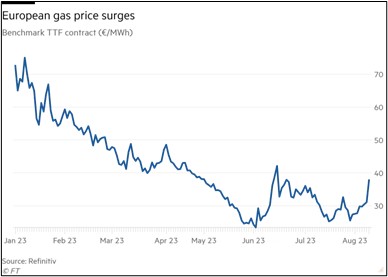

- The war in Ukraine and possible labor protests in Australia have added to the energy uncertainty. Russia and Ukraine have launched attacks near each other’s energy infrastructure. On Wednesday, a Russian drone strike hit an oil depot in Ukraine, while Ukrainian drone strikes in the Black Sea have raised concerns about potential supply disruptions, as they could damage shipping vessels carrying oil and gas. Simultaneously, natural gas prices in the region surged almost 40% following reports that workers at important LNG plants in Australia are planning a strike for higher pay and better job security. The issues in Ukraine and Australia raise the likelihood of supply shortages.

- Although the euro area has made significant progress in building up its energy storage for the winter, there are still risks that could lead to energy spikes. A prominent German utility company has cautioned lawmakers against becoming overconfident in the region’s energy security. He warned that there is still much uncertainty concerning the upcoming winters, which could potentially lead to an energy crisis. A possible shortage of natural gas will weigh heavily on the struggling European economy and may push it into recession.

Middle East Pivot: The White House has made a breakthrough with Saudi Arabia and is now hopeful of reaching a similar agreement with Israel.

- Saudi Arabia agreed to terms that would allow it to recognize Israel in exchange for progress on the Palestinian issue and security guarantees. The details of the arrangement are still being negotiated, but U.S. officials are optimistic that a deal can be reached within the next year or so. Additionally, Washington is also urging Riyadh to impose limits on its relationship with China. In response to the agreement, Israel has also requested a defense pact with the U.S. to join the deal with Saudi Arabia, as it seeks protection from a growingly assertive Iran.

- The U.S.’s efforts to resolve tensions between Saudi Arabia and Israel are a sign that it still wants to be a major player in the Middle East, even as it pivots toward the Indo-Pacific. This agreement will likely help counter the inroads China has made in the region. Over the last year or so, Beijing has engaged in talks with Riyadh over creating a petroyuan and has played a crucial role in restoring ties between Saudi Arabia and Iran. Resolving tensions between the two sides will likely build on the progress made with the Abraham Accords by paving the way for more peaceful relations in the Middle East.

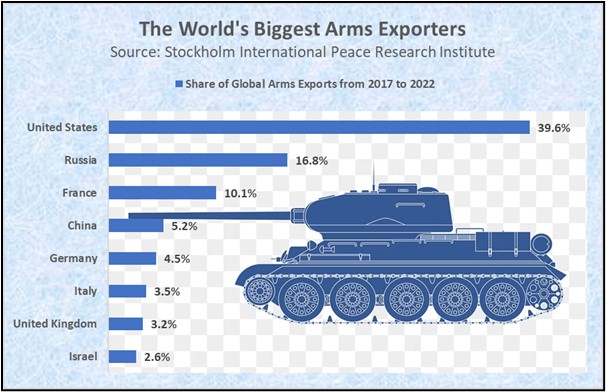

- As the U.S. moves away from its role as an importer of last resort, it will likely continue to provide defense assistance to other countries to maintain its influence. This could take the form of intelligence sharing, joint military exercises, or weapon exports. We have already seen some of this play out in Ukraine and Taiwan, and it is possible that the U.S. would be willing to do the same in the Middle East. American defense and aerospace industries are well-positioned to capitalize on the global rearmament trend, as they have a long history of providing arms to allies and partners around the world.