Daily Comment (April 8, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning all! U.S. equity futures are mostly elevated this morning in the wake of yet another record S&P 500 close. We open commentary this morning with the Fed minutes. Economics and policy follow with corporate taxes in the spotlight. Pandemic news is next. China news follows, and we close with our international news roundup.

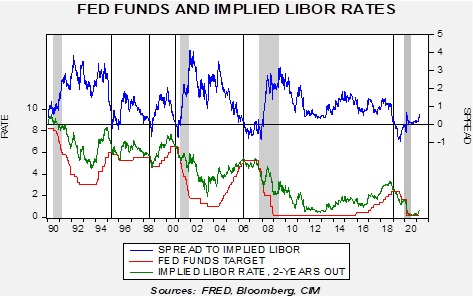

Fed minutes: There were no obvious surprises in the minutes from the March 16/17 meeting. There were expressions of concern about inflation, but it is also obvious that the FOMC intends to keep rates steady at least into 2023. Although there are comments circulating that the market is starting to discount rate hikes sooner than the FOMC is suggesting, our Eurodollar model suggests that rates are merely normalizing, but it doesn’t appear to us that the rise in market rates is out of the ordinary.

Eurodollar yields reflect both expectations of policy changes and credit risk. The current spread suggests no rate hikes for two years.

Economics and policy: Better global growth is coming, and a global corporate tax agreement is being floated.

- The IMF meetings are being held virtually this week; they usually are held in Washington this time of year. Mainly due to aggressive U.S. fiscal action, but also aided by expectations of waning pandemic influence, the group raised its forecast for this year’s global GDP growth to 6%, up from the 5.5% forecast made in January. Despite this rising growth, the dispersion of growth is also widening; vaccine distribution has mostly been focused on the developed world, meaning that the emerging world economies are mostly lagging.

- Morning Consult, a survey firm, notes in a recent study that states dependent on tourism are lagging in the recovery.

- We usually don’t engage in a deep analysis of proposed tax changes until we are confident that they will be passed. That doesn’t mean we are not paying attention. For now, we will rely on the work of others in this area. Here you will find some background on the details of U.S. corporate taxes. Although the headline focus tends to be on the marginal rate, the bigger battle is in the details. The U.S. corporate tax code has provisions that tax multinational corporations on their global income. The idea is that America is the home of a large number of global firms, and merely taxing their U.S. operations allows them to avoid taxes on what may be the bulk of their earnings. At the same time, most foreign nations also tax these firms on their “domestic” operations. Thus, there is a complicated set of rules that govern tax credits on foreign taxes paid. This area is where the controversy lies. Of course, a major problem is that some nations have low or no corporate taxes. Firms are, therefore, encouraged to locate some level of operations there, where profits are funneled to further avoid taxes. One way to address this issue is to create a minimum global standard of taxation; there is some EU support for this idea. However, for some of these small nations that benefit from the current arrangement, it would be very difficult to get them to sign off on a minimum tax regime. The bottom line is that we are still a long way from actually seeing tax changes.

- The tax increases are part of the infrastructure package, which, to be fair, stretches the word “infrastructure” so broadly it really is no longer meaningful. There are two new threats to getting this package passed:

- The Democrats’ margin in the House continues to narrow. There are currently five vacant seats in the House; three are vacant due to representatives joining the administration. On April 6, Alcee Hastings (D-FL) died at 84 from pancreatic cancer. The other vacancy was Ron Wright (R-TX), who passed away from complications tied to COVID-19. After the November elections, the Democrats held a 222-213 margin; that is now 218-212. Under House rules, vacancies must be filled by special elections. Two will be held in May, one in June, one in November, and the Florida one has not been set. Two of the elections may lead to a switch in parties; the other two are not expected to change. Currently, there are seven Democrats who hold districts that Trump won in 2020. For the Speaker, the margin has narrowed to the point where it will make it difficult to pass more radical measures.

- The narrow margin in the Senate means that White House legislation either needs 10 GOP senators to pass (assuming unanimity among the Democrats) or the passage via budget reconciliation rules. The reconciliation rules do restrict what can be put into a bill (it has to have some relationship to budget matters decided by Senate Parliamentarian). Several of the proposed measures in the president’s proposal are in danger of not meeting these requirements, which may reduce the scope of the measure.

- We also note the infrastructure bill includes plans to increase the housing supply. We view this as an important idea if the goal is to narrow wealth inequality. For the bottom 90% of households, residential real estate is the largest part of wealth. There is a need for greater supply. It remains to be seen whether this part of the bill (a) is part of the final version and (b) addresses the issue.

- An interesting sidelight to the pandemic’s effect on rents is the well-documented drop in the rents in previously fashionable urban areas, but the consequent jump in rents in outlying areas was not initially noticed. The rise is pricing out residents who were living in these areas.

- Although the concept of shareholder primacy was not directly part of the Reagan/Thatcher revolution, it was sort of a fellow traveler. Shareholder primacy is the idea that companies should be run for the sole benefit of the owners. Milton Friedman, Michael Jensen, and William Meckling are names most closely tied to the notion. In the 1930s, Adolf Berle and Gardiner Means argued for a broader responsibility for managers. Since the late 1970s, shareholder primacy has come to dominate thinking about how corporations should be run. However, in recent years, there has been a steady shift to the Berle and Means position where managers balance competing interests, including labor, shareholders, stakeholders, and society at large.[1]

- The latest JP Morgan (JPM, USD, 153.41) shareholder letter makes it abundantly clear that shareholder primacy is on its way out. Instead of maximizing value for shareholders, the stated purpose of a corporation is to be a responsible community citizen. The recent spate of corporate decisions and comments on political behaviors is part of this trend.

- The dollar’s share of global reserves has fallen below 60% to 59% in December, the lowest level since 1995. Although the greenback remains the world’s primary reserve currency, there is clear concern about the continued focus on dollars for reserve purposes. These include rising Treasury debt[2] and the U.S. weaponization of the dollar for foreign policy purposes.

- There has been an emerging idea that Chinese sovereign debt may be an alternative to Treasuries. The yields are higher and Beijing’s fiscal policy, at least on the surface, looks less risky (although central government debt is not excessive, the real risk is the local government borrowing, and defaults in that sector likely end up on the central government balance sheet). If this notion catches hold, the reserve currency threat from the CNY will become much more credible.

- The NY FRB reports that the majority of stimulus checks are being saved or used to pay down debt.

- The western U.S. appears to be in a deep drought. As summer approaches, this condition raises the possibility of a rough fire season for this region.

- The tax increases are part of the infrastructure package, which, to be fair, stretches the word “infrastructure” so broadly it really is no longer meaningful. There are two new threats to getting this package passed:

COVID-19: The number of reported cases is 133,250,442 with 2,890,706 fatalities. In the U.S., there are 30,923,521 confirmed cases with 559,117 deaths. Both cases and fatalities in the U.S. are declining. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 225,294,435 doses of the vaccine have been distributed with 171,476,655 doses injected. The number receiving at least one dose is 109,995,734, while the number of second doses, which would grant the highest level of immunity, is 64,422,618. The FT has a page on global vaccine distribution. The Axios state map shows a mixed picture, with the net result of mostly steady infection rates.

Virology

- The AstraZeneca (AZN, USD, 48.42) vaccine situation is becoming a mess. European regulators now admit that there is a blood clotting problem with the vaccine. It rarely occurs, and given the relative risk of clotting compared to the dangers of the virus, there is a case for continued use. However, with alternative vaccines available, it’s hard to suggest that it should be widely used.

- EU nations have responded as expected; the AstraZeneca vaccine is mostly restricted to older recipients. Belgium, Italy, Spain,

- and the U.K.. are restricting distribution.

- Romanians are generally refusing to accept the vaccine.

- The EU has essentially banned vaccine exports. India will restart exports in June if the current surge in cases declines.

- The Czech Republic’s inability to control the pandemic has led to the firing of the nation’s health minister. He is the third to be fired since the pandemic began.

- Due to COVID-19, Chile, which was planning on voting on a new constitution, has delayed the election.

- One of the difficulties in examining the impact of the virus is the total fatality count. The data above rely on reports from medical facilities, and, in some cases, the determination of death is difficult. An alternative method is to look at the normal death rate and see how many “excess” deaths occurred. Although also imperfect, it can offer a broader estimate of the impact of the pandemic. For example, if a person committed suicide due to a drug overdose that was partly driven by social isolation, it might be considered a pandemic-related fatality. A recent study suggests that last year, there were 523,322 excess fatalities and 378,039 directly attributed to COVID-19.

- The Brazil variant (P.1) is starting to spread and is currently hitting British Colombia. It appears to be quite virulent; the most recent outbreak closed a popular ski resort and shut down the Vancouver Canucks of the NHL. Meanwhile, in the U.S., the U.K. variant (B.1.1.7) is becoming dominant.

- To some extent, the U.S. is facing a race between vaccination and variant spread.

- With vaccine cards becoming the informal vaccine passport, a thriving market for fake or stolen vaccine cards is developing.

China: Regional tensions remain elevated, and it appears the U.S. is backing down from a boycott of the Olympics.

- Tensions in the first island chain remain elevated.

- Beijing is warning Japan not to adopt U.S. sanctions over the Uighurs and Hong Kong. It also continues to pressure the Philippines by massing Chinese vessels in its territorial waters.

- One of China’s diplomatic tactics is to attempt to make all regional relationships bilateral. If it can force each individual nation to negotiate one-on-one, it stands a better chance of dominating the relationship. The U.S. is a threat to this tactic because it is powerful enough to create a unified response.

- We note the U.S. has sent the USS Theodore Roosevelt and the associated strike group to the area to bolster defenses.

- Japan is considering deploying F-35s to its south to defend the disputed Senkaku islands (known by China as the Diaoyu islands).

- Taiwan is starting its annual war games with one part based on a Chinese invasion. Beijing is repeatedly violating Taiwan’s defense identification zone.

- A boycott of the summer Olympics next year has apparently been considered by Washington. However, the State Department has signaled that a boycott isn’t likely.

- Multinational firms struggle to reduce their China exposure and are increasingly caught between the U.S. and China. China’s size makes avoiding China costly. We also note that some of China’s most advanced military technology is being built with Taiwan and American technology. These goods are acquired by purchases through Chinese private tech companies.

- A recent Chinese hack of Microsoft (MSFT, USD, 249.90) shows signs that it was facilitated by earlier data gathering. If so, China may have built a database of personal information that it is weaponizing for cyberattacks.

- One of the more interesting developments for Chinese society is that the one-child policy will soon lead to a situation where most Chinese children won’t have much of an extended family. Only children for generations are those who eventually lack aunts and uncles. It is unclear what sort of impact this will have, but a recent report by Eberstadt and Verdery explores the issue. On a related issue, China is expected to release data from its 2020 census soon.

International news: Our roundup.

- Myanmar’s junta is considering extending military rule for up to two years as the government tries to cope with continued unrest.

- The U.S. is considering retaliation against Russia for its recent cyberattacks and other nefarious activities. The EU should take notice; the Biden administration is considering appointing a special envoy to thwart the NordStream 2 pipeline.

[1] The ESG movement would be part of this idea.

[2] This is nothing new, BTW. The Triffin dilemma, which discussed this problem, emerged in the 1960s.