Daily Comment (April 5, 2019)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] It’s employment Friday! We cover the data in detail below, but the quick take is that it is a nearly perfect report. Payrolls recovered, unemployment remained low and wage pressures eased. Here is what we are watching today:

Trade progress: President Trump[1] and Chairman Xi[2] made positive comments on the potential for a trade deal but the two sides still haven’t resolved the most difficult parts of the negotiations.[3] One emerging issue is biotech crops.[4] The comments do suggest both sides want some sort of agreement in the near term. Financial markets have mostly discounted a positive outcome, although the actual news of an agreement might give equities a short-term boost.

Brexit: About the only thing new is that the May government has asked the EU for an extension to June 30.[5] European Council President Tusk has floated the idea of a one-year extension with the flexibility of cutting it short if a deal is reached.[6] Talks between Corbyn and May don’t appear to be going anywhere,[7] although there is growing talk of a second referendum.[8] The House of Lords, the upper house in the U.K. legislature, is also pressing the PM to consult with them before any debate.[9] Meanwhile, the government is monitoring its citizens’ buying behavior, worried that panic buying tied to Brexit could lead to shortages.[10]

War in Libya? General Haftar, whose forces control the eastern half of Libya, has ordered his troops to march on Tripoli in a bid to take control of the country.[11] Although current maps are difficult to confirm, this linked one in the footnote suggests Haftar does control most of the country and has decided to complete the takeover.[12] If Haftar is able to bring the country under singular control, it would likely increase oil output. However, history of warfare shows that conquering is one thing, while controlling is another. His attempt to take over could lead to increasing unrest and, if his bid fails, disruption of oil supplies may follow. We would not be surprised to see a drop in Libyan supplies in the coming days as tensions rise.

Anger in Riyadh? Reuters[13] is reporting that unnamed Saudi officials are threatening to stop pricing oil in dollars if Congress follows through and subjects OPEC to U.S. antitrust rules. The reaction is rather odd. First, the chances of this legislation passing through Congress is nil, and even if it does the president would veto it. Second, for much of its history, the oil market has had a cartel-like body that manages output. From Standard Oil to the Texas Railroad Commission to OPEC, the oil market has always had a body that holds excess capacity off the market to prevent price volatility. This bill in Congress is counterproductive to that essential role. Third, although there would be all sorts of claims of the demise of the dollar if the Saudis were to abandon the greenback, the reality is far less dire. Where would the Saudis go—would they use euros? What bond would they hold in reserve—German bonds with a negative yield, or maybe Italian bonds with credit concerns? Would they hold the yuan? And, would China be comfortable with its financial system being affected by the price of oil? The bigger concern is if Iran were to attack Saudi Arabia, would the country rely on Beijing or Berlin to come to its aid?

Our take is that such leaks suggest either panic or inexperience. We lean toward the latter. MbS, the de facto ruler of the kingdom, has a history of overreacting to slights. To leak this sort of response to a bill that has no chance of passage is uncalled for. However, it does suggest a degree of insecurity at the leadership level of the royal family.

Cain for the FOMC: President Trump has two vacant seats on the FOMC. Although Marvin Goodfriend did go to Congress for interviews, his performance was less than stellar and his appointment has been in limbo ever since. Recently, the president has offered Stephen Moore, a controversial option. Yesterday, he indicated he would nominate Herman Cain. Although Cain isn’t an economist, he has experience as a member and chairman of the K.C. FRB.

The national media will suggest neither man is especially qualified for the role, but we view both as defensible choices. However, the real issue is loyalty. President Trump, like a significant number of his predecessors, rightly views the Fed as an influential government entity that he has little control over. Since the Rubin/Clinton/Greenspan peace accord in the 1990s, we have had unusually serene relations between the FOMC, the chairs and the White House. However, Truman, who signed off on Fed independence, did so with great trepidation. President Johnson reportedly pushed Bill Martin against the wall in protest of higher interest rates.[14] Nixon leaked that Arthur Burns wanted an exorbitant pay raise and then offered to scotch the rumor in return for compliant policy.[15] Reagan ordered Volcker not to raise rates in 1984[16] and loaded the FOMC with loyalists to undermine Volcker.[17] The Rubin/Clinton/Greenspan detente worked mostly because of falling inflation; the fact that it held as long as it did was remarkable.

It is clear that undermining the independence of the Federal Reserve can affect inflation expectations. If investors, consumers and firms become convinced that the Fed will accommodate inflation impulses, then they will act to accentuate these impulses by accelerating purchases and building inventories. We are nowhere close to that being a problem now, but the fact that Fed independence is being seen mostly as unnecessary suggests the public is becoming inured to low inflation and can’t conceive of it becoming a problem.

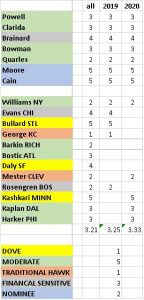

The table below shows our “hawk/dove” estimates. We are assuming that the nominees will be hardcore doves, although only under a Trump administration. They might shift with a Democrat in the White House. The change in policy stance is significant. The overall composition of the board goes from 3.00 to 3.32. The members this year jump the average to 3.25 from 2.90, and next year moves from 3.00 to 3.33 (scale is 1 being most hawkish, 5 being most dovish). Although these two new members (we are assuming they will be confirmed) can’t move policy by themselves, they will likely never vote to hike while Trump is president and may always vote to ease, leading to a higher level of dissention. Historically, three governor dissents is considered a no-confidence outcome for a chair, thus Powell may find himself in an untenable position at some point.

All this points to policy accommodation, which should be supportive for equities but might be bearish for longer duration debt.

[1] https://www.nytimes.com/2019/04/04/business/economy/trump-xi-china-trade-meeting.html?emc=edit_MBE_p_20190405&nl=morning-briefing&nlid=5677267tion%3DtopNews§ion=topNews&te=1

[2] https://finance.yahoo.com/news/trump-says-china-trade-deal-215844061.html

[3] https://www.wsj.com/articles/u-s-china-trade-talks-in-end-game-but-no-final-deal-yet-chamber-leader-says-11554382517?mod=hp_lead_pos6

[4] https://www.reuters.com/article/us-usa-trade-china-biotech/biotech-crops-still-a-sticking-point-in-u-s-china-trade-deal-sources-idUSKCN1RH02X

[5] https://finance.yahoo.com/news/britains-may-asks-eu-brexit-083130235.html

[6] https://www.politico.eu/article/eu-brexit-flextension-plan/

[7] https://www.ft.com/content/9496494c-56da-11e9-a3db-1fe89bedc16e?emailId=5ca6c94d6008f300048dd485&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[8] https://www.ft.com/content/b01c7c02-56cd-11e9-91f9-b6515a54c5b1?emailId=5ca6c94d6008f300048dd485&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[9] https://www.ft.com/content/86afb140-56cd-11e9-91f9-b6515a54c5b1?emailId=5ca6c94d6008f300048dd485&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[10] https://www.politico.eu/article/uk-government-employs-firm-to-track-brexit-stockpiling-data-food-supply/?utm_source=POLITICO.EU&utm_campaign=7a46094dbb-EMAIL_CAMPAIGN_2019_04_05_04_54&utm_medium=email&utm_term=0_10959edeb5-7a46094dbb-190334489

[11] https://www.aljazeera.com/news/2019/04/chief-deeply-concerned-military-escalation-libya-190404081217912.html?wpisrc=nl_todayworld&wpmm=1

[12] https://libya.liveuamap.com/ Haftar’s region is in red.

[13] https://www.reuters.com/article/us-saudi-usa-oil-exclusive/exclusive-saudi-arabia-threatens-to-ditch-dollar-oil-trades-to-stop-nopec-sources-idUSKCN1RH008

[14] https://www.nytimes.com/2017/06/13/business/economy/a-president-at-war-with-his-fed-chief-5-decades-before-trump.html

[15] https://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.20.4.177

[16] https://www.businessinsider.com/ronald-reagan-fed-chair-volcker-trump-2018-10

[17] https://www.latimes.com/archives/la-xpm-1986-10-03-fi-4106-story.html