Daily Comment (April 26, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT]

ECB: The statement was dovish. It indicated that balance sheet expansion is scheduled to end in September but actual tapering won’t start anytime soon. Interest rates were left unchanged and forward guidance was generally left unchanged, meaning rates are expected to stay low even after tapering begins. The initial reaction to the statement was muted; the EUR was up modestly before the statement and held its levels after the report. Market action suggests the markets were expecting a dovish statement. The press conference did not offer any major surprises. The lift in the EUR suggests the market was leaning bearish going into the meeting and thus we are seeing some short covering. In addition, we have seen a drop in U.S. interest rates and a rise in commodity prices. Those moves are consistent with dovish monetary policy.

China trade negotiations: Treasury Secretary Steven Mnuchin, NEC Director Larry Kudlow, Director of Trade Peter Navarro and USTR Bob Lighthizer are going to China next week to discuss trade. It’s an interesting group. The first two are establishment figures and support free trade, while the latter two are protectionists. If the Chinese can’t divide this group, it will be a diplomatic own goal. We doubt anything will come of these meetings but headline volatility is possible because the free traders and the protectionists will have different takes on Chinese concessions. Sending a group that is this divided is unusual for most presidents but not a huge shock for this one; Trump likes improvising and thus sending a group that can’t possibly agree gives Trump room to deal with Xi directly.

Macron recap: The personal chemistry between Macron and Trump appeared very warm. However, Macron’s comments were diametrically opposed to Trump’s worldview. Using Mead’s archetypes, Macron is probably closer to Wilsonian, while Trump is almost pure Jacksonian. These views of foreign policy are completely incompatible. However, it’s important to remember that Mead’s archetypes are relevant for American administrations. It’s easy for foreign governments to be Wilsonian when they don’t bear the costs of enforcing human rights across the world.

Confirmation: The South China Morning Post[1] confirms reports that have been circulating that Mt. Mantap has been severely compromised by recent nuclear tests and is no longer safe to use for such tests. In fact, the article suggests the most recent blast has created a “chimney” that could allow radioactive fallout to rise into the atmosphere. Thus, the decision to end nuclear tests may not fully reflect a change in policy by North Korea but a necessity brought on by test site conditions.

Energy recap: U.S. crude oil inventories rose 2.2 mb compared to market expectations of a 2.3 mb draw.

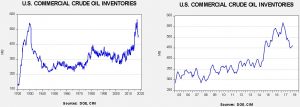

This chart shows current crude oil inventories, both over the long term and the last decade. We have added the estimated level of lease stocks to maintain the consistency of the data. As the chart shows, inventories remain historically high but have declined significantly since last March. We would consider the overhang closed if stocks fall under 400 mb.

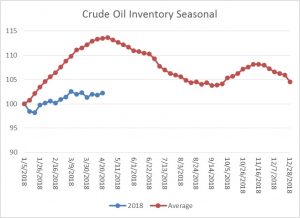

As the seasonal chart below shows, inventories are usually rising this time of year. This week’s rise in stockpiles is normal. We note that next week’s report is usually the seasonal peak in inventories. If we follow the normal seasonal draw in stockpiles, crude oil inventories will decline to approximately 422 mb by September.

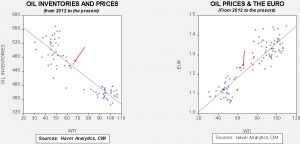

Based on inventories alone, oil prices are undervalued with the fair value price of $64.31. Meanwhile, the EUR/WTI model generates a fair value of $74.12. Together (which is a more sound methodology), fair value is $70.86, meaning that current prices are below fair value. Using the oil inventory scatterplot, a 422 reading on oil inventories would generate oil prices in the high $70s to low $80s range. At present, we have no reason to believe that inventories won’t follow their usual path so, barring an increase in supply or a sharp rise in the dollar, the case for higher oil prices is improving.

Another factor we are watching is that Yemeni rebels are reportedly[2] targeting Saudi oil facilities using missiles and drones. So far, the kingdom has been able to intercept the incoming weapons before they do any damage. However, if we see a successful attack, we would expect a strong upward price move due to current tightness in oil markets.

[1] http://www.scmp.com/news/china/diplomacy-defence/article/2143171/north-koreas-nuclear-test-site-has-collapsed-and-may-be-why-kim-jong-un?utm_source=emarsys&utm_medium=email&utm_content=20180425&utm_campaign=scmp_china&aid=190131336&sc_src=email_2220763&sc_llid=6483&sc_lid=151052347&sc_uid=U5LNF58jFg&utm_source=emarsys&utm_medium=email

[2] https://www.wsj.com/articles/yemens-rebels-step-up-attacks-on-aramco-oil-facilities-1524656858?mod=ITP_world_0&tesla=y