Daily Comment (April 23, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning! Ramadan begins this evening. Equities are steady this morning as financial markets digest historically weak economic data out of Europe. Meanwhile, oil prices continue to recover; we update our views on oil in this week’s Weekly Energy Update. We also update the COVID-19 news below, and, proving that geopolitics, like rust, never sleeps, we update geopolitical concerns over North Korea and China. Here are the details:

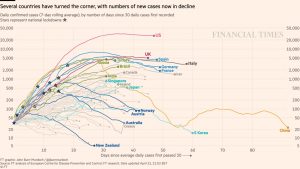

COVID-19: The number of reported cases is 2,647,512 with 184,372 deaths and 721,349 recoveries. In the U.S., there are 842,624 confirmed cases with 46,785 deaths and 76,614 recoveries. Here is the FT chart:

The virus news:

- The reopening after lockdown is the next phase of the virus. We are watching with great interest the steps that various governments are using to make this work.

- South Korea is quarantining those with the virus and using wristbands to make sure that those who are ordered to stay home do so.

- Chile is issuing “immunity passports” to those who have recovered from the virus. This will allow them to return to work.

- In the U.S., because of our federal system, states and local governments are generally in charge of reopening. This is leading to a mixed response, with Georgia taking a rather aggressive stance compared to a more cautious one from New York. However, reducing restrictions is one thing, but changing behaviors is another. Even reducing restrictions may not lead companies and households to change their behavior. Another lurking worry is fear of litigation. Although the White House has argued that businesses should not be liable for infections that occur on their premises, it isn’t a stretch that some lawyer somewhere will bring a case against a restaurant or a grocery store for a patron that believes he contracted the disease while visiting that establishment. That may keep businesses from aggressively reopening.

- Another factor is that, for some workers, the combination of state unemployment plus the federal boost is high enough to discourage returning to work. That may slow reopening as well.

- New reports indicate that the first confirmed case of COVID-19 occurred in Santa Clara as early as February 6. This means COVID-19 got here earlier than previously thought.

- The most vulnerable to the virus appear to be residents of nursing homes.

- Meanwhile, there remains great uncertainty about the veracity of the infection and fatality data. This report sheds some light on the issue by comparing overall death rates to normal rates in numerous nations. One interesting sidelight is that Sweden’s fatality rate is only running about 12% above normal compared to Spain at 66% or England and Wales at 33%. Sweden has been doing “lockdown-lite” and this data would suggest it is working, at least so far.

- A new, and we must say, unsettling, development is being reported about COVID-19. Infections seem to be triggering difficult to control blood clotting in some patients. Researchers are not sure but speculate that the clotting may be caused by the body’s reaction to the virus itself. In other words, COVID-19 doesn’t directly lead to clotting but the body’s immune response triggers the reaction. There were some reports of clotting overseas but the U.S., plagued by obesity and heart disease, is seeing more cases. Apparently, it has become a risk factor for women immediately after childbirth. This is the first time we have heard of this characteristic, but it might explain why age has become such a serious risk factor for the virus.

- In China, testing of patients who have had the disease, recovered and are asymptomatic are still showing the virus remains present. It is unclear whether (a) these patients continue to shed the virus and are thus able to spread it, or (b) the tests are generating false positives. It is universally held by researchers that the key to reopening economies and easing social restrictions is testing. However, we are increasingly concerned the testing may be flawed. When one creates an indicator, there is always a tension between sensitivity and accuracy. Constructing an indicator for sensitivity will tend to give lots of positive signals but risk false positives. Making one that leans toward accuracy means the test confirms clear cases but will miss borderline ones or generate false negatives. This is simply a fact of creating such instruments. We suspect researchers have feared false negatives more than false positives, which makes sense. And, we note there has been little evidence that those who have recovered have been transmitting the disease to others. However, if we go “all in” on testing, we could create situations where we believe we are surrounded by “typhoid Mary’s” who we quarantine when they pose no threat at all.

- China is facing a new surge in cases in Heilongjiang province which borders Russia in the northeast. Local officials have imposed travel restrictions with Russia, fearing that the new cases are being imported from the north.

- SOS Pompeo has accused China of deliberately destroying coronavirus samples as part of a cover-up to prevent analysts from determining the origin of COVID-19. This allegation continues the pattern of deteriorating relations between the U.S. and China.

The policy news:

- There is a brewing battle between the Speaker of the House and the Majority leader in the Senate. State and local governments have increased their spending to respond to COVID-19. Democrats wanted to boost support for state and local governments in the latest stimulus package but were rebuffed. McConnell revealed his thoughts yesterday, suggesting state and local governments should probably avail themselves to the bankruptcy courts.

- The position of state and local governments has been a brewing problem for some time. A number of states (our neighbors east, in particular) have difficult financial positions due to pension obligations. Bankruptcy may be the only way to address the pension problem, forcing a resolution.

- That might be a solution, but now is a potentially dangerous time to bring it up. Financial crises develop because asset holders fear a “run on the bank.” If muni bond holders begin to believe their bonds could default on a widespread basis, it could trigger a mass selloff and lead to a broader financial crisis.

- We will watch to see how the Fed and the White House react; our suspicion is that McConnell will get some sympathy for his position, but, in the end, there will be aid for state and local governments.

- Another area we are watching closely is the mortgage industry. There are growing concerns that Fed support isn’t broad enough and the fiscal side isn’t doing enough either.

- It appears the backlog for the Paycheck Protection Program is growing rapidly and may quickly exhaust the $320 billion new funding. Another item we discovered that we didn’t know before: there are moral clauses in SBA lending which are shutting out businesses for these loans. We are starting to see talk of a stimulus idea that, in one form, which we noted over a month ago, would be a payroll tax holiday. However, what is being considered now would put the plan on steroids; it would use the system in reverse to funnel money to firms that pay the payroll tax to subsidize keeping employees on the payroll.

- As we note below, European PMI data fell to historically low levels. The European Commission is mulling a €2.0 trillion support package that includes loans and grants. However, there has still been no movement on a Eurobond.

The economic news:

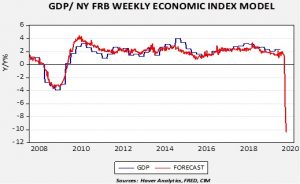

- The preponderance of the data still points to a very weak economy. The NY FRB has issued a weekly estimate of GDP designed to show what the yearly change in GDP will be based on current data. The index doesn’t have a long history, but it fits GDP rather well. It is suggesting a nearly 11% yearly decline is on its way. We will continue to monitor this data for insights into the path of the economy.

- It’s not all bad, however. Daily consumer sentiment data from Morning Consult is suggesting that consumers remain glum, but conditions are not worsening.

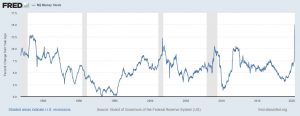

- The move to cash by households and firms has led to a massive jump in M2. This measure of the money supply is up over 15% from last year. Under normal circumstances, this available liquidity would be considered bullish for future growth. However, uncertainty surrounding the futures will, at least for a while, lead to a drop in velocity.

- Quietly, China is admitting it won’t meet its 6% GDP target this year.

The market news:

- Another meatpacking plant has been forced to close due to COVID-19. Tyson Foods (TSN, 59.92, -1.99) announced it would close its Waterloo, IA, pork processing plant, the largest in the company. This follows closures by other firms in South Dakota. We would expect pork shortages to begin developing very soon.

- One of the consequences of working from home may be that households begin to realize that living in a big, expensive city may not be necessary for employment. That may lead to an exodus from these overcrowded areas into areas with lower costs of living.

The foreign policy news:

- We reported recently that Australia was taking measures to force news aggregators to pay more to content providers (news organizations). France has moved in a similar direction and the EU is considering action as well. If this trend accelerates, it will affect Google (GOOGL, 1258.41, +46.25) and Facebook (FB, 182.28, +11.48).

- Declines in developed nation employment are hitting remittances from immigrant workers to their families in emerging economies.

- Iran’s Revolutionary Guard Corps is using the pandemic to increase its influence in the country. We have wondered for some time whether when Ayatollah Khamenei dies the Corps might end up seizing power and either dispensing with rule by clerics or installing a puppet to take full control.

China: China has been taking increasingly aggressive actions in the South China Sea. Malaysia is reporting that a Chinese survey vessel has been operating in its waters without asking for permission. This same ship, the Hai Yan Di Zhi 8, operated in a disputed area near Vietnam. This is just the latest in a series of actions China has taken recently. To some extent, this is nothing new; China has claimed the entire South China Sea as its own, but does appear to be using the distraction triggered by the COVID-19 pandemic to continue these actions. The U.S. has responded by sending U.S. warships into the area. China has also been accused of using social media to send fake messages into the U.S. designed to spread disinformation. These actions, along with others, have been increasing anger at China, which may have an adverse reaction in the future.

North Korea: Although COVID-19 is clearly dominating the news and markets, there are other concerns we are monitoring. The mystery of Kim Jong Un’s health is front and center. As we have noted, the “young general” has been out of sight for much of April. He missed his grandfather’s birthday remembrance celebration on April 15. There are reports, still not actually confirmed, that he had heart surgery, perhaps of an emergency nature. Kim is said to be a heavy smoker and may be sporting a BMI of 45. On the one hand, those risk factors would point to a cardiac problem; at the same time, there are plenty of men in their early 30s with those factors who do just fine. It’s when they get a bit older that problems emerge. Thus, if Kim needed bypass surgery at this age, that would be a problem.

At the same time, we are not seeing the sort of behavior we usually see when an authoritarian leader is stricken. Often, if the leadership is in doubt, the military is confined to barracks to prevent a coup and, if a praetorian guard is in place, it is put on high alert. None of these situations have been reported. It is not uncommon for those whose status is totally dependent on the sickened leader to head for the exits when it looks like a new person is going to take over. After all, the new leader will have his own people and the previous leader’s sycophants are usually dispatched either to remote and hostile areas of the country or to regions beyond this earthly pale. There is no evidence of high-level defections. This isn’t the first time Kim has disappeared; he was missing for a month in September 2014, only to reappear using a cane. It was suspected the young leader fell victim to a bout of gout. So, we do have to take care in overreacting.

Here are two items to consider. First, if Kim is really in grave danger, watch China and South Korea. China is always worried about a collapse in Pyongyang because it will trigger a refugee crisis. If we see Beijing take steps to aggressively seal the border with North Korea, it would probably mean something is up. South Korea has similar worries. Seoul is terrified of the costs West Germany bore to integrate East Germany. Given how militarized the 38o parallel is, it would be suicidal for North Koreans to flee south unless the regime completely collapses. But, if South Korea starts moving to protect the border, it may mean it knows the regime is in trouble. Second, there are reports that Kim’s half-sister, Kim Yo Jong, would be the next in line for the “throne.” We have serious reservations about this idea. The Kim regime isn’t called the “Hermit Kingdom” for nothing; this is a dynastic system and it isn’t clear a woman would be accepted as leader. She might, but it’s not guaranteed. Kim Jong Un has an older brother, Kim Jong Chul. The oldest brother, Kim Jong Nam, was assassinated in 2017.

The collapse of the North Korean regime would be a geopolitical mess. There would be a scramble for power among the non-Kim leaders. We could see a mass selloff of military hardware, and there is the aforementioned refugee crisis. There are reports that the U.S. has contingency plans, which is good. However, one must always remember Mike Tyson’s comment about plans. If a breakdown occurs, equities in South Korea and Japan would be at highest risk.

Argentina: The government missed a $503 million debt payment yesterday, starting the clock for default. If an arrangement isn’t made in the 30-day grace period, there will be an official default on $65 billion of debt owed to private creditors.