Daily Comment (April 17, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Good morning and happy Friday! Equities are rebounding this morning on a positive drug trial. China’s GDP turns negative. We update the COVID-19 news. Here are the details:

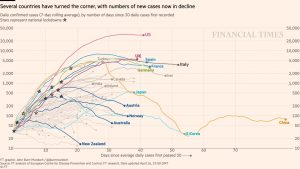

COVID-19: The number of reported cases is 2,169,022 with 146,071 deaths and 522,264 (yes, that’s down from yesterday) recoveries. Here is the FT chart:

There is a clear bend in the U.S. curve, which is good news.

The virus news:

- U.S. equity futures rallied overnight on reports that a clinical trial for Gilead’s (GILD, 76.54) remdesivir was effective in treating COVID-19 patients.

- The reports came from a Chicago hospital. Remdesivir was initially developed to combat Ebola; it is an anti-viral, meaning it attacks the virus itself.

- First, it is always good news when some drug works. Second, we are still a long way from remdesivir becoming a widespread treatment. The Chicago report was a clinical trial; it was used alone. The gold standard for drug testing is the double-blind study, where sick patients are either given the drug or a placebo. Neither the patient nor the doctors administering the drug know what a patient is receiving.

- The reports on what occurred in Chicago are glowing (hence the nearly 3% jump in equity futures), but without a double-blind study we may be merely observing a fluke.

- It is also worth noting that remdesivir won’t prevent one from being infected by COVID-19; however, if it works, it may reduce the severity of the infection and save lives. A rough comparison is with Tamiflu; it doesn’t prevent one from getting the flu but it can make the symptoms less severe. Remdesivir appears to be much more potent than Tamiflu but the usage is similar.

- There is a myriad of treatment options being investigated. The U.S. is helping fund the vaccine effort.

- The counting effort has become a source of uncertainty as well:

- Spain’s death toll will likely be revised higher due to undercounting of nursing home resident deaths. The death count is having a political impact in Spain and Italy.

- New York raised its total as well, counting more who died outside of hospitals.

- Wuhan doubled its death toll after reviewing the data. There have been growing doubts about the death toll (cremations seemed to far exceed death reporting) and even this increase is likely an undercount.

- As we noted yesterday, we still don’t know enough about the virus. In Wuhan, serological testing has begun. The initial reports suggest the city, which was hard hit, is still well below herd immunity levels. Meanwhile, the U.S. Navy is nearly finished testing the sailors on the U.S.S. Theodore Roosevelt. About 13% have tested positive and of those 60% were asymptomatic. This would suggest a very wide dispersion in how people are affected and that silent carriers can spread the disease outside of social distancing.

- The U.K. has extended social distancing measures for another three weeks.

The policy news:

- The U.S. has unveiled its plan for reopening the economy after the shutdown. There were no huge surprises. It’s a standard issue set of guidelines that gives state and local governments the authority to make their own plans.

- In California, some of the larger cities and counties are preparing to slowly reopen.

- Another development we continue to watch is that groups of states are planning their reopening in concert.

- The EU unveiled its plan for reopening; it is similar to the U.S., except it uses nations instead of states.

- There is a growing backlash against the sheltering orders. If this grows and governors cannot enforce them, there is a risk of a second wave of infections and deaths during the summer.

- It is looking like the mortgage servicers will be the next to need a bailout. As borrowers are unable to pay either their mortgage or rent, the servicers are required to pay the bondholders. Many of them lack the capital to do this for very long. If the bailout is coming, the quasigovernment firms may not be the source of funds.

- The small business bailout program has exhausted its funds. Replenishment is caught in a political figh

The economic news:

- Although it comes as no great surprise, China’s Q1 GDP fell 6.8% from last year, and -9.8% from Q4, for an annualized decline of 34%. This is the first decline in China’s GDP since it began reporting on a quarterly basis. During the “Great Leap Forward,” which ran from 1958 to 1960, China experienced a -27.3% drop in GDP in 1961.

- One interesting tidbit; excavator sales are jumping in China on expectations that there will be a jump in stimulus spending on public works.

- As we reported yesterday, there is a looming bottleneck developing in the meat industry as the processors close due to worker infections. This is leading to shortages in stores and involuntary herd expansion for farmers and ranchers.

- There has been a remarkable adjustment by manufacturers to repurpose assembly lines for medical supplies.

The market news:

- Airlines who took bailout funds are being forced to maintain routes even as passenger counts dwindle. And, there is a chance that we have seen the end of the airlines’ ability to put more passengers on planes.

The foreign policy news:

- The origin narrative of COVID-19 is increasingly looking like it may have escaped from a Chinese bioweapons lab. Initial reporting pointed at China’s “wet markets,” where wildlife is sold for food, but that idea is becoming increasingly suspect. U.S. intelligence agencies have been investigating the lab origin for a while. It does not appear that COVID-19 is a bioweapon; genetic reports indicate that a weapon designer would have made it differently. Instead, the idea is that poor security practices led to a leak of a bat virus that crossed the species barrier. China has had problems with biosecurity before—it was evident in the SARS epidemic. At this point, the intelligence agencies have not been able to determine with confidence that a leak caused this pandemic. They may never be able to reach a high standard of proof. But the standards of proof in the court of global public opinion are lower. U.S./China relations were already on tenterhooks; COVID-19 is likely to further freeze the relationship.

- China’s standing is even suffering in Africa, where it has been a large investor and lender.

- There are reports within China of a surge of xenophobia; it appears the relationship tensions flow both directions.

- We reported yesterday that Japan was helping fund companies that wanted to leave China. There is increasing evidence of Japan’s withdrawal from the Chinese economy.

- How bad is it? It’s so bad that Venezuelans who have fled the country are going back! At the same time, oil-rich Venezuela is running out of gasoline.

- French President Marcon warns that the EU may unravel if it doesn’t work together to help nations hit hard by the virus.

- Brazil’s President Bolsonaro has fired his health minister. The president has strongly opposed social distancing, while Luiz Henrique Mandetta, his health minister, had been pushing for such measures.

- Drug smugglers have apparently been hiding shipments in medical imports.

Odds and ends: Argentina has made a restructuring offer for its debt. It is looking for a three-year grace period from lenders. The Navy is accusing Iran of harassing Persian Gulf shipping. Russian oil firms are fighting over the allocation of production cuts. Despite everything, the Johnson government in the U.K. refuses to ask for a Brexit extension.