Daily Comment (April 15, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning all! Risk assets are higher this morning in a quiet trade. We have a long roster of economic data this morning which we cover in detail below. Our coverage begins with the Beige Book, which turned equities lower yesterday. International news follows, with the U.S. announcing the withdrawal of American troops from Afghanistan and sanctions on Russia. Economics and policy are up next, with a discussion of money markets. China news follows, and we close with our pandemic coverage.

Beige Book: The Beige Book is a report from all the Fed district banks that discusses economic conditions. The goal is to offer a regional picture of the economy. Overall, the report showed a stronger economy, which is good news, but rising price pressures, which were negative for equity markets yesterday. In related news, Chair Powell spoke to the Economic Club of Washington yesterday, reiterating that policy rates will stay low for an extended period. However, he also noted that bond purchases would be tapered before rate hikes would occur.

International news: The withdrawal from Afghanistan begins, and the U.S. will sanction Russia.

- Yesterday, President Biden announced that the U.S. would end its military involvement in Afghanistan on September 11. When American troops leave, it will officially end the longest war in U.S. history. For hegemons, conflicts in minor nations always present problems. On the one hand, leaving suggests that the hegemon lacks staying power and is weak. On the other, staying in a conflict with no clear endpoint becomes a distraction and a drain on resources. Afghanistan was always a problematic conflict. The country has a reputation—it’s called the “graveyard of empires” for a reason. Both the British and the Russians failed to win conflicts in the country. Is there a risk to leaving? Yes. The Taliban will almost certainly take control of the government and implement its medieval rules. Afghans who oppose the Taliban will either try to leave, creating a refugee problem, or create an ongoing civil conflict. In other words, instability will likely follow (not that what is in place now is at all stable). And, as the Viet Cong realized, the U.S. can be outlasted in areas that are not of vital concern. That knowledge will limit America’s power to project into similar areas. This experience should also be a warning to U.S. leaders that if you are going to use the military in places like Afghanistan, “mission creep” should be avoided. NATO allies are not happy that the U.S. made this decision unilaterally; to some extent, the lack of concern about NATO from Washington reflects American dominance of the group. Interestingly enough, America’s withdrawal now becomes a problem for China. Unrest in Afghanistan could spill over into Xinjiang.

- By ending American involvement in Afghanistan, the U.S. can increase its focus on other areas of the world, e.g., China. Ending the conflict in Afghanistan also marks the end of the War on Terrorism so the U.S. can prepare for great power conflicts with China.

- In response to the SolarWinds (SWI, USD, 17.99) hack and other activities, the U.S. announced it would impose additional sanctions. These include reducing U.S. banks’ participation in the Russian bond market and expelling 10 Russian diplomats.

- Initial presidential elections in Peru have led to a runoff between two starkly different candidates. Pedro Castillo is a trade unionist running on a left-wing populist platform. He will be challenged by Keiko Fujimori, the daughter of the former (imprisoned) president who is under scrutiny for corruption. Castillo wants to nationalize various industries and is running on a hard-left platform; Fujimori will appeal to market-friendly voters.

- In September, Germans will vote for a new government. The current ruling coalition government of Chancellor Merkel, dominated by the CSU/CDU, is in turmoil. Markus Söder, from the CSU, would be a different conservative from the CDU’s line. He is much more socially conservative and would be less supportive of the EU. At the same time, he is much more popular than the CDU candidate, Armin Laschet. If Merkel blocks Söder, it is much more likely the CDU/CSU will not govern. But, if Söder becomes the candidate, German policy might change significantly.

- There was an attack on an Israeli-owned vessel in the Gulf of Oman. It is likely the attack was at least sponsored by Iran. It is the third attack on an Israeli vessel in the Persian Gulf area.

Economics and policy: Regulators are making another attempt to reduce the risks from money markets.

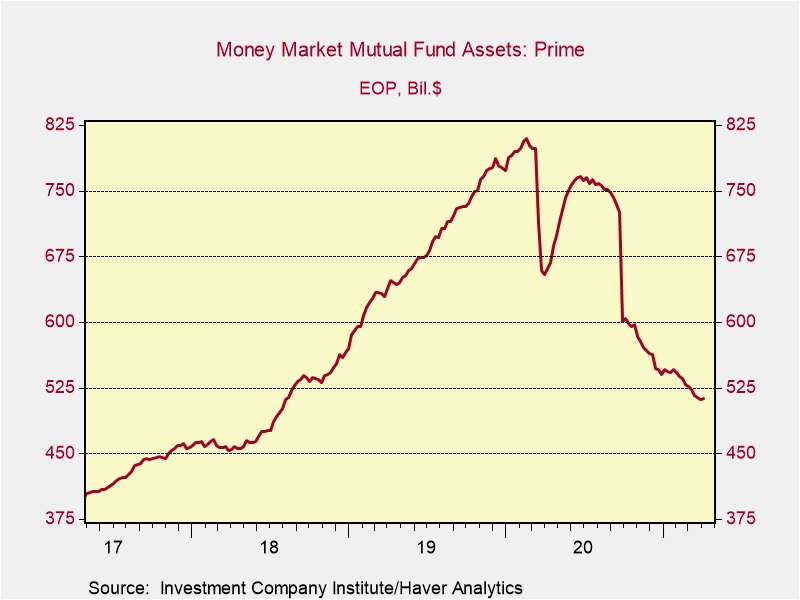

- The money market fund was initially created as a sort of regulatory arbitrage to a retail banking industry constrained by Regulation Q, which set maximum deposit rates.[1] The money market has become a key supplier of funds for the non-bank financial system. Unfortunately, as the Great Financial Crisis showed, money market funds are “runnable.” During 2008-09, money market funds came under pressure as some of their assets (usually commercial paper) defaulted, and the funds came under threat to “break the buck.” Since then, regulators have struggled to address the problems of the product. Since 2008, money market funds have faced occasional problems; for example, last March, investors pulled funds from prime money market funds, and the Fed had to put a backstop in place.

The Treasury is considering new rules to reduce the systemic risk money markets have created. The industry is concerned that the rules will make money markets indistinguishable from bank deposits. That development would pretty much end money markets as we know them. But, as banking showed during the 1930s, the lack of deposit insurance can lead to bank runs. An obvious solution would be for the value of money market funds to fall below $1 per share. Investors wanting a higher yield should be willing to accept some degree of risk. But the industry has built its business model as being identical to bank deposits, so they will fight such measures. The regulatory decisions will be important because money markets are the primary source of funds for the non-bank financial system. At the same time, it doesn’t make much sense to allow runnable funding for this part of the market.

- One of the areas we favor is homebuilding. Not only is the supply of housing tight, but demand has been strong. One of the characteristics we have noted since the Great Financial Crisis is that commercial investment has increased in the single-family sector. It appears that foreign investors are moving into the area of the market as well. With the large fiscal deficit, we expect the current account deficit to widen, which (by the very nature of the saving identity) means that foreign investment will also rise. Foreign investment into single-family homes will likely add more support to the homebuilding industry.

- Meanwhile, the pandemic led to forbearance and the postponement of evictions. As the economy reopens, mortgage holders and renters will need to address the arrears that have developed. Because these arrears could cause disruptions to the economy, recent legislation has allocated $25 billion of relief for renters. Local governments are now trying to figure out how to distribute this aid.

- Logistics firms are raising wages in a bid to attract workers. An increasing number of delivery options, along with rising demand, is leading to labor shortages for drivers. At the same time, there is some good news from California ports; the backlog of ships waiting to dock appears to be lessening.

- Remember the Ever Given, the huge container ship that blocked the Suez Canal? Port authorities have impounded the vessel to force its owner to pay for the costs of the disruption.

- Amazon (AMZN, USD, 3333.00) is coming under scrutiny for its apparent practice of forcing firms that use its platform to provide data to other parts of Amazon. Before Bork, such activity was seen as a violation of antitrust rules. Because of the steady march to a pre-Bork antitrust legal standard, this sort of activity is now being called into question.

China: Chinese regulators continue to crack down on leverage, and tensions with Taiwan and Japan remain elevated.

- One way local governments meet their economic targets is through borrowing. They often create special purpose vehicles that raise funds for specific projects. Lenders work under the assumption that the central government will backstop these vehicles, which makes them attractive. Beijing is signaling that this assumed backstop isn’t reliable and wants these vehicles to be restructured if the loan goes bad. The Xi government is starting to aggressively deal with China’s massive debt, calling it a “national security” issue. Corralling local government borrowing is an element of slowing the debt expansion. On a related note, the PBOC will expand its stress tests to include all that nation’s banks (all 4,024 of them). The central bank has conducted stress tests since 2012 and usually covers about 40% of them. Expanding to cover all of them suggests Beijing is worried about unreported risks in smaller banks.

- One of our internal discussions since Xi took office is the purpose for his centralizing power. There is a case to be made that he centralized power (e.g., not naming a successor and making himself president for life) simply because he liked being powerful. An alternative was that he believed China faced serious threats and needed a strong “helmsman” to ensure the country thrived. The issue of Taiwan would be a threat; the debt would be as well.

- At the same time, these threats are nothing new. So, why is the action on debt occurring now? One possibility is that China is observing the U.S. fiscal expansion and realizes that it will almost certainly lead to a massive current account deficit that China can fill through exports. In other words, as it brings its debt under control, it could maintain economic growth by expanding exports. Even if the U.S. applied trade barriers on China, other nations would fill the gap created by the fiscal expansion, and China would export to those other nations.

- On a side note, banks are not the only area coming under examination by regulators. Technology is as well, and most Chinese firms are cooperating with regulators.

- Tomorrow, PM Suga of Japan will visit the White House. The U.S. is pressing Japan to issue a joint statement supporting Taiwan. This would be historic; the last time a Japanese PM issued a joint statement with the U.S. on Taiwan was in 1969. It is possible that Suga will disappoint the U.S. In 1969, Japan was not as closely tied to China’s economy. That is no longer the case. At the same time, Japan does view Taiwan with great interest. Japan controlled the island from the late 1800s until the end of WWII, and if China controlled Taiwan, it could more easily disrupt trade flows to Japan.

- The U.S. is sending a delegation to Taiwan. In response, China is conducting military exercises, including live fire, in the waters between the mainland and Taiwan.

- John Kerry is planning to meet with Chinese officials over climate issues.

- Yesterday, we noted that the declassified National Intelligence Estimate had a focus on China. One of the key issues regarding relations with China is that Beijing views itself as a peer. That position will complicate relations. Essentially, China will likely challenge the U.S. in various areas of the world.

- A bipartisan bill in the Senate Foreign Relations Committee, designed to weaken China’s power, would add sanctions and increase support for nations in the Indo-Pacific. If the bill makes it out of committee (which looks likely), we would expect the Senate to pass it.

COVID-19: The number of reported cases is 138,422,960 with 2,975,830 fatalities. In the U.S., there are 31,422,960 confirmed cases with 564,406 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 250,998,265 doses of the vaccine have been distributed with 194,791,836 doses injected. The number receiving at least one dose is 123,917,385, while the number of second doses, which would grant the highest level of immunity, is 76,681,252. The FT has a page on global vaccine distribution. The weekly Axios map shows rising cases in about half the country.

Virology

- The CDC has delayed a decision on the Johnson & Johnson (JNJ, USD, 159.92) vaccine after there were reports of blood clotting in recipients. The body wants more data before making a decision. So far, there have been six cases (one fatal) reported after 6.8 million doses have been administered. Although the risk is clearly low, with alternatives available, it is possible the U.S. may decide not to allow the vaccine to be used in the U.S.

- The J&J vaccine has attractive properties. It is a single-shot vaccine, and it doesn’t require the extreme freezing the mRNA vaccines require. If the U.S. decides not to use it, the vaccine will likely be shipped to the developing world.

- The EU is also deciding on the J&J vaccine. It is also ordering additional vaccines from other producers.

- Former leaders are calling for patent relaxation on vaccines to expand production to the developing world.

- Researchers are testing whether various vaccines can be combined. A trial is starting where some participants who have received one vaccine are given one of the newer ones. Scientists will see how the candidates react to different vaccine strains and check for safety and efficacy. If the combined vaccines prove safe and effective, it would allow for greater flexibility in distributing vaccines.

- Small studies conducted at the state level suggest that vaccines offer strong protection against adverse outcomes from COVID-19. They don’t completely prevent infection, but they clearly reduce the severity of the disease.

- We have been watching the COVID-19 passport issue as vaccinations have become widespread. Globally, there is a growing issue of falsified documents, which, if not addressed, will render passports ineffective. Despite the expansion of fake documentation, private businesses and universities are starting to insist on proof of vaccination before allowing people to use their services.

- India is trying to cope with a massive surge in infections.

- Studies show that keeping middle seats vacant on aircraft reduces virus transmission risk.

- Although lockdowns did reduce the risk from COVID-19, it almost certainly increased the risk for other problems; drug overdose deaths soared during lockdowns.

[1] This is why one would get a toaster if they opened an account at a bank or savings and loan in the late 1970s. The toaster represented interest the firm couldn’t legally pay the depositor.