Daily Comment (April 9, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with some observations on gold prices, which hit a record high yesterday. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including more signs of a Western trade war against China over its dumping of excess production on world markets and another indication that US commercial real estate prospects may be on the verge of improving.

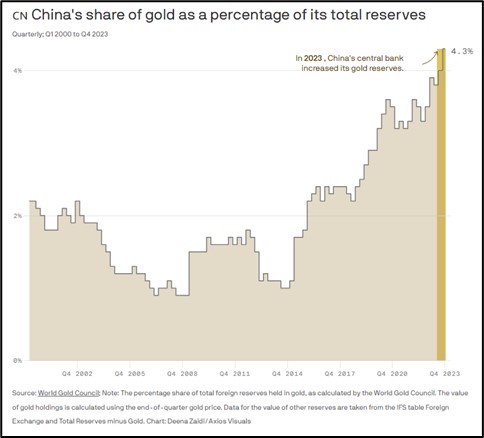

Global Gold Market: Gold prices hit a new all-time record yesterday, closing at $2,357.80 per ounce despite investors’ realization that the Federal Reserve isn’t likely to cut interest rates as aggressively as previously thought (gold prices have historically been hurt by high real interest rates). In our view, the anomaly reflects a broad commodity rally, geopolitical tensions, and especially strong buying by central banks.

- Gold has long been seen as a “safe haven” asset that can hold its value in the face of currency debasement, rising price inflation, and wars or other geopolitical tensions.

- More recently, it’s become clear that gold is a safe haven even to foreign governments and their central bankers, especially in the rival China-led geopolitical bloc. As those governments and central banks digest how the West has essentially frozen or seized reserves held by countries like Afghanistan, Iran, and Russia, they’ve become much more intent on holding their reserves in hard assets such as the yellow metal.

- The process of central banks shifting their reserve holdings toward gold, silver, or other physical commodities could well continue for some time. Therefore, it’s possible that gold’s current uptrend will continue.

European Union-China: New reports say waves of imported autos are piling up at European ports, reflecting not just the onslaught of mostly Chinese-made vehicles but also a shortage of truckers to move them out and a slowdown in demand among European consumers. We think the situation will only make it more likely that the EU will formally impose anti-dumping tariffs or other trade barriers against China once its current investigation of the issue is completed.

European Union-Russia: Yesterday, the European Commission’s top diplomat, Josep Borrell became the latest high-level European official to warn of an impending war with Russia. In a speech in Brussels, Borrell warned that “Russia threatens Europe . . . War is certainly looming around us, and a high-intensity, conventional war in Europe is no longer a fantasy.” Consistent with our outlook for bigger military budgets around the world, Borrell urged the creation of a joint EU financing mechanism to boost the bloc’s defense industrial capacity to prepare for war.

Eurozone: The European Central Bank said its first-quarter survey of commercial banks revealed a substantial decline in corporate loan demand. The fall in demand for credit apparently reflects weaker investment plans, so the data may more strongly prompt the central bank to signal the beginning of interest-rate cuts when it holds its policy meeting later this week. At this point, investors largely expect the ECB to start cutting rates in June.

Turkey-Israel: Under domestic political pressure to do more to stop Tel Aviv’s war against Hamas in Gaza, the Turkish government today said it will restrict the export of 54 different products to Israel. The restrictions will affect exports ranging from construction machinery and metal products to fuels and oils. The move reflects how Israel’s war on Hamas and the resulting civilian casualties are increasingly isolating the country politically and economically, with potentially long-term consequences.

Japan: In testimony before parliament today, Bank of Japan Governor Ueda said the central bank will keep monetary policy accommodative for now, despite its decision to end its negative interest-rate policy last month. Ueda did say that the policymakers might reduce the amount of accommodation if consumer price pressures worsen, but he offered no firm guidance on when interest rates might rise again. The testimony suggests Japanese rates will rise only slowly and remain relatively low for the time being, keeping downward pressure on the yen.

United States-China: In her visit to China this week, Treasury Secretary Yellen has delivered a tough warning that the US will respond if Beijing keeps pushing unwarranted investment that leads to more excess capacity and increased dumping of cheap Chinese goods on the world market. However, Chinese officials have pushed back on the criticism, claiming that excess capacity is normal, and that China is merely trying to develop its economy appropriately.

- Yellen’s tough message and Beijing’s pushback point to further US-China tensions.

- As we have noted many times before, the increasing tensions threaten to catch investors in the crossfire going forward.

US Bond Market: Treasury yields across the maturity spectrum rose to their highest levels since November, with the benchmark 10-year rate closing yesterday at 4.422%. So far this morning, the higher yields appear to be enticing some investors to buy bonds again, pulling yields a bit lower. Nevertheless, as we noted in our Comment yesterday, investors are likely to remain skittish about buying fixed income in the face of sticky consumer price inflation and a Federal Reserve that is less likely to cut interest rates than earlier thought.

US Commercial Real Estate Market: Private investing giant Blackstone yesterday said it is buying Apartment Income REIT, known as AIR Communities, which owns 76 upscale apartment communities mostly in coastal markets such as Miami and Boston. The $10-billion buy comes after a period in which Blackstone was being cautious in the face of high interest rates, rising commercial real estate vacancies, and falling building values. The deal, therefore, could signal an upturn in the sector’s fortunes and a potential rebound in commercial real estate values.