Daily Comment (April 8, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

While everyone else today will be talking incessantly about the solar eclipse, our Comment opens with another step in the Biden administration’s effort to strengthen its alliances in the face of China’s geopolitical challenge. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including new tactics being used by Russia in its invasion of Ukraine and multiple developments regarding US interest rates and the bond market.

United States-Australia-Japan: The AUKUS defense ministers today will announce that the pact’s countries are inviting other nations to join in the grouping for its “Pillar II” projects related to technologies such as quantum computing, undersea sensors and weapons, hypersonic missiles, artificial intelligence, and cybersecurity. A key focus will be to bring in Japan, transforming the group to “JAUKUS.”

Russia-Ukraine War: The Russian military has reportedly shifted its tactics recently, launching missile and drone strikes against Ukraine’s energy infrastructure in relatively less protected regions. The attacks appear aimed at causing more long-lasting damage, since the remote facilities can’t be repaired easily or quickly. In addition, it appears the Russians are trying to force Kyiv to shift its air defense systems to areas away from the main urban centers and battle lines to make it easier for Russian forces to launch an expected new ground offensive.

Slovakia: In presidential elections yesterday, Peter Pellegrini, an ally of pro-Russian, populist Prime Minister Robert Fico, won with approximately 54% of the vote. In Slovakia, the president has only limited power, but the result is seen as burnishing the political power of Fico at the expense of the Slovakian politicians who are more pro-Western, pro-European Union, and anti-Russian.

Ecuador-Mexico: On Friday, the government of Ecuador’s tough-on-crime President Daniel Noboa intruded on the Mexican Embassy in Quito and arrested a former Ecuadorian vice president who had been granted asylum there from charges of corruption. The move prompted Mexico to cut diplomatic ties with Ecuador, but it is also apparently boosting the political position of Noboa as he begins positioning himself for re-election next year.

Mexico: In a debate ahead of the presidential election looming on June 2, leftist frontrunner Claudia Sheinbaum of the ruling Morena Party appeared to successfully fend off biting personal attacks from Xóchitl Gálvez, the main opposition candidate. In the latest opinion polls, Sheinbaum has had a commanding lead with support from about 59% of likely voters. The polls suggest the leftist Morena Party will likely retain the presidency and perhaps control of Congress as well. That will likely keep Mexican equity prices lower than they otherwise could be.

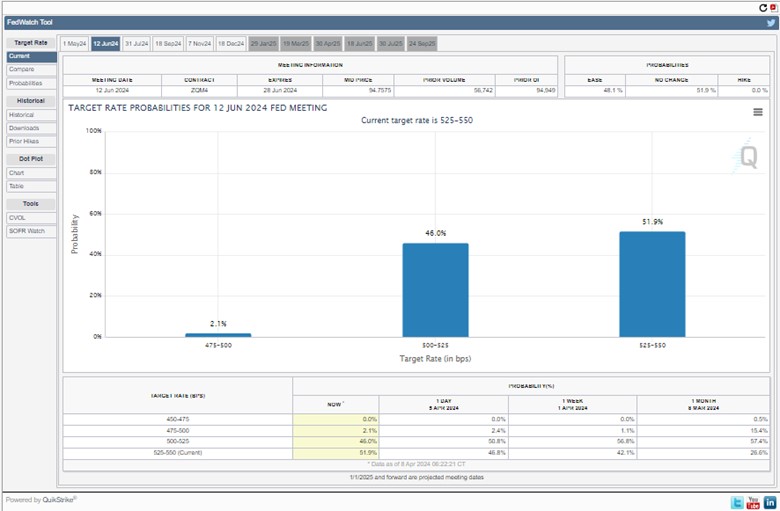

US Monetary Policy: After Friday’s report showing strong labor demand and job growth in March, futures trading now suggests investors no longer expect the Fed to cut its benchmark interest rate in June. Based on the CME FedWatch Tool, investors now see a 51.9% probability that the policymakers will keep the rate in its current range of 5.25% to 5.50%. Some investors now expect the Fed to cut rates only twice this year, while others are entertaining the possibility of just one or even no cuts.

- The scenarios of just one cut or no cuts at all are probably less likely, but they are plausible if economic growth remains healthy.

- In any case, adjusting to the possibility of continued high interest rates has become at least a temporary challenge for stock investors, as reflected in the price declines seen last week.

US Bond Market: Looking further into the future, JPMorgan Chase CEO Jamie Dimon warned today in his widely read annual letter that US interest rates could surge to 8% or more in the coming years in response to expanding fiscal deficits, the energy sector’s “green transition,” and worsening geopolitical tensions. Dimon has been overly gloomy in recent years, but his general analysis is consistent with our view that future inflation and interest rates are likely to be higher and more volatile because of the factors Dimon cites in his letter.

US Fiscal Policy: President Biden today will unveil another sweeping plan to slash student loan debt for millions of borrowers, despite his earlier attempts being turned back by Congress and the courts. The plan marks another effort to curry favor with progressive and younger voters ahead of the November election, and administration officials say they hope borrowers will see reduced payments by the autumn. However, Republican resistance to the plan is already growing and could well thwart it.

- Under the plan, individual borrowers who earn $120,000 or less and married couples who make $240,000 or less would be eligible for forgiveness of the entire amount that their current loan balance has increased beyond the principal.

- The plan would essentially cap accrued interest at the amount of the original principal.

US Industrial Policy: In the latest announcement of subsidies to boost advanced semiconductor manufacturing in the US under the CHIPS and Science Act of 2022, the Commerce Department said it will give $6.6 billion in grants, plus up to $5 billion in loans, to Taiwan Semiconductor Manufacturing Corp. for its effort to build three new fabrication facilities in Arizona.

- Under the deal, TSMC has agreed to start producing its most advanced 2-nanometer chips in the new facilities.

- According to the Commerce Department, that would put the US on track to produce 20% of the world’s advanced computer chips by 2030.