Daily Comment (April 5, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with the latest signs and implications of worsening U.S.-China tensions, including an important admission by a top U.S. business leader that China poses major economic threats to the U.S. and must be confronted. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a surprisingly aggressive interest-rate hike in New Zealand, hawkish statements by a key Federal Reserve official, and evidence that the Fed’s own policies are helping draw deposits out of the U.S. banking system.

United States-China: The U.S. Department of Defense stated in a recent report that China is now, for the first time ever, keeping at least one of its six Jin-class ballistic missile submarines on patrol in the South China Sea on a 24/7 basis. According to the report, the subs are also now carrying China’s new JL-3 missile, which can deliver multiple independently targeted nuclear warheads all the way to the U.S. mainland. The enhanced operating tempo suggests that the Chinese sub force is making important strides in communications, command and control, logistics, and other operational skills. Even though the Jin-class subs are relatively noisy and therefore easy to detect, keeping them in China’s well-protected South China Sea bastion could help them survive any initial conventional or nuclear attack from the U.S., giving China an enhanced ability to launch a retaliatory second strike. That will likely force the U.S. to increase the deployment of its nuclear hunter-killer attack subs, surface ships, and sub-hunting aircraft to the region to track the Chinese vessels and prepare to destroy them if needed in time of conflict. In turn, that will presumably further increase the current strain on the U.S. military and defense industry and worsen U.S.-China tensions.

- Separately, Chief of Naval Operations Admiral Michael Gilday said this week that the U.S. Navy’s updated force structure analysis will probably show that it needs even more ships than its current target of 373 to carry out its global responsibilities and counter the growing threat from China. The Navy’s actual current inventory is only 296 ships. The updated force structure analysis is due to Congress by mid-June.

- Additionally, Jamie Dimon, CEO of JPMorgan Chase (JPM, $128.42), warned in his widely followed annual letter to shareholders that China is now in a position to disrupt the supply of critical commodities and products to the U.S. and its allies, and that it must not be allowed to do so.

- In Dimon’s words, “China, using subsidies and its economic muscle to dominate batteries, rare earths, semiconductors or [electric vehicles], could eventually imperil national security by disrupting our access to these products and materials. We cannot cede these important resources and capabilities to another country.”

- Dimon’s comments are notable because he, like many other top U.S. business leaders, had previously been a champion of tighter U.S.-China economic relations. Dimon’s about-face suggests that business leaders may finally be swinging around to the consensus view that China is an increasingly dangerous military, economic, and diplomatic threat to the U.S. and should be countered.

United States-Taiwan-China: Taiwanese President Tsai Ing-wen meets House Speaker McCarthy in California today. The meeting is expected to prompt strong responses from China, including at least accusations that the U.S. is abandoning its “one China” policy and probably some sort of aggressive, retaliatory military exercises around Taiwan in the coming days. If those drills happen, they will raise the risk of an accidental conflict. At the very least, they would worsen U.S.-China tensions, potentially putting investors in the cross-fire.

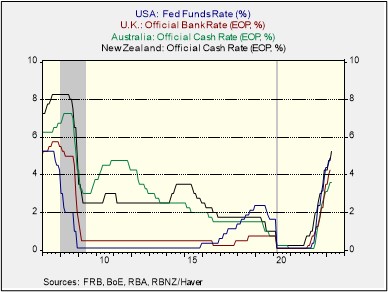

New Zealand: The Reserve Bank of New Zealand announced an unexpectedly big increase in its benchmark short-term interest rate to 5.25% from 4.75% previously. The hike was especially surprising because recent data has shown that New Zealand’s economy is weakening and may be on the verge of a recession. The aggressive rate hike also marks a contrast with the Fed and the Bank of England, which have slowed their rate-hiking campaigns. The Bank of Canada and the Reserve Bank of Australia have both recently paused their rate hikes.

Mexico: The Mexican government said it has reached a deal to buy most of the electricity-generating assets owned in the country by Spanish utility Iberdola (IBDRY, $50.15) for $6 billion. The deal marks a victory for leftist President Andrés Manuel López Obrador, who had long pressured Iberdola to sell as part of his “new nationalization” program. As such, the deal also illustrates the government’s strong nationalist and left-wing populist bent, which has prevented Mexico from taking full advantage of the trend of “near shoring” production to be closer to the U.S.

U.S. Monetary Policy: Cleveland FRB President Mester today warned that consumer price inflation remains too high and stubborn, and that it could take until 2025 to bring it down to the Fed’s 2% target. Mester stressed that the Fed will continue to focus on inflation despite the need to address the recent mid-sized bank crisis. The statement reinforces our view that the Fed is probably not yet ready to stop tightening monetary policy, although it is probably getting close to that point.

U.S. Banking Crisis: Concerns about sudden bank runs have dissipated, and analysts (including those at Confluence) are now focusing on the new risk that banks are facing—a slow-motion loss of deposits as individuals and businesses look for higher-yielding places to store their funds. One place these depositors are shifting to are money market funds, which are putting increasing amounts of money to work in the Fed’s “reverse repo” facility.

- In turn, that’s generating concern that the Fed itself is exacerbating the outflow of deposits from banks because of the relatively high interest rates it pays to money market funds in the reverse repo facility.

- More broadly, the outflow of deposits from banks could eventually help prompt the Fed to begin cutting its benchmark fed funds interest rate.