Daily Comment (April 28, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with a deep dive into the GDP data and why we believe that the economy may still be headed for a recession. Next, we give our thoughts on the Bank of Japan’s recent policy decision. Lastly, we discuss the yuan’s (CNY) rising prominence on the global stage.

Growth Moderation: The U.S. economy skirted recession in the first quarter of 2023; however, problems remain under the surface

- Strong spending from households helped prevent the economy from contracting. According to the Bureau of Economic Analysis, U.S. GDP grew 1.1% at an annual rate in the first three months of the year. The most significant gains came from consumption which accelerated from 1.0% in Q4 2022 to 3.7% in the following quarter. The improvement in the level of spending was related to a sharp pick-up in demand for motor vehicles, which expanded at a pace not seen in the pre-pandemic era.

- Although it is never good to bet against the U.S. consumer, it is unclear how long spending can continue to save the day. Last week, earnings reports from the four major banks reported an increase in customer delinquencies. At the same time, the Bank of America Institute stated that credit card spending slowed to its weakest pace in two years. The increase in defaults and the decrease in spending will likely worsen throughout the year as the Federal Reserve keeps interest rates elevated to combat inflation. Additionally, the slow rise in jobless benefits suggests that the labor market is finally starting to loosen up.

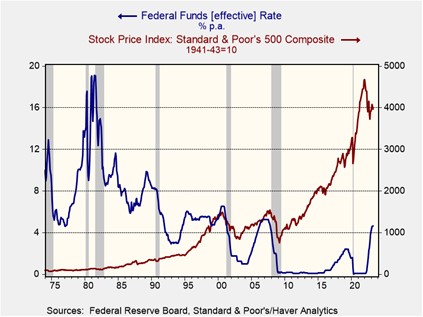

- The major unknown is how the Federal Reserve will react once the economy enters recession. The market is accustomed to the Fed cutting rates aggressively during a downturn, but with inflation still elevated, policymakers may instead decide to hold rates steady. The central bank has cut rates below 2% in response to the previous three recessions. As the chart above shows, this aggressive easing has helped fuel market rallies in each of those cycles. The expectation of possible rate cuts helps explain why NASDAQ has gotten off to a solid start for the year. However, the Fed’s failure to repeat this trend could lead investors to readjust their portfolios to reflect the elevated risk associated with tighter-than-normal policy.

No Rush: The Bank of Japan is not close to ending yield curve control (YCC) even as data shows that price pressures are building in the economy.

- In his first meeting, newly appointed BOJ Governor Kazuo Ueda didn’t surprise markets but paved the way for an eventual pivot. The BOJ left its ultra-accommodative monetary policy unchanged, removed guidance on the future path of policy, and included plans to conduct a long-term policy review. The market widely expected the decision to keep rates intact as investors assumed Ueda would not want to make significant changes to interest rates given the ongoing market turmoil. However, his plan to release the findings on the review of the central bank’s ultra-accommodative policy sometime in 2024 has added to speculation that he is not ready to pivot toward more hawkish policy.

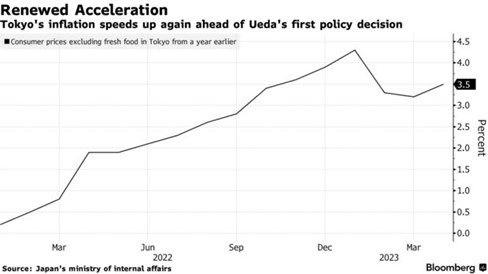

- That said, the central bank’s lack of guidance on future policy suggests that it has not fully committed to maintaining YCC. Its latest statement scrapped references to keeping rates at “current or lower levels,” indicating that it seeks policy flexibility. The softening of its stance comes amidst mounting evidence that price pressures are becoming sticky. Consumer prices, excluding fresh food in the country’s largest city, accelerated from 3.2% to 3.5% in April. Investor concerns about rising inflation and easy monetary policy led to JPY depreciation against other peer currencies following the BOJ’s announcement.

- Keeping rates low prevents disruption to the international financial system but incentivizes speculative attacks on the 10-year JGB. The popularity of the yen-carry trade, in which traders try to earn arbitrage profits by borrowing at low rates in one country to invest in higher yielding assets in another, has meant that many traders are exposed to exchange rate risk. The International Monetary Fund has warned that an abrupt end to YCC may have spillover effects on global financial markets. However, doubts about whether the BOJ can credibly maintain its peg may lead to central bank intervention. As a result, the JPY may have less upside now than we thought at the beginning of the year.

Renminbi Rising: In a sign that China is looking to set up a parallel trading system, its currency has increased in popularity.

- Beijing is encouraging more countries to use the yuan (CNY) to pay for Chinese goods. On Wednesday, the Argentine Prime Minister announced that his government would use CNY instead of USD for transactions with China. The switch in currency preferences was designed to prevent a drain on Argentinian foreign reserves which have been strained by high debt servicing costs and rising import prices. The CNY is already the most popular traded currency in Russia and is now being considered by Saudi Arabia to price oil sales.

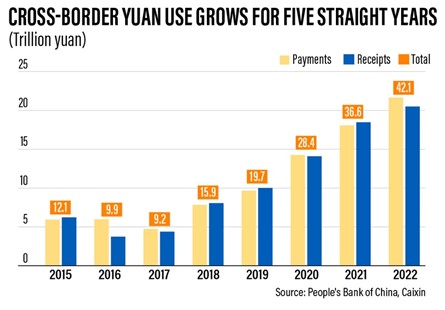

- The war in Ukraine has fueled Beijing’s ambition to make CNY a global currency. According to the Standard Charter’s Renminbi Globalization Index (RGI), usage of the Chinese currency increased by 26.6% in 2022. Although cross-border CNY payments have increased for five consecutive years, transactions in this currency have more than doubled their pre-pandemic level. In March of this year, local cross-border payments surpassed the greenback for the first time on record. These statistics suggest that China is becoming more aggressive in reducing its dependency on the U.S. dollar as it fears possible isolation.

- The rising demand for CNY reinforces our view that the U.S. dollar is headed for a secular decline. As regional blocs begin to form worldwide, countries may be forced to hold on to both Chinese and American currencies. We suspect that dual holdings will be most prevalent in countries that find themselves on the wrong side of U.S. sanctions. Thus, the CNY should be popular in authoritarian states. That said, China’s unwillingness to open its capital account will prevent its currency from emerging as a true challenger to the greenback. As a result, we still believe that concerns about the dollar losing its hegemonic status are overblown.