Daily Comment (April 26, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are off to a slow start today as inflation concerns linger for investors. But on a brighter note, the Florida Panthers are surging ahead with a commanding 3-0 series lead over the Tampa Bay Lightning. Today’s Comment explores the importance of central bank independence, analyzes investor anxieties surrounding the latest economic growth data, and delves into the reasoning behind Argentina’s recent surge in attention. As always, we conclude with a summary of key domestic and international economic releases.

Fed Independence Under Attack: Some speculate that if former President Donald Trump is reelected, he might seek to exert greater influence over the Federal Reserve.

- A proposal is gaining traction among allies of the former president that could weaken the Federal Reserve’s independence. According to the Wall Street Journal, a group of former officials and supporters drafted a 10-page document advocating for increased presidential influence on the Fed. The proposal reportedly requires the Fed to consult the president before making rate decisions and empowers the Treasury Department to act as a check on the Fed’s authority. Additionally, it would seek a way to help push Fed Chair Jerome Powell out of power before the end of his term in 2026.

- The Federal Reserve’s independence has been a cornerstone of price and currency stability since the collapse of the Bretton Woods system. This was particularly evident in the late 1970s when then-Fed Chair Paul Volcker’s decisive action to raise interest rates, despite short-term economic pain, reassured markets of the US’s commitment to tackling inflation. This bold move restored credibility to the dollar, making US Treasury securities more attractive to foreign investors and fueling a subsequent bond bull market over the next three decades.

- While former President Trump’s responsiveness to market fluctuations should temper fears of aggressive action to weaken Fed independence, the very discussion raises concerns. Investor and central bank confidence in the Fed’s autonomy is crucial. A loss of faith could trigger a flight from Treasurys, a favoring of hard assets like gold, and a push toward a bear scenario with rising yields for the bond market, similar to periods of high government spending in the post-WWII era. This could likely have spillover effects into equities as investors may be less comfortable investing in risky assets. Investors should continue to monitor this situation closely.

Worse Fears: The Gross Domestic Product (GDP) report didn’t give investors anything to smile about as it showed the economy was slowing, and inflation was accelerating.

- The US economy grew at a sluggish 1.6% annualized rate in the first quarter of 2024, falling short of analysts’ predictions of 3.4% and the prior quarter’s 2.5% growth. This weaker-than-anticipated report was primarily driven by a slowdown in consumer spending, which dipped from 3.3% to 2.5%. While some investors might see this as a positive sign indicating a potential cool-down in the economy, a key inflation measure — the core PCE price index — painted a contrasting picture. This index rose from 2.0% to 3.7% in the first quarter, suggesting inflationary pressures are actually intensifying.

- Slowing growth coupled with persistent service sector inflation raises the specter of a stagnant economy with high prices. The surge in price pressures was driven by increases in services, particularly shelter and financial services, which have risen at an annualized rate of 5.7% and 15.9% in the first quarter, respectively. The massive acceleration sent shockwaves through markets, with the S&P 500 dropping 0.5% on the day and the 10-year Treasury yield rising 5 basis points. Investors are now re-evaluating their expectations, with some abandoning hopes for rate cuts and a growing number pricing in the possibility of another rate hike later this year.

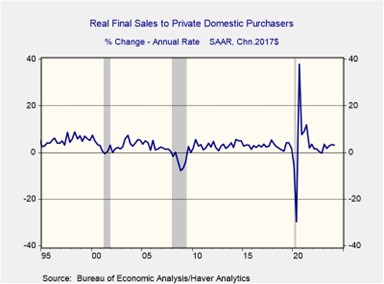

- Despite a disappointing Q1 2024 GDP report, a bright spot emerged. Final sales to private domestic purchasers, a key metric of core economic activity, remained stable at an annualized growth rate exceeding 3%. This excludes factors like inventories, net exports, and government spending, suggesting businesses and consumers are still on solid ground. However, the PCE Price Index’s jump highlights ongoing inflationary pressures driven by the tight labor market. The next quarter’s GDP report could see a rebound, but inflationary concerns remain.

The Argentine Paradox: Argentina’s new market-friendly policies, which were praised by investors, have sparked protests from some citizens, echoing a recurring pattern in the country’s history.

- President Javier Milei is facing mounting pressures following his pledge to curb public spending in Argentina. Thousands of protestors voiced their opposition to the government’s decision to forgo increased education spending, even though inflation has increased 80% over the last year. This demonstration serves as the first major test of Argentina’s willingness to accept austerity measures to rein in the ballooning budget deficit following Milei’s election victory in December. He is expected to implement a series of potentially unpopular measures, including a 50% devaluation of the Argentine peso (ARS), cuts to energy and transportation subsidies, and closures of government buildings.

- Despite the social unrest, investors have started to take Argentina seriously again. Over the last three months, Argentina’s parallel currency has outperformed its peers surging 25%, despite the ARS being down nearly 10% on the year in what is known as the blue-chip swap. The strong currency performance has also helped boost returns for foreign investors as the Argentine stock market has emerged as one of the best performing in the world this year, up 26.7%, driven primarily by the energy and financial sectors.

- Although economic changes are likely something to cheer about, it is important to remember that investors have been down this road before in Argentina. The country has often gone through waves of leaders that favor market-friendly policies only to have them thrown out of office and replaced with leaders that favor social goals instead. This pattern has led to significant fluctuations in the stock market, creating an environment where investors should view Argentina more as a trade opportunity rather than a stable long-term investment.

In Other News: Strong earnings reports from multiple tech companies, coupled with a surprise dividend from Alphabet, have fueled optimism that the tech sector remains a favorite among investors. The US is ramping up pressure on allies to tighten restrictions on semiconductor exports to China, aiming to hinder its technological progress in strategic sectors.