Daily Comment (April 25, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a leading global investor’s view on the economic implications of climate change and the world’s responses to it (spoiler: the result is more inflation). We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a big U.S. technology firm’s effort to appease European antitrust regulators and multiple new signs of weakening demand in the U.S.

Global Economics of Climate Change: In an interview with the Financial Times, the chief of Norway’s massive sovereign wealth fund warned that global warming and the responses to it will contribute to higher price inflation in the coming years. According to Nicolai Tangen, the changing climate is already disrupting food production, but societies will also face higher costs as they shift their energy mix to greener sources and invest in new infrastructure to mitigate the impact of warming temperatures.

- Here at Confluence, we have long argued that the fracturing of the world into relatively separate geopolitical and economic blocs will tend to push up both inflation and inflation volatility. The key inflation drivers in this world include shortened and less efficient supply chains, the need to invest in new and more resilient production facilities, commodity trade embargos by rival blocs, and insufficient past investment in new sources of energy and other commodities.

- Tangen’s observations suggest the impacts of climate change will be an additional source of inflation, as will slowing birth rates and continued labor shortages in many countries.

- If inflation does remain relatively high as we expect, interest rates will probably also be elevated. For investors, that means bonds are likely entering a long-lasting bear market, while commodities will likely be buoyed.

Global Defense Spending: The Stockholm International Peace Research Institute reported that global defense spending in 2022 reached an all-time high of $2.24 trillion, up 3.7% from the previous year after stripping out inflation. Much of the increase reflected a 13% rise in Europe which was related to Russia’s ongoing invasion of Ukraine. The data is consistent with our view that global fracturing and increased geopolitical tensions will drive higher defense spending in the coming years.

EU Antitrust Regulation: Microsoft (MSFT, $281.77) has reportedly decided to stop bundling its Teams video conferencing and messaging app with its Office suite of software products in an effort to avoid an official antitrust probe by European Union regulators. Microsoft will now make Teams an optional additional app that a business can purchase when buying Office. The decision illustrates how the EU’s tough efforts to regulate big U.S. technology firms have been effective in changing their behavior.

South Korea-Japan: The South Korean government has reinstated Japan to its “white list” of preferred trading partners, signaling a further cooling of tensions after years of acrimony over Japan’s treatment of Koreans before and during World War II. The move will significantly cut the red tape South Korean manufacturers must deal with in order to sell to Japan. Better Japan-Korea trade ties will also bolster U.S. efforts to reduce China’s role in global supply chains and build a close-knit alliance of liberal democracies to thwart China’s geopolitical aggressiveness.

Australia: Yesterday, the government released a new “defense strategic review” that calls for the country to revamp its armed forces to combat threats faster, farther away, and alongside regional partners amid concerns over China’s rapid military build-up. For example, the review calls for cutting planned investments in armored vehicles geared for use on Australian territory to free up funds for new, long-range precision strike missiles and nuclear-powered attack submarines under the AUKUS agreement with the U.S. and Britain.

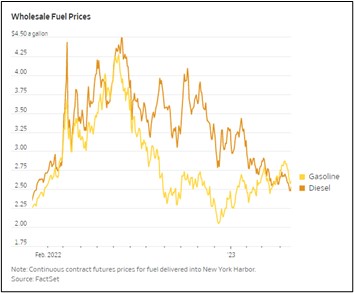

U.S. Diesel Demand: Wholesale diesel prices have now fallen more than 43% since their peak last summer, reaching approximately $2.53 per gallon. The big decline largely reflects much weaker trucking activity, which in turn provides more evidence that U.S. economic growth is faltering rapidly ahead of the much-anticipated recession.

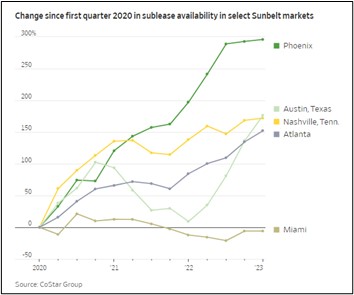

U.S. Office Demand: In another sign of spreading economic weakness, new data shows the decline in office demand is now spreading from the big, expensive coastal cities like New York and San Francisco to cities in the Sun Belt. Asking rents in the Sun Belt are beginning to stagnate, and floorspace available for sublease is surging. The data adds to the signs that the economy is weakening ahead of the expected recession.

U.S. Financial Markets: Official data shows individuals bought $48.4 billion of U.S. Treasury bills through accounts on the Treasury department’s website in March. Direct individual purchases reportedly have remained strong in April, illustrating how people are pulling deposits out of the banking system in search of higher yields elsewhere. We continue to believe that this process of “disintermediation” adds to the risk of slower bank lending and even weaker economic growth.

- Separately, medium-sized California lender First Republic Bank (FRC, $16.00) reported yesterday that its customers withdrew more than $100 billion of their deposits amid last month’s banking scare. First Republic’s stock is down some 20% today in pre-market trading.

- Of course, First Republic’s sudden hemorrhaging of deposits mostly reflected customer concerns about the bank’s stability. Nevertheless, the firm said deposits have been continuing to drift lower this month, suggesting that customers continue to look for higher returns in mutual funds, Treasury bills, and the like.