Daily Comment (April 24, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with new data showing how China’s post-pandemic economic reopening is boosting its imports from other countries, including Australia. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a worrying statement by the Chinese ambassador to France and new research suggesting auto dealers’ markups have been a big driver of U.S. inflation.

China-Australia: New data shows that China’s imports of Australian coking coal quadrupled in March compared with February, while its imports of Australian thermal coal were 14 times higher. Chinese coal imports from Australia remain far below their levels from early 2020, when Beijing banned a number of Australian products in retaliation for Canberra’s call to investigate China’s role in the coronavirus pandemic. Nevertheless, the big jump in the coal trade during March shows that a recent trade thaw between the countries is continuing.

- Beijing’s willingness to drop its trade barriers against Australia probably aims to ensure sufficient supply as the Chinese economy recovers from the government’s strict pandemic lockdowns.

- That reflects the extent to which Beijing has prioritized its post-pandemic economic recovery, which is likely to boost global growth and help support the world’s stock markets in the near term. A major beneficiary is likely to be Australia.

China-European Union: In an interview on French television, Chinese Ambassador Lu Shaye asserted that ex-Soviet republics such as Latvia, Lithuania, and Estonia have no legal status as independent countries. The three Baltic states, which are all members of the European Union, have summoned their respective Chinese ambassadors to register their complaints.

- The Chinese government has already shown at least tacit support for Russian President Putin’s illegal invasion of Ukraine. Even though the Chinese foreign ministry today disavowed Ambassador Lu’s assertion, the slip of the tongue suggests at least some Chinese officials are willing to also support Putin’s attitude toward the other formerly Soviet states.

- Lu’s statement illustrates the increasingly tight policy coordination between Beijing and Moscow. With China and Russia offering each other mutual support, the statement suggests Western countries may no longer be able to differentiate between the two rogue nations. Growing China-Russia policy coordination is likely to further exacerbate the fracturing of the world into relatively separate geopolitical and economic blocs.

Russia-Ukraine War: New reports indicate that Ukrainian forces have now established a sustained presence on the east bank of the Dnipro River for the first time since early in Russia’s invasion. Meanwhile, Yevgeny Prigozhin, head of the Wagner Group of Russian mercenaries, late last week called for the Russian forces to adopt defensive positions ahead of an expected Ukrainian counteroffensive.

- The reports suggest the Russians may be conserving ammunition or are otherwise paralyzed by the likelihood of new Ukrainian attacks in force with modern Western weapons. If so, it could point to a coming sea change in the conflict, with Ukraine taking the initiative and potentially forcing the Russians to retreat in at least some areas.

- Separately, officials in Crimea stated that Ukrainian drone boats tried to attack the Russian fleet at Sevastopol, but they were repelled before they could cause any damage. Other Russian reports say a Ukrainian drone aircraft crashed in the forests outside Moscow, but it also apparently caused no damage.

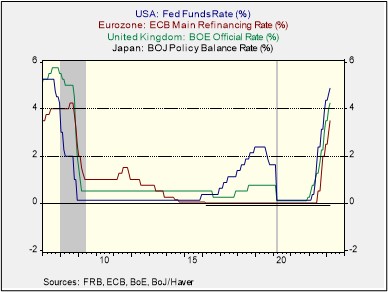

Eurozone: National Bank of Belgium Governor Pierre Wunsch, who sits on the European Central Bank’s rate-setting committee, warned in an interview that investors are underestimating how high Eurozone interest rates will rise. Since ECB policymakers want to push down both wage growth and price inflation, Wunsch said the ECB’s benchmark short-term interest rate may have to go to 4.00% at some point, slightly above current market expectations for a peak of 3.75% and well above the current rate of 3.00%.

Switzerland: First-quarter results show customers of Credit Suisse (CS, $0.8912) yanked about $68.6 billion of deposits from the institution during the first quarter, mostly in the run up to its forced takeover by UBS (UBS, $20.29). The big drop in business illustrates how severely Credit Suisse was damaged amid the fallout from the March banking crisis in the U.S. The drop in business means Credit Suisse could be an even bigger challenge for UBS to integrate than previously thought.

United States-Sudan: As rival Sudanese military groups continue to battle for control of the country, the U.S. military evacuated about 100 Americans yesterday, mostly consisting of U.S. Embassy employees. The United Kingdom, Germany, and France were among the other countries that also evacuated their citizens.

U.S. Price Inflation: New research from the Bureau of Labor Statistics shows that dealer markups on new cars were a big driver of price inflation over the last three years. According to the study, those markups alone accounted for 0.3% to 0.7% of the nearly 16% rise in the consumer price index from the end of 2019 to the end of 2022. The increase in markups was driven by the fact that auto demand surged after customers got their pandemic stimulus checks, while supply-chain snarls reduced supply.

U.S. Retail Industry: Yesterday, iconic household goods retailer Bed, Bath, and Beyond (BBBY, $0.2935) filed for bankruptcy protection and said that it expects to eventually close all 360 of its Bed Bath & Beyond stores and all 120 of its Buybuy Baby retail locations. In the meantime, the bankruptcy filing give the company time to conduct going-out-of-business sales at its physical stores and solicit interest from potential buyers for its remaining assets, such as its branding. If the firm liquidates as expected, it will leave many large retail buildings vacant across the country, dealing another blow to real estate investors.

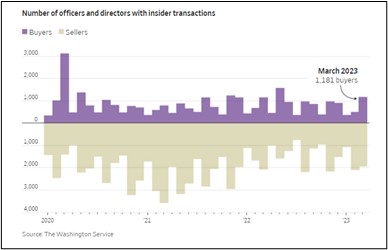

U.S. Stock Market: Washington Service, an insider-trading data provider, said more than 1,000 directors and officers at more than 600 publicly traded firms bought their own company’s stock in March, marking the strongest insider buying since last May. The strong buying activity, despite last month’s bank crisis, suggests that company officials are looking past the bank issues and remain optimistic about the economy and their corporate prospects.

- Separately, CBOE (CBOE, $139.51) today is launching a new version of the VIX index of stock market volatility. The new one-day Volatility Index, or VIX1D, is designed to measure expected volatility in the S&P 500 over the next day of trading, rather than over the next month like the VIX.

- The launch of the new one-day VIX is consistent with the recent rise of ultra-short option trading, which is not reflected in the traditional VIX.