Daily Comment (April 23, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are off to a strong start as investors await earnings, and the Los Angeles Lakers fell 0-2 against the Denver Nuggets in the NBA playoffs. Today’s Comment kicks off with an examination of how TikTok is adding yet another layer to the rivalry between the US and China, followed by an exploration of how the conflict between Iran and Israel has highlighted investors’ leanings toward safe-haven assets. Additionally, we delve into Brazil’s ascent as a geopolitical power. As always, the report wraps up with international and domestic economic releases.

Tech Wars: Facing a potential US ban, TikTok tightens security measures to address concerns, while Beijing simultaneously strengthens its domestic tech industry, potentially hindering American competitors.

- The Chinese social networking company ByteDance faces hurdles across the West in its fight to maintain access to lucrative markets. On Monday, the company announced it would challenge the legality of a potential ban of its TikTok app by arguing that it would violate free speech principles despite national security concerns. At the same time, the EU has threatened fines and has suspended TikTok’s new reward program, where users are paid to watch videos. Regulators fear this could make the app more addictive and may have a negative impact on children. The controversy over TikTok highlights the vulnerability of tech in the growing rivalry between the US and China.

- US tech companies aren’t immune to the escalating tensions either. Just days before the proposed TikTok ban made its way through the House of Representatives, Beijing retaliated by forcing Apple’s app store to remove Meta apps Threads and WhatsApp. Additionally, China has prioritized strengthening its domestic tech industry by boosting the marketability of its own companies within the country. This strategy has squeezed US tech giants like Tesla and Apple, leading them to lose market share in China, one of their biggest markets. Sales of iPhones in China last quarter were the worst since 2020, and Tesla’s price cuts on vehicles threaten to wipe out their operating earnings in the country.

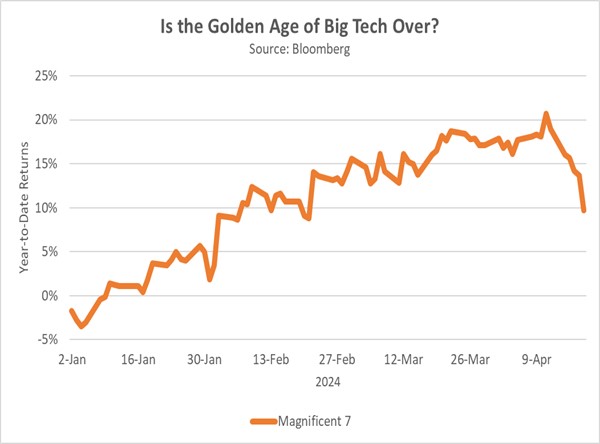

- Regulatory risks stemming from the escalating US-China rivalry remain a major, yet often downplayed, concern for the tech sector. Many US tech companies have a significant presence in China, both in terms of revenue and supply chains. As tensions rise, these firms will likely face headwinds as they adjust to a new, more challenging operating environment. Even industry giants like Nvidia aren’t immune. Recent sanctions have complicated its efforts to sell some of its cutting-edge AI chips to China, highlighting the potential for disruption across the tech sector. Despite these challenges, other sectors continue to offer promising opportunities.

Calm Returns: Easing tensions in the Middle East have prompted investors to shift out of safe-haven assets and back into equities.

- Israel is shifting its attention from escalating tensions with Iran to addressing the situation with Hamas in Rafah. Israeli Prime Minister Benjamin Netanyahu pledged on Sunday to intensify pressure on Hamas to release the remaining hostages. His remarks follow the Israeli military’s decision to temporarily pause operations in Rafah to refocus on the Iranian issue following a scaled-back response on Friday. While the shift signifies an escalation in Gaza, it also signifies a crucial avoidance of the worst-case scenario in a potential broader conflict across the Middle East. As a result, there was an increase in investor risk appetite.

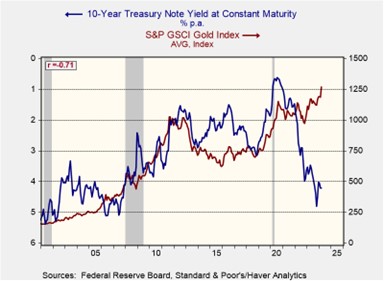

- The recent Iran-Israel conflict has highlighted a discernible shift in investor preference for safe-haven assets. Traditionally, during “flight to safety” episodes, investors gravitate towards bonds and gold, leading to an inverse correlation between Treasury yields and gold prices. However, since 2022, this relationship has become more intricate. Bond yields and gold prices have unexpectedly moved in tandem, a dynamic further reinforced by Monday’s news of easing tensions. This was evidenced by a 5-basis point decline in the 10-year Treasury yield and a 2% drop in the gold spot price on the same day.

- Investor anxiety about interest rate risk has likely caused the breakdown in the traditional correlation between bonds and gold. This anxiety stems from the current uncertainty surrounding monetary policy, fueled by the rising US federal deficit. The trend may persist until policymakers offer a clear path toward lower rates, and lawmakers find common ground on controlling government spending. Fed Chair Jerome Powell’s comments at the next meeting will be closely watched for any hints of doubt regarding potential rate cuts later this year. Despite the complex market dynamics, gold remains a compelling option for investors seeking a haven during times of uncertainty.

Lula’s Dance: Despite Brazil’s fiscal struggles, the president persists in promoting the country’s image as a global player.

- Brazilian President Lula Da Silva finds himself embroiled in a power struggle with Congress, where lawmakers are poised to advance legislation that would boost spending by around $18.5 billion over the next two years. Additionally, lawmakers stepped in to preserve tax benefits for the events industry, a move that complicates efforts to reduce spending. These developments came soon after the administration watered down its budget target, in order to lower expectations of achieving a 2025 surplus. The country’s inability to control its budget has weighed on the currency.

- In contrast to domestic struggles, Lula’s foreign policy of engaging with other nations to broaden his country’s influence remains effective. Despite strong ties with the United States, the Brazilian president has pursued a closer relationship with China. This month, Lula met with Brazilian beef producers to oversee the first meat shipments under the export deal he struck with China in 2023. This move reflects Lula’s strategic vision to position Brazil as a key player in the global food and energy markets, capitalizing on China’s desire to diversify its suppliers away from the US.

- While our analysis suggests a tilt towards China, Brazil’s economic growth depends on maintaining strong relationships with both the US and China. A rising US dollar could worsen Brazil’s existing dollar-denominated debt, particularly as President Lula ramps up social spending. However, China’s massive import market offers Brazil’s agricultural sector a chance to expand, stimulating the broader economy. Navigating this relationship will require Brazil to demonstrate it is not beholden to Beijing, despite its current focus on the Chinese market. Failure to establish this distance could put Brazil in Washington’s crosshairs, particularly as it seeks US assistance with Amazon deforestation.

In Other News: In a troubling sign of Mexico’s growing crime issue, masked men held up Claudia Sheinbaum, the frontrunner in the presidential race, along a highway. Russia has threatened to escalate attacks after the US approves a military aid package to Ukraine, signaling a potential shift in the war’s trajectory. Lockheed Martin’s strong earnings report adds to evidence of rising demand in the US defense industry, likely fueled by growing global tensions.