Daily Comment (April 22, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s report begins with a discussion of how a hawkish Federal Reserve could impact financial markets and the global economy. Next, we review the latest international news, including developments in the Russian invasion of Ukraine. Afterward, we give a brief overview of economic and policy news and conclude with our pandemic coverage.

At the IMF spring meeting, Federal Reserve Chair Jerome Powell suggested the central bank may raise rates by 50 bps in its next meeting and hinted at the possibility of front-end loading policy if inflation remains elevated. His announcement had a negative impact on markets, with some investors pricing the possibility of a 75 bps rate hike in the June and July meetings. The NASDAQ fell 2.1% from the prior day, while the S&P 500 fell 1.5%. The sell-off in equities was due to concerns that the Fed could make a policy mistake that could lead to an economic contraction.

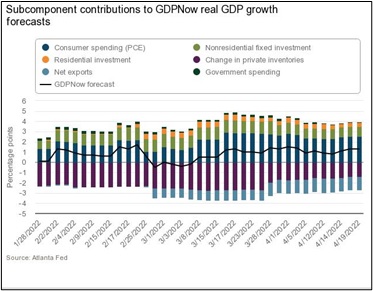

In his remarks, Powell mentioned that the labor market was too hot and could not be sustained. The reference to employment suggests that the central bank may prioritize inflation over the economy. This point is reinforced by comments made by St. Louis Fed President and voting member James Bullard earlier this month. In an interview with the Financial Times, Bullard urged the Fed to curtail growth as a way to reduce inflation. Although Powell and other Fed officials have dismissed the possibility that increasing rates will lead to a contraction, the market is not convinced. The last time the Fed successfully engineered a “soft landing” was nearly three decades ago. Additionally, forecasts seem to indicate the economy is already showing signs of deceleration. The latest Atlanta GDPNow forecast suggests the economy expanded at an annualized rate of 1.3% in Q1 of 2022. If true, this would be a considerable slowdown in growth from the previous quarter’s rise of 6.9%

A hawkish Fed also has implications for central banks worldwide, but particularly for emerging markets due to concerns that higher U.S. rates will lead to more capital outflow and less foreign direct investment. As a result, central banks in emerging markets have already started to incorporate the Fed shift into their own policy planning. The People Bank of China tried to mitigate the impact the Fed’s policy shift would have on its economy by lowering the official yuan midpoint. In Mexico, central bank Governor Victoria Rodriguez Ceja hinted the bank may accommodate its monetary policy to adjust for the Fed’s pivot toward tighter monetary policy.

When the Fed raises rates, it is particularly dangerous for emerging market countries that rely on the inflow of dollars to generate growth and repay debt. Currently, Sri Lanka appears to be most sensitive to rate moves as it was on the verge of a collapse even before the Fed started tightening monetary policy. It isn’t clear whether a default from Sri Lanka will be enough to start a ripple effect on the global economy; however, that doesn’t mean it can’t happen. The 1997 financial crisis started in Thailand and spread across East Asia. Rising food and fuel price will likely increase the chance of an economic collapse in Sri Lanka. As a result, we think rising rates are creating unfavorable investing conditions for emerging market equities.

International news

- In an unexpected remark, U.S. Treasury Secretary Janet Yellen warned European countries of the potential damage to the global economy if it bans Russian energy imports. Her concerns appear to be related to the impact that a lack of Russian oil production will have on prices. Although the U.S. has tried to address the shortfall of Russian energy by releasing some of the country’s oil reserves, it appears the Biden administration has failed to find a long-term solution. As a result, there are growing concerns that if Europe pursues its goal of banning Russian energy imports, it could lead to oil supply shocks similar to those that took place in the 1970s.

- The United Kingdom is preparing legislation that will allow it to scrap key parts of the Northern Ireland protocol. This protocol allows for trade from the EU to flow freely to Northern Ireland but places checks on goods from the U.K. It was implemented in the Brexit deal to prevent the need for a hard border between Northern Ireland and Ireland. The protocol has caused a lot of infighting in Northern Ireland as Unionists, a group loyal to the Crown, fear it could lead to eventual reunification with Ireland. The law would give ministers powers that will allow them to switch off key parts of the protocol in the U.K. The move could lead to greater friction between London and Brussels.

- Japan and New Zealand boosted their military ties amid growing tensions with Russia and China. The move comes two days after China signed a security agreement with the Solomon Islands that will potentially allow China to build military bases in the region as well as send in its troops. As China’s presence grows in the region, we expect rivaling countries to build closer ties and rely more on the U.S. for security.

- China has urged domestic investors to purchase more equities as it looks to prop up its financial markets. Chinese equities tumbled on Thursday after the country offered less than expected policy support. Its reluctance to provide stimulus in light of the COVID-19 lockdowns and slow economic growth is likely related to the country’s wanting to prevent the yuan from depreciating.

Economic News and Policy

- The U.S. reinforced its threat regarding its plans to hold China accountable if it supports Russia’s effort to invade Ukraine. In a speech in Brussels, Deputy Secretary of State Wendy Sherman stated China would face sanctions if it is discovered it is aiding the Russian war effort. The move signals the contentious relationship the U.S. and China now have due to the war in Ukraine and provides additional signs of a future decoupling of the two economies.

- Former U.S. President Barack Obama blamed the rise of disinformation on tech companies failing to address the problem. His speech provides more evidence of a growing bipartisan push to rein in Big Tech.

- New research links the labor shortage to an increase in substance abuse. A study released by the National Bureau of Economic Research argues that the pandemic led to increased drug use that prevented workers from returning to the labor force.

COVID-19: The number of reported cases is 507,561,599 with 6,211,101 fatalities. In the U.S., there are 80,848,684 confirmed cases with 990,663 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The CDC reports that 720,813,845 doses of the vaccine have been distributed, with 571,201,893 doses injected. The number receiving at least one dose is 257,058,180, while the number of second doses is 219,160,055 and the number of the third dose, granting the highest level of immunity, is 99,804,811 The FT has a page on global vaccine distribution.

- The return of mask mandates to combat the rise in COVID-19 cases has been met with skepticism throughout the country. Philadelphia was forced to scrap its mask mandates two weeks after bringing them back. As states grapple with developing a strategy to contain the latest surge in cases, it is becoming clear that Americans are trying to put the pandemic behind them. So far, hospitalizations have not risen to the level hospitals cannot handle; thus, it is still possible this new variant will not pose a severe threat to the economy. That being said, it is too early to make a final judgment.

- On the bright side, cases in Asia appear to be decelerating at a stable pace. Hong Kong announced it would allow foreign travelers to enter starting May 1. Meanwhile, Singapore plans to remove all of its COVID-19 restrictions by April 26. Any moves by Asian countries to lift restrictions may help relieve some supply chain pressures.