Daily Comment (April 2, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with increasing geopolitical tensions after an apparent Israeli airstrike killed senior Iranian military commanders in Damascus, Syria. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including a growing likelihood that the Japanese government will intervene in the currency markets to support the weakening yen, and new signs that investors are giving up on the likelihood of a Federal Reserve interest-rate cut in June.

Israel-Hamas-Syria-Iran: In an indication that Israel’s war against Hamas in the Gaza Strip threatens again to escalate, the Syrian government yesterday claimed Israel was behind a missile strike on an Iranian diplomatic post in Damascus. The strike reportedly killed several high-level Iranian military leaders. It also marked at least the fourth Israeli strike on Iranian military forces in Syria this year, potentially aimed at provoking Iranian proxy forces in the area to fight back so that they can be targeted. The risk is that such an incident could draw Iran directly into the conflict.

- Separately, an Israeli airstrike has killed seven workers from World Central Kitchen, the aid group established by celebrity chef José Andrés that first rose to fame by providing food aid to Ukrainians displaced by the Russian invasion of their country. After the UN, World Central Kitchen is reportedly the largest food-aid group operating in Gaza.

- Israel today claimed the airstrike was unintentional, but the killing of aid workers is likely to further undermine global support for Israel’s attacks on Hamas in Gaza.

Russia-Ukraine War: Britain’s defense intelligence agency has issued a dire warning that a key Ukrainian defensive line west of Avdiivka is beginning to collapse as Russia pours new troops, equipment, and munitions into the area. The report suggests that Russian forces may be starting to build sufficient momentum to overcome Ukrainian resistance, especially now that Kyiv’s forces are facing severe resource constraints.

- Any additional Russian momentum will likely cause greater angst in Western European capitals regarding future threats from President Putin.

- In turn, that could spur additional European aid to Ukraine and even more commitment to boost European defense spending.

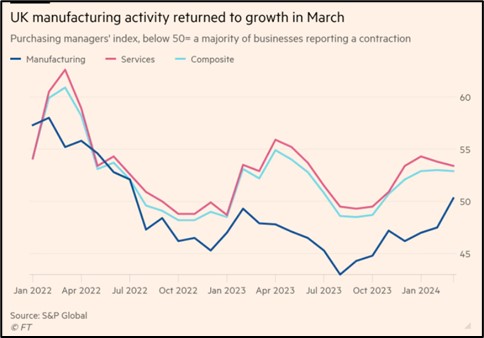

United Kingdom: S&P Global said its March purchasing managers’ index for manufacturing rose to a seasonally adjusted 50.3, beating both the flash estimate of 49.9 and the February reading of 47.5. Like most major PMIs, this one is designed so that readings over 50 indicate expanding activity. With the rise in March, the index suggests Britain’s factory sector is now growing again for the first time since July 2022.

Japan: Finance Minister Suzuki warned today that he is watching trends in the currency market with a “high sense of urgency” and that his ministry would address any “excessive movements” in the yen (JPY). That marks the latest in a string of government warnings that it might intervene in the market to keep the yen from weakening further.

- Despite the Bank of Japan’s recent move away from negative interest rates, investors have been dumping the yen on concerns that the central bank doesn’t intend to keep hiking rates. In contrast, investors increasingly think that continued good economic growth in the US may prompt the Federal Reserve to slow or even abandon its plan to start cutting its current high interest rates.

- So far this morning, the yen is trading essentially flat at 151.65 per dollar ($0.0066), its weakest level in approximately 34 years and is down 7.1% for the year-to-date.

US Monetary Policy: Against the backdrop of strong US economic data and signs of sticky price inflation, investors continue to ratchet down their expectations for interest rate cuts from the Fed. In a little-noticed development, trading in interest-rate derivatives now indicates only a 56.8% chance that the policymakers will implement their first rate cut at their policy meeting in June; trading suggests there is a 49.1% chance that they will keep the benchmark fed funds rate unchanged until at least their July meeting.

US Stock Market Regulation: In an exclusive report by the Wall Street Journal today, US regulators are examining whether big money managers such as BlackRock and Vanguard are truly acting passively when their index funds amass more than 10% of the shares in major banks. To date, the regulators have exempted the index providers from some rules that treat investors as active when they surpass 10% ownership. The new probe reflects bipartisan concern that the index funds are using their big ownership stakes to push ideological causes, from climate-change policies to pay equity.