Daily Comment (April 19, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with several new initiatives in European economic policy, including subsidies for semiconductor manufacturing and a tax on imports tied to greenhouse gas emissions. We next review a range of other international and U.S. developments with the potential to affect the financial markets today, including a report on consumer price inflation in Britain that has raised concerns about more interest-rate hikes in the advanced countries.

EU Industrial Policy: The European Commission formally unveiled its proposed “EU Chips Act” yesterday, which would provide some €43 billion ($47 billion) in subsidies and other assistance for semiconductor manufacturers operating in the EU. The support represents an attempt to compete with the subsidies in last year’s U.S. Chips Act and could make the EU more self-sufficient in both commoditized and advanced computer chips. The proposed program also illustrates how it has become more acceptable for governments to use active “industrial policy” to offer protections and backing for certain industries.

EU Environmental Regulation: The EU parliament approved a first-of-its-kind law yesterday that will tax imports into the bloc based on the greenhouse gases emitted to make them. The new legislation is designed to make sure that EU manufactured goods are not put at a competitive disadvantage by imports from countries with looser, less costly environmental regulations.

Eurozone Bank Health: Concerns are growing ahead of the late-June expiration of the European Central Bank’s pandemic bank-support program known as “targeted longer-term refinancing operations,” or TLTROs. Expiration of the program will require banks in the Eurozone to repay hundreds of billions of euros back to the ECB, replacing them with more costly sources of funding. Many banks, especially some in Italy, may find it challenging to raise the required liquidity.

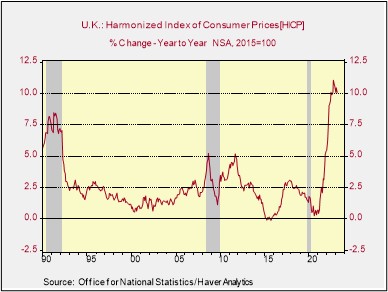

United Kingdom: The March consumer price index came in 10.1% higher than in the same month one year earlier, marking a modest deceleration from the 10.4% rise in the year to February but dashing expectations that inflation would finally fall into single digits. Excluding the volatile food and energy components, the core CPI in March was up 6.2% on the year, just as it was in February. The report has rekindled concerns about continued high inflation and additional interest-rate hikes throughout the advanced countries in the coming months, which are weighing on global stock markets so far this morning.

Turkey: An in-depth article in the Wall Street Journal yesterday linked the massive devastation and loss of life from the country’s February earthquakes to a systemic weakening of building regulations as President Erdoğan relied on construction to goose the economy and boost his political support over the last two decades.

- The article shows that the government’s deliberate easing of building rules and failure to prosecute rule-breaking likely resulted in tens of thousands of building collapses and deaths during the quakes.

- Since Erdoğan is now so closely identified with the construction boom of the last two decades, the scandal about building regulations is a key threat to his re-election prospects when the nation goes to the polls on May 14.

India: The United Nations Population Division released new data today showing that India has now overtaken China as the world’s most populous country. Reflecting its higher birth rate, India’s estimated population now stands at 1.428 billion, while China, with its low birth rate, has an estimated population of 1.425 billion. Meanwhile, technology giant Apple (AAPL, $166.47) opened its first retail store in India yesterday, further expanding its commitment to the country after its recent opening of manufacturing facilities there. The population data and the move by Apple are being taken as further validation of India’s increasingly attractive investment prospects compared with China.

Mexico: The Supreme Court invalidated part of a law pushed by President Andrés Manuel López Obrador last year that put the country’s national guard under the military’s control. The ruling is a strong rebuke to the president’s penchant for putting more government functions under the control of the military and means that the national guard must now remain under civilian control. While the president argues correctly that the Mexican military is one of the country’s most efficient and competent institutions, putting more government functions in its control raises concerns about transparency and whether the military is being given jobs for which it is poorly equipped, including local policing.

China-Taiwan-United States: Admiral John Aquilino, the head of U.S. Indo-Pacific command, said in testimony before Congress yesterday that he would not join his fellow top military officials in speculating about when China might try to seize control of Taiwan and spark a war with the U.S. However, Aquilino did say the Defense Department and defense industry need to accelerate their efforts to boost U.S. military power in order to deter China. We continue to believe that increased geopolitical frictions will boost global defense spending in the coming years, presenting attractive opportunities for investors, but Aquilino’s statement matches our concern that the U.S. military buildup still appears to lack urgency.

U.S. Financial Regulation: In testimony before the House Financial Services Committee yesterday, Securities and Exchange Commissioner Gensler was heavily criticized by Republicans for his efforts to crack down on the cryptocurrency markets. In response, Gensler stated that crypto companies flout regulations worse than any firms he has ever seen. The exchange points to continued muddled enforcement efforts by the SEC and prolonged political pushback in Congress.

U.S. Media Industry: Yesterday, Fox Corporation (FOX, $31.20) agreed to pay $787.5 million to settle its legal conflict with Dominion Voting Systems just before the start of a trial on the voting-machine company’s allegations that it was defamed by Fox News after the 2020 presidential election. The settlement avoids a court case that could have ultimately clarified and tightened the legal responsibilities of media companies in potential defamation cases. All the same, the big payment to settle the case is a shot over the bow of media firms and could make them more cautious about how they report on political news going forward.