Daily Comment (April 18, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are surging as investors await another round of earnings reports today. Meanwhile, Real Madrid, after dethroning Champions League champion Manchester City, now gear up for their semi-final clash against Bayern Munich. Today’s Comment explores how the Federal Reserve’s shifting sentiment has impacted market expectations for interest rate cuts, why nuclear power is considered a potential solution to the energy constraints of artificial intelligence, and how the debate over military aid to various countries contributes to global uncertainty.

Powell Pivot: Markets have regained composure following Federal Reserve Chair Jerome Powell’s hawkish shift toward a restrictive-for-longer monetary stance.

- Investors drove the decline, seeking to capitalize on the highest Treasury yields of the year. The strong demand for the 20-year bond auction, which yielded 4.818% (2 basis points lower than the pre-auction yield), fueled optimism. However, despite exceeding expectations, the auction resulted in the second-highest Treasury yield since the 10-year tenor’s reintroduction in 2020. Additionally, the bond yields for the two-year Treasury fell below 5%, while the bond volatility declined after it hit its highest level since January in a sign that investors are still hopeful of rate cuts this year.

- Investor expectations for Federal Reserve interest rate cuts have undergone a dramatic shift in the last several months. Initially, markets anticipated up to seven cuts this year, fueled by the Fed’s confidence in controlling inflation and concerns about a slowing job market (evidenced by declining job openings and payroll figures). However, recent data has dashed hopes of an imminent slowdown. Inflation data reveals persistent price pressures, particularly in wage-sensitive sectors. As a result, policymakers have grown reluctant to cut rates anytime soon, as they fear such a move could undermine their credibility in fighting inflation.

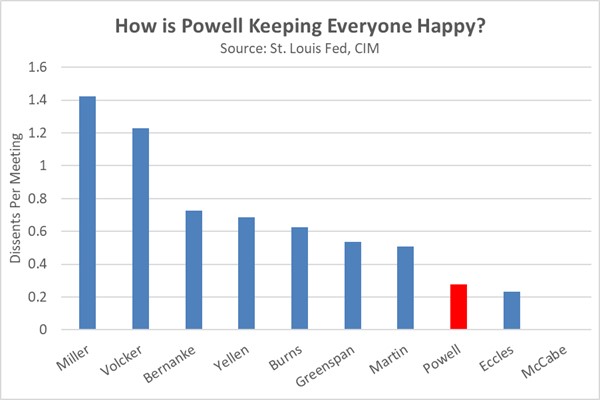

- Federal Reserve Chair Jerome Powell’s recent shift to a more hawkish stance is likely a reflection of his cautious decision-making approach. Powell prioritizes consensus among policymakers before taking action, which has resulted in one of the lowest dissent rates in Fed history during his tenure. Over the last few weeks, members have offered a range of opinions about the inflation trajectory. Some dismiss the recent data as a blip, while others voice concerns about a new trend of stickiness. However, employment has been an area of agreement. If jobs slow considerably in the coming months, policymakers may be open to a rate cut, but until then, expect “higher for longer” to be a major theme going forward.

AI Energy Problem: The future may belong to artificial intelligence (AI) but addressing its ever-increasing energy demands is a critical challenge.

- The AI boom is raising concerns for the overall economy. A representative from UK semiconductor company ARM predicts that AI could consume more electricity than India, the world’s most populous country, by 2030. This surge is driven by companies training increasingly complex AI systems with ever-larger datasets. The energy constraint has become a significant roadblock to AI development, potentially surpassing chip shortages as the top concern among tech companies. While these firms have made strides in efficiency with custom chips, these solutions may only offer up to 15% energy savings in data centers.

- Nuclear power is emerging as a promising solution. Energy Secretary Jennifer Granholm recently announced the Department of Energy’s support for using small-scale nuclear plants to power AI and data centers. This groundbreaking approach brought together tech giants to explore the deployment of compact, on-site nuclear reactors utilizing nuclear fission. This initiative seamlessly aligns with the Biden administration’s focus on modernizing infrastructure, prioritizing a shift towards cleaner energy sources. The forthcoming rejuvenation of the Holtec Palisades facility serves as a testament to this commitment and could herald the resurgence of similar plants nationwide.

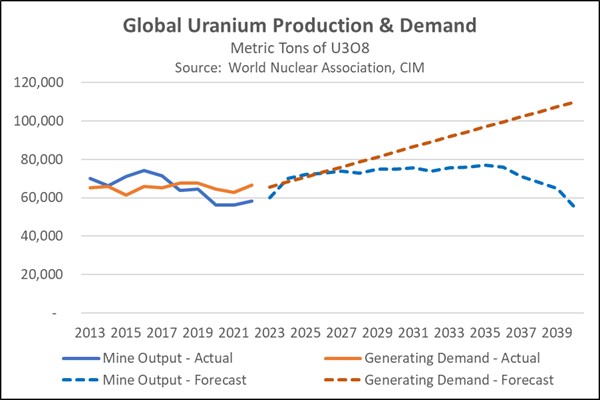

- Nuclear energy, currently supplying 20% of the nation’s power, is poised for a resurgence as the US divests from fossil fuels. Analysts predict a uranium supply crunch due to surging demand, especially with more countries adopting nuclear power. This scarcity is likely to make uranium a strategic investment, potentially granting uranium companies leverage in pricing. The recent 80% price increase over a year reflects this optimism in the nuclear sector, particularly for miners. This momentum is expected to continue as navigating the regulatory hurdles for uranium production is a slow process for many countries.

Military Aid Dispute: Despite edging closer to approving funding for military efforts abroad, persistent political wrangling among lawmakers raises concerns about future efforts.

- On Wednesday, House Speaker Mike Johnson (R-LA) informed fellow party members of his decision to schedule a crucial vote on foreign aid packages earmarked for Ukraine and Israel, set to take place this Saturday. The announcement comes amid simmering tensions within the leader’s own party. Some members are pushing for more funds to address domestic issues like border security, while others are wary of ballooning the deficit. This internal rift makes securing bipartisan support crucial, particularly as pockets of strong opposition have solidified within the party itself.

- While aid can provide much-needed support to these countries, it’s unlikely to be a cure-all for the long shadow cast by surging geopolitical tensions. The situation in Ukraine has taken a drastic turn for the worse in recent weeks. Anxieties mount as the country struggles to repel Russian advances due to a critical lack of anti-missile defenses, exemplified by Tuesday’s loss of a key power plant. Meanwhile, the specter of wider conflict looms as Israel weighs a response to Iran’s weekend attack, with Tehran threatening further escalation in the event of another military strike.

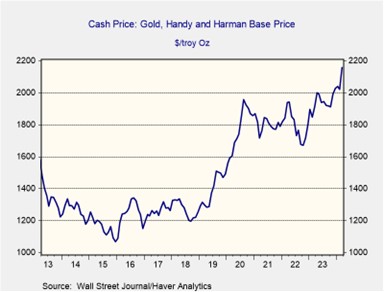

- Escalating geopolitical flashpoints exacerbate global uncertainty, sending investors scrambling for hedges against potential supply chain disruptions in a wider war. This uncertainty fuels a surge in gold prices, as the precious metal reclaims its safe-haven status. The preference for safe-havens is likely to persist, with long-term Treasury yields expected to remain volatile. The US’s growing debt burden adds to this volatility, as investors grapple with the government’s ability to manage it. Our analysis suggests that growing threats from the Russia-China-Iran alliance will necessitate increased US security spending, further limiting its ability to control spending in the coming years.

In Other News: A group of conservative economists is advocating for a 17% flat income tax and maintaining the cap on SALT deductions. This plan comes as the presumed Republican presidential nominee is likely to consider ways to reduce taxes. Weight loss drug Ozempic is unexpectedly linked to increased fertility rates in users. This raises concerns about potential unintended consequences of the medication. Japan and Korea are working with the US to weaken the rise of the dollar.