Daily Comment (April 17, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with the latest on the potential for a broader, more intense war in the Middle East. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including downgraded debt rating outlooks for Chinese banks and a statement by Federal Reserve Chair Powell that confirms the central bank is less likely to cut US interest rates in the near term.

Iran-Israel: As the Israeli government continues to consider how and when it will retaliate for Iran’s direct missile and drone attack over the weekend, the Iranian government and military are reportedly preparing for an assault. Iranian and Iran-backed Hezbollah militants in Syria are being dispersed, while the Iranian air force is preparing for an attack on Iran itself. The Iranian navy will also escort commercial ships in the Red Sea. The moves illustrate how the war between Israel and Hamas could still broaden and escalate into a disruptive regional conflict.

- US and European officials continue to put strong pressure on Israel not to retaliate or at least to avoid any major retaliation.

- In a sign that the US and European messages may be getting through, the Israeli government has reportedly assured Arab countries in the region that its response to Iran’s attack wouldn’t endanger their security and would likely be limited in scope.

- Nevertheless, investor concern about a broader war has driven the VIX stock volatility index to its highest level since last October.

Chinese Stock Market Regulation: The China Securities and Regulatory Commission has clarified that its recent rule updates designed to make stocks more inviting for investors won’t be applied to smaller companies. The clarification comes after investors raised concerns that the new rules would discourage small companies from listing and force others to abandon their current listing. The CSRC’s move is another example of Chinese regulators clamping down on a sector, only to backtrack after going too far or scaring off investors.

- According to the CSRC, its new policy to flag companies for unsatisfactory dividends will mostly target healthy, profitable firms that pay no dividends at all or relatively small dividends over several years.

- The agency also emphasized that the “special treatment” tag applied to such firms would not necessarily be grounds for delisting.

Chinese Banking Industry: Just days after cutting the outlook for China’s sovereign debt rating, Fitch has cut the outlook for China’s major state-owned banks from stable to negative, citing China’s slowing economic growth and the government’s more limited ability to support the institutions as fiscal challenges increase.

United States-China: President Biden today will propose more than tripling a key tariff on imports of Chinese steel and aluminum. The move will lift the tariff to 25% from its current level of 7.5%. Moreover, the higher rate would be in addition to the Trump administration’s tariffs of 25% on Chinese steel and 10% on Chinese aluminum, which Biden has kept in place. The resulting total tariffs of 50% on steel and 35% on aluminum are sure to further worsen US-China trade tensions and will probably invite some kind of trade retaliation from Beijing.

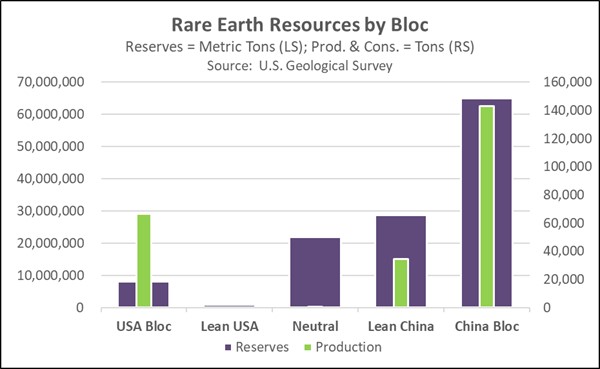

United States-Australia: Just weeks after rare-earth mining firms Lynas of Australia and MP Minerals of the US came to an impasse in their merger bid, Australian mining billionaire Gina Rinehart has amassed at least 5% of the shares in each company, raising expectations that she will serve as kingmaker to facilitate the link-up.

- China and its geopolitical bloc currently account for the vast majority of proven reserves, production, and refining capacity for rare earths, which are critical to the more electrified economy of the future.

- The Lynas-MP Minerals merger is seen as one potential way to help boost Western production of rare earths and establish a more secure supply chain for the minerals.

US Monetary Policy: At an event yesterday, Fed Chair Powell gave the strongest hint yet that the central bank expects to hold interest rates “higher for longer” because of continued high consumer price inflation. According to Powell, “Given the strength of the labor market . . . and progress on inflation so far, it’s appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us.” The statement is consistent with our view that investors have been too aggressive in expecting near-term rate cuts.

US Labor Market: The United Auto Workers today will begin a unionization vote at a Volkswagen car plant in Tennessee, marking a key step in the union’s effort to organize workers at foreign-owned factories outside the more union-friendly areas in Michigan. Results of the vote are expected by the end of the week. With the vote, the UAW is trying to capitalize on the increased leverage workers have during today’s labor shortages and the union’s recent success in boosting pay at “Detroit Three” automakers.

US Military: Six months into the federal fiscal year, the Army and Air Force have reported improved recruiting results compared with the previous year. The improvement reflects a number of new programs and policy changes, such as remedial training for low-scoring applicants and relaxed standards for drug use and tattoos. However, the Navy continues to lag its recruiting goals, leaving it undermanned in both at-sea positions and on-land billets.

- After years of falling short of recruiting goals, Army Secretary Christine Wormuth says her service is now about 5,000 contracts ahead of where it was at the same point last year. She also said the Army is on track to meet its goal of 55,000 new recruits for the whole fiscal year, in large part because of a new, 90-day soldier prep course that helps low-scoring applicants meet the Army’s academic and fitness standards.

- In the Air Force, recruiting has been strong enough for the service to hike its goal for the year to 27,100, compared with its original goal of 25,900. According to service officials, the improvement mostly reflects easier tattoo rules, bonus increases, and expanded efforts to recruit lawful permanent residents.