Daily Comment (April 16, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an examination of China’s latest economic growth, which will have a big impact on global markets. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including new signs that the Russian military is regaining momentum in its invasion of Ukraine and a major new antitrust suit being prepared in the US.

China: After stripping out price changes, first-quarter gross domestic product was up 5.3% from the same period one year earlier, beating expectations and accelerating slightly from the 5.2% rise in the year ended in the fourth quarter of 2023. However, the country’s growth is looking increasingly lopsided. In the year to the first quarter, most of the economic expansion came from corporate investment, industrial production, and exports, while consumer spending and housing investment remained tepid.

- The data is consistent with official plans to encourage massive new investment in higher-technology production, such as electric vehicles, batteries, and solar panels to make up for the weakness in consumption and the steep correction in residential building. The problem is that domestic demand isn’t strong enough to absorb all that new production, so Chinese firms are increasingly dumping excess output at fire-sale prices on the world market, further stoking trade frictions.

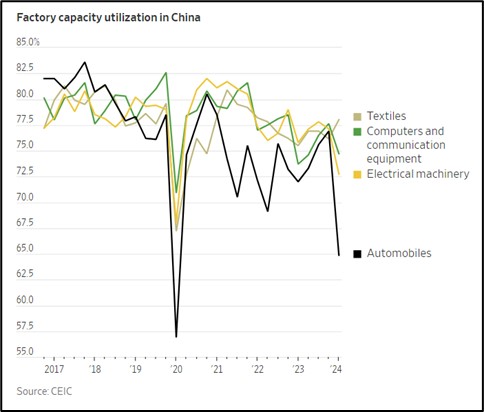

- So long as the government refuses to stimulate consumption spending or allow another spurt of housing investment, and so long as Western countries keep clamping down on Chinese dumping, the strategy will likely lead to further excess capacity in the economy. Indeed, other data today showed Chinese industrial capacity utilization falling in March to just 73.6%. Excluding the pandemic period, that was the lowest since 2016.

Japan: The yen depreciated further yesterday, closing at 154.37 per dollar, its lowest level since 1990. Given the Japanese government’s recent warnings that it will intervene in the currency markets if the currency weakens much further, the likelihood of intervention has probably risen sharply.

- More broadly, last week’s unsettling report on US price inflation and yesterday’s report of strong US retail sales have pushed foreign stock markets sharply lower today.

- Since the data adds to concerns that the Federal Reserve may be even more reluctant to cut US interest rates, the dollar has surged against a number of currencies and forced foreign investors to consider a prolonged period in which capital will be drawn to the US and out of Europe and Asia.

Iran-Israel: The Israeli war cabinet today continues deliberating whether or how to respond to Iran’s big missile and drone attack against Israel over the weekend. As discussed in our Comment yesterday, domestic political dynamics are likely to push the Israeli government to launch some kind of response. The key question is how big and destructive such a response could be. A bigger response would raise the risk of a significant expansion of the current war between Israel and Hamas and threaten Middle Eastern energy supplies.

Russia-Ukraine: As warmer weather returns and dries out the ground, making it easier for Russia’s armored vehicles to maneuver, the Ukrainian military says Russian forces are now attacking more intensively along the front lines. Kyiv has rushed forces to try to plug the gaps in the line, but residents of front-line cities and towns are fleeing, and it is looking increasingly like the Russians could gain new offensive momentum and re-seize significant territory across Ukraine.

- To the extent that the Russians retake territory in Ukraine, it will have negative security implications for Western Europe. In such a scenario, the Europeans would likely have even more incentive to try to coalesce politically and boost their defense spending.

- If the Russians conquer huge new swaths of Ukrainian territory, it could also have an important political implication in the US, as the Democrats would likely pin the blame on those Republicans who have blocked further US military aid to Kyiv in recent months.

US Antitrust Regulation: The Justice Department is reportedly preparing to file an antitrust suit against concert promoter and ticket vendor Live Nation, alleging it has leveraged its dominance in a way that undermines competition for ticketing live events. The company has long been criticized for exorbitant ticket fees and poor customer service. In any case, the potential suit is another example of the Biden administration’s effort to toughen antitrust enforcement, which creates increased regulatory risk for investors.

US Energy Industry: In a little reported development last week, the Biden administration has announced an increase in the royalties paid and bonds posted to drill for oil on federal land. Royalties paid to the government will rise from 12.50% to 16.67%, marking their first increase since 1920. Bonds posted will rise from $10,000 to $150,000, for their first increase since 1960.

- The industry naturally has complained that the moves will weigh on domestic energy exploration and production. However, it’s important to remember that only about 10% of US oil output comes from federal land.

- In all likelihood, Biden’s move aims to placate supporters on the left wing of the Democratic Party, many of whom have been disappointed by his energy policies.

US Electric Vehicle Industry: Premium EV maker Tesla yesterday said it is laying off more than 10% of its workforce to deal with the worldwide slowdown in demand for fully electric cars. In response, Tesla’s stock price fell some 5.6%, bringing its year-to-date loss to more than 33.0%. Tesla’s layoffs and stock decline illustrate the sharp reversal in fortune for EV makers since last year — a trend that could get even worse as Chinese producers look to dump their excess production on world markets at fire sale prices.

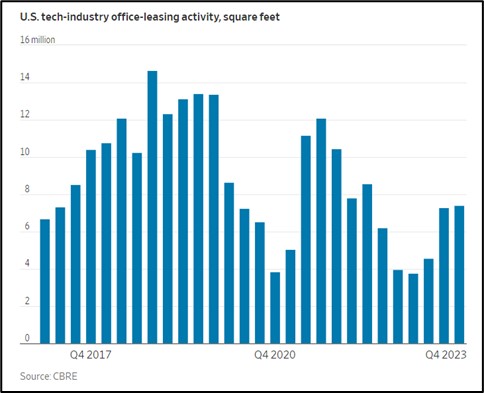

US Commercial Real Estate Industry: New data shows that technology firms have sharply curtailed their purchases and leases of office space in coastal markets, despite strong demand for the companies’ products. The drop-off in technology office demand marks yet another blow to the commercial real estate industry. The trend has reportedly boosted sublease listing, driven down lease rates and building values, and hurt office owners.