Daily Comment (April 11, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are mixed after the weaker-than-expected PPI report. In a Champions League upset, Barcelona edged past PSG in Paris, and took a 1-goal lead into the return leg. Today’s Comment examines how rising inflation (CPI) impacts interest rates, explores the increase in defense spending due to growing geopolitical tensions, and analyzes the hints of possible easing by the ECB as part of a wider trend among developed central banks.

Rate Cut Expectations: Stronger-than-expected March inflation and hawkish FOMC meetings have led to a rethink on rate cuts.

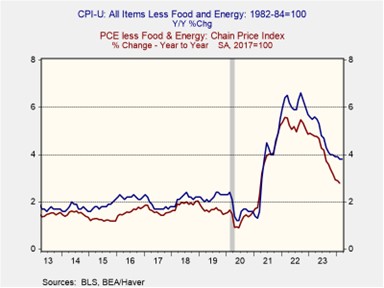

- Inflation surged in March, exceeding forecasts, and year-over-year consumer prices jumped to 3.5% (up from 3.2% in February). Core CPI, excluding volatile food and energy, also climbed to 3.8%, driven by rising costs in housing, healthcare, and car insurance. This robust report dampens hopes for the Fed achieving its 2% target, as indicated in recent meeting minutes. The minutes also reveal a divided committee, where some members fear geopolitical tensions and relaxed financial conditions could further inflate prices. In contrast, others see the potential for downward pressure from technological advancements and continued immigration.

- Recent data exposes unexpected inflation trends. Despite the Federal Reserve’s anticipation of falling housing costs, shelter inflation remains stubbornly high. The three-month annualized rate rose to a worrying 7.11% in March, a significant departure from the expected disinflation. Furthermore, inflation isn’t limited to housing. Core services, excluding rent, have also seen substantial increases, rising 9.3% at an annualized rate over the past three months. This unexpected increase in core services, which are sensitive to wages, suggests a tight labor market, which could fuel broader inflationary pressures.

- March CPI data complicates the Fed’s policy decisions. Their preferred gauge, core PCE inflation, is near their target (2.78% vs 2.50% target range). However, headline CPI inflation, the more widely followed measure, remains above 3.5%. This divergence creates a challenge. The higher CPI number suggests the Fed may now need to hold interest rates steady for a longer period than initially anticipated to avoid accusations of partisanship in an election year. Although a summer rate cut isn’t entirely off the table, its likelihood has diminished significantly.

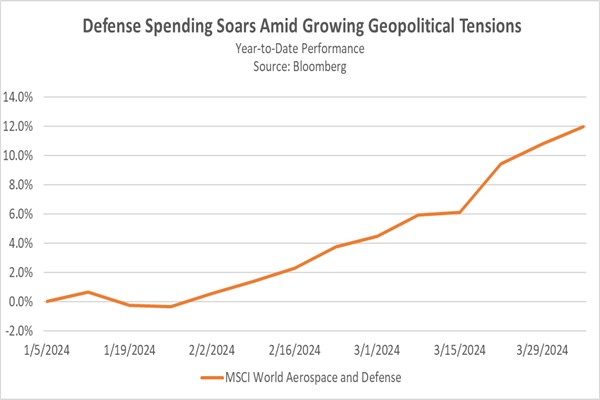

Defense Spending Splurge: Rising global tensions are prompting governments to ramp up defense spending in a bid to deter potential adversaries.

- The Middle East simmers with escalating tensions as the US and Israel ramp up collaboration on missile defense. This follows recent threats from Iran vowing retaliation after a strike in Syria killed a high-ranking Iranian general. The simmering conflict raises fears of a wider regional war, with US officials warning of potential targeted missile attacks by Iran. In a defiant move, Israel issued a stark warning, promising a forceful response on Iranian soil if its borders are breached. Adding to the regional turmoil, two major disputes threaten to ignite further chaos: Ukraine and Russia, as well as Armenia and Azerbaijan.

- While a wider Middle Eastern conflict remains a major concern, the drone revolution is another threat to global stability that shouldn’t be underestimated. Iran’s cheap, combat-proven drones are captivating developing nations, bolstering defenses and aiding militaries like those in Ukraine and Sudan. Their global production network, spanning South America and Central Asia (including some US parts), raises questions about the effectiveness of sanctions. Meanwhile, Ukraine’s experience exposes limitations in US drone capabilities, prompting Ukraine to explore Chinese alternatives for reconnaissance. This highlights how any nation, regardless of size, can exploit niche strengths, reshaping the modern military landscape.

- The intensifying tensions in both the Middle East and Asia emphasize the critical importance of resilient supply chains. Recognizing the emerging alliance between Russia, China, and Iran, US allies are joining forces to bolster their military capacities, aiming to deter potential aggression. This collaborative effort is yielding early successes, as shown in the groundbreaking military drone radar developed by a notable French defense company. As geopolitical rifts deepen, the imperative for security investment grows, underscoring the importance for countries to support global defense companies in safeguarding collective defense interests.

ECB’s Cautious Pivot: The European Central Bank decided to hold rates steady as it prioritizes economic growth over the inflation fight.

- The ECB Governing Council voted to hold interest rates steady for the fifth consecutive meeting. The main refinancing rate remains at 4.5%, and the deposit rate stays at 4.0%. While the central bank’s updated policy statement hinted at a future easing of monetary restrictions, it provided no concrete timeline. However, there are strong indications that a rate cut could come as early as June. The ECB also plans to continue its balance sheet reduction program and will reinvest principal payments from its pandemic bond purchases until the end of 2024.

- In a sign of shifting tides, the ECB’s decision to hold rates steady reflects a growing global trend towards a pause in interest rate hikes. This follows the Swiss National Bank’s surprise rate cut last month, the first among G-7 central banks. Similarly, the Bank of Canada has hinted at a possible June cut as it looks to ease its rate by 100 bps by the end of the year. This cautious approach comes as inflationary pressures, which peaked in the summer 2022, have begun to show signs of moderation, and economic growth has become more of a concern.

- Global monetary policy is in uncharted territory as central banks are deviating from the Federal Reserve’s cautious approach. This divergence, coupled with ongoing doubts about the need for US rate cuts given its economic resilience and robust labor markets, could significantly strengthen the dollar. A stronger greenback could pose a double challenge for economies reliant on dollar-priced imports as it would exacerbate inflationary pressures, forcing them to reconsider planned rate cuts. Additionally, a robust US economy might lead their central banks to maintain higher interest rates than desired, potentially hindering domestic growth.

Other News: Manhattan rent dips hint at a stabilizing market, but high housing costs remain a hurdle for the central bank in achieving its 2% inflation target. Facing a persistent Russian offensive, Ukraine confronts growing challenges in maintaining momentum. Switzerland will hold a peace conference to mediate the Ukrainian/Russian crisis.