Daily Comment (April 1, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with yet another warning from a top European leader of a potential war with Russia. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including several key economic reports out of Asia and various notes on the US economy and markets.

European Union: In an interview last week, Polish Prime Minister Donald Tusk became the latest high-level EU official to warn of an impending war in Europe. According to Tusk, “I know it sounds devastating, especially to people of the younger generation, but we have to mentally get used to a new era. We are in a pre-war era. I don’t exaggerate. This is becoming more and more apparent every day.” In his interview, Tusk said it is essential for the EU to stand by Ukraine and make sure it is not overrun by Russia’s invasion forces.

Turkey: In local elections yesterday, incumbent Istanbul Mayor Ekrem İmamoğlu, one of President Erdoğan’s top critics, appears on track to win reelection with about 50.8% of the vote. Opposition candidates also look set to win in other major urban areas, potentially setting up a major embarrassment for Erdoğan and his conservative Islamist political party.

Japan: The Bank of Japan said its “Tankan” index of optimism among large manufacturers fell to 11 in the first quarter, slightly beating expectations but still coming in weaker than the reading of 13 in the fourth quarter. The index is designed so that positive readings point to more manufacturers seeing positive business conditions rather than seeing negative conditions. Even though the decline in the first quarter was the first since the beginning of 2023, the positive reading therefore still suggests Japan’s factory sector is in good condition.

South Korea: The country’s exports, a bellwether for global trade, showed a total value of $56.56 billion in March, up 3.1% from the same month one year earlier. The increase was a bit weaker than expected, and it marked a slowdown from the 4.8% rise in the year to February. Nevertheless, South Korean exports have now risen on a year-over-year basis for six straight months, suggesting that global economic activity is picking up after some softness in 2023.

- According to the data, exports to the US were up a healthy 12.0% in the year to March, reflecting the country’s continued strong economic performance.

- In contrast, exports to China were up just 0.4%, reflecting that country’s continued lethargy as it faces a slew of structural economic headwinds.

China: The government’s official March purchasing managers’ index for manufacturing rose to a seasonally adjusted 50.8, beating expectations and marking a sharp improvement from the reading of 49.1 in February. Like most major PMIs, the official Chinese index is designed so that readings over 50 indicate expanding activity. The March reading therefore suggests that China’s factory sector is now growing again after five straight months of contraction, despite the weakness suggested by China’s lessening demand for South Korean products.

- The rebound in Chinese manufacturing may seem like a positive for the global economy and financial markets, but that isn’t necessarily the case.

- We note that the rise in the manufacturing PMI came in part from a surge in new export orders, which is consistent with the idea that Beijing is trying to re-accelerate its economy by dumping electric vehicles, batteries, solar panels, and other products on world markets. Such dumping threatens to decimate key industries throughout the developed countries.

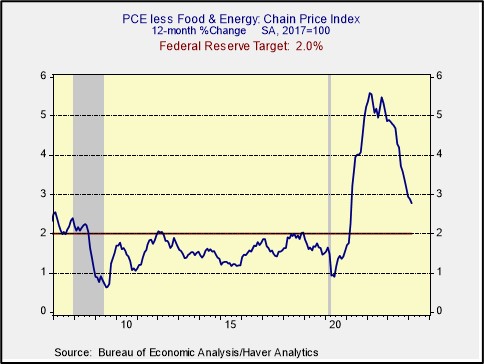

US Monetary Policy: After Friday’s personal income and spending report showed the Fed’s preferred measure of consumer price inflation remained above target, Chair Powell took a sanguine attitude, stating at an event in San Francisco that he still expects price pressures to keep easing, even if the road to 2.0% inflation will be “bumpy.” Nevertheless, Powell also warned that the Fed would take its time in cutting interest rates if price pressures prove sticky.

- In Friday’s report, February personal income rose by a seasonally adjusted 0.3%, slowing from a gain of 1.0% in January. Nevertheless, despite the slowdown in income growth, February personal consumption expenditures (PCE) jumped 0.8%, accelerating from their rise of 0.2% in the previous month. On a year-over-year basis, personal income in February was up 4.6%, while PCE was up 4.9%.

- Excluding the volatile food and energy components, the February core PCE price index was up 2.8% year-over-year, after two straight months in which it increased an annual 2.9%.

US Bond Market: New data shows corporate bond issuance has already hit $606 billion so far in 2024, up about 40% from the same period last year and the highest year-to-date total since at least 1990. Reports suggest companies are rushing to market in part to take advantage of today’s low corporate yield spreads over Treasury obligations, but they may also be trying to get ahead of any potential volatility in the marketplace as the November elections draw closer. Trading in VIX futures also points to investors betting on election-driven market volatility.

US Labor Market: According to the Wall Street Journal, new high school graduates and other members of Generation Z are increasingly eschewing college in favor of training in trades such as welding and plumbing. The report says the number of students enrolled in vocational-focused community colleges rose 16% last year to a record high. The number in construction-trades programs alone jumped 23%. The figures are consistent with our view that US reindustrialization and today’s labor shortages will help broaden the workforce going forward.

US Artificial Intelligence Industry: Technology giant Microsoft and OpenAI are planning to jointly build a specialized data center costing up to $100 billion to boost OpenAI’s computing capacity for artificial intelligence. The data center would house a supercomputer called StarGate with millions of specialized AI processors. In return for funding the project, Microsoft would have exclusive rights to use the resulting AI systems. The project illustrates how much investment could be needed to build out AI systems in the US going forward.

- A separate report today says big AI firms will soon run out of the high-quality internet text needed to train their large language models. As a result, they may have to shift toward using synthetic text derived from videos, proprietary data, or other sources.

- The report may also help explain China’s extensive hacking of large US databases and its promotion of social media tools like TikTok, which could vacuum up immense amounts of user data. If even the internet isn’t big enough to feed modern AI models, Beijing may be surreptitiously gathering immense amounts of private data from US citizens to aid its influence campaigns and espionage efforts.

US Agriculture Industry: After years of concern about falling honey-bee populations, new data from the Department of Agriculture suggests bee colonies are making a strong comeback. For example, the data shows that more than one million new bee colonies have popped up around the US since 2007, making them the fastest-growing type of livestock in the country.

- The rise may in part reflect inflation, since the Agriculture Department only counts bee colonies producing at least $1,000 of revenue each year.

- Nevertheless, the strong rise in counted bee colonies suggests populations are indeed rising, allaying concerns that global warming, invasive species, and other challenges are reducing the population of bees that are so critical to pollination and food production. The new data is therefore creating a buzz among environmentalists. (Sorry)