Daily Comment (April 1, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! We begin today’s report with a brief update on the Russian invasion. Next, we discuss U.S. economic and policy news, with an emphasis on yesterday’s yield curve inversion. We follow with our international news roundup and COVID-19 coverage.

Ukraine and Russia are scheduled to resume peace talks on Friday. There is growing optimism that the sides are getting closer to reaching a ceasefire agreement. Ukraine has stated that it is willing to accept Russia’s demands to remain a neutral state, meaning it will not join a military alliance with either Russia or the U.S. As we have mentioned in the past, we are not optimistic that a ceasefire agreement will completely end the conflict. While talks have improved, the conflict between the sides continues. Ukraine President Volodymyr Zelensky has accused Russian troops of deliberately targeting agriculture, while the Kremlin claimed two Ukrainian helicopters attacked an oil depot in a Russian city. However, there have been signs of de-escalation. Russian troops have left Chernobyl and a northern suburb of Kyiv.

Other Ukraine related news:

- Putin’s image appears to be improving in Russia. A recent poll conducted by the Levada Center, an independent Russian polling firm, showed that Putin’s approval rating improved 12 percentage points from a month ago to 83%. The jump in support is likely to grow over the next few months as sanctions start to hit the economy. As the war rages, we suspect Putin could play up his rivalry with the West as he attempts to frame the sanctions against a deliberate attack from the West on the Russian people.

- The Biden administration leveled new sanctions against Russian tech firms on Thursday. The sanctions targeted Russia’s largest chipmakers and companies within the aerospace sector.

- Putin proposed a plan that would stop the supply of gas to countries that he considers unfriendly to Russia unless they pay for it using rubles. The plan will be enforced next Friday; however, there have been no reports of a slowdown in Russian gas deliveries.

U.S. Economic and policy news

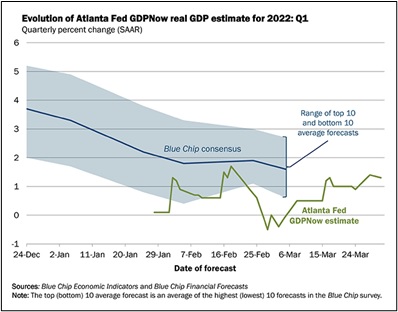

- The yield for the 2- year Treasury rose above the 10-year note for the first time since 2019. This phenomenon, also known as a yield curve inversion, is considered a warning sign that the economy may be heading into a recession within the next two years. In our view, the most recent inversion reflects growing concerns that the impact of the fallout of the Russia-Ukraine war and hawkish Fed policy will hurt economic growth. Although we are not currently forecasting a recession this year, we suspect that the fiscal drag due to lack of stimulus will lead to slower growth. The chart below shows the latest forecast from the Atlanta Fed for Q1 GDP. The latest reading estimates the economy grew at an annualized rate of 1.3% in the first quarter of the year.

- The release of strategic oil reserves to offset the loss from Russia may not have a lasting impact on prices. Although the release of oil helps address supply concerns in the short term, there are fears it could potentially scare away investment used to expand the production capacity of firms. After taking losses for years, investors have pushed oil-producing firms to return much of the profits from higher prices back to shareholders rather than reinvesting them. To deter this behavior, the Biden administration is expected to push Congress to impose fines on oil drillers that do not take advantage of their oil leases.

- There is growing support in the Democratic Party for the federal government to offer households rebates or direct payments to offset the rise in gasoline prices. The proposal is seen as an alternative to removing gasoline taxes, which some states are already doing. As the Mid-term elections approach, we suspect incumbents to push legislation to ease voter concerns about rising gasoline prices.

International news

- OPEC+ countries have decided to increase oil production at a modest pace, even as prices remain elevated. In its latest meeting, the cartel decided to increase oil production by an additional 432,000 barrels a day, a slight increase from its previous increase of 400,000 barrels a day. Although members of the cartel have expressed openness to increasing production, so far, no country appears willing to violate the pact by exceeding their production targets.

- Germany is considering nationalizing Gazprom and Rosneft units in the country. Discussions regarding expropriation are because of fears over the country’s energy security.

- Chinese authorities are expected to comply with U.S requests for audit reports for companies listed on New York exchanges. Previously, Chinese regulators have resisted giving the U.S. access to these reports over concerns that it could expose state secrets. The decision to comply is a rare concession by China and is another signal that its crackdown on firms may be easing.

- China is still trying to prop up its ailing financial system. The People’s Bank of China is considering obtaining several hundred billion yuan to help aid some of its financial institutions.

COVID-19: The number of reported cases is 487,775,962, with 6,142,161 fatalities. In the U.S., there are 80,103,665 confirmed cases with 980,624 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The CDC reports that 702,957,265 doses of the vaccine have been distributed, with 560,823,729 doses injected. The number receiving at least one dose is 255,534,750, while the number of second doses is 217,639,435, and the number of the third dose, granting the highest level of immunity, is 97,674,972. The FT has a page on global vaccine distribution.

- Senators came to an agreement on a new $10 billion COVID-19 spending bill that will go to producing more vaccines, testing, and measures designed to contain the virus,

- New COVID-19 cases in Hong Kong have started to decline, signaling that the virus may be slowing down. The city is considering a mass at-home testing order as a way to gauge whether to loosen restrictions.