The Case for Small Caps (December 7, 2020)

by Bill O’Grady, Mark Keller, and Dan Winter | PDF

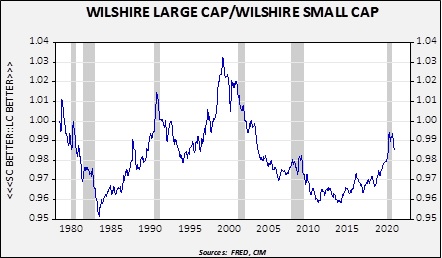

To measure market capitalization, we use the Wilshire Large Cap and Wilshire Small Cap indices. The following chart shows the log-transformed ratio.

On this chart, a rising number indicates stronger large caps relative to small caps. In general, small caps tend to outperform coming out of recessions, which are shown on the chart with gray bars. The basic idea is that, going into recession, investors tend to prefer large cap stocks for the safety. Larger companies have better access to capital and can generally garner more resources to “weather the storm.” As the business cycle improves, smaller firms that have made it through the downturn are usually attractively priced and thus recover faster. Since we believe the recession is already over, we would expect smaller caps to outperform and, as the above chart suggests, there is evidence that this outperformance has already started.

Over the last business cycle, a couple of other cyclical indicators are supporting the case for small caps.