Business Cycle Report (September 28, 2023)

by Thomas Wash | PDF

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

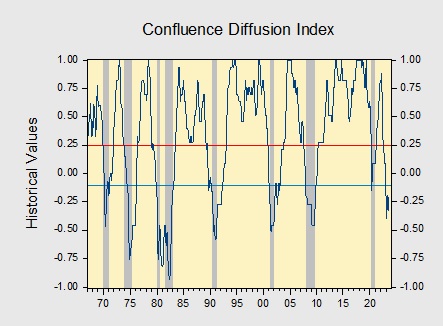

The Confluence Diffusion Index declined for the first time in seven months in a sign that the economy is still not in the clear. The August report showed that seven out of 11 benchmarks are in contraction territory. Last month, the diffusion index declined from -0.1515 to -0.3333, below the recovery signal of -0.1000.

- Equities are losing steam due to concerns about monetary policy.

- Consumer sentiment is improving but confidence remains low.

- Despite a slowdown in hiring, the labor market remains tight.

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is in recovery. The diffusion index currently provides about six months of lead time for a contraction and five months of lead time for recovery. Continue reading for an in-depth understanding of how the indicators are performing. At the end of the report, the Glossary of Charts describes each chart and its measures. In addition, a chart title listed in red indicates that the index is signaling recession.