Business Cycle Report (October 24, 2019)

by Thomas Wash

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. We have created this report to keep our readers apprised of the potential for recession, which we plan to update on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

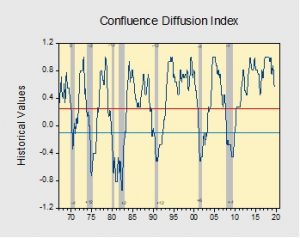

Data released for September suggests the economy is still firmly in expansion, but a slowdown in manufacturing and signals of financial weakness continue to be a drag on the index. Currently, our diffusion index shows that nine out of 11 indicators are in expansion territory, with several indicators approaching warning territory. The index remains unchanged from the prior month at +0.575.[1]

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is headed toward a recovery. On average, the diffusion index is currently providing about six months of lead time for a contraction and five months of lead time for a recovery. Continue reading for a more in-depth understanding of how the indicators are performing and refer to our Glossary of Charts at the back of this report for a description of each chart and what it measures.

[1] The diffusion index looks slightly different from last month due to adjustments we made to the formula and revisions in certain data sets.