Business Cycle Report (June 25, 2020)

by Thomas Wash

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

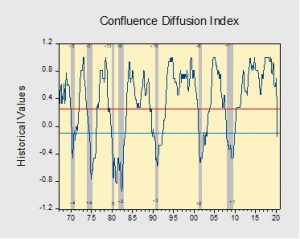

In May, the diffusion index fell deeper into recession territory as improvements in several indicators could not outweigh the negative impact of the previous two months. Last month, states started reopening their economies which resulted in a rise in economic conditions. The financial market continued to show signs of improvement as the Federal Reserve offered reassurances that it would continue to intervene in markets when needed. Additionally, increased economic activity led to a sharp rise in equities. Meanwhile, a reduction in lockdown restrictions allowed firms to hire workers in record numbers. However, the impact of the pandemic continued to weigh heavily on both investor and consumer confidence as concerns persist surrounding economic outlook. As a result, six out of the 11 indicators are in contraction territory. The reading for this month fell to -0.152 from +0.030 in April, well below the recession signal of +0.250.

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is headed toward a recovery. On average, the diffusion index is currently providing about six months of lead time for a contraction and five months of lead time for a recovery. Continue reading for a more in-depth understanding of how the indicators are performing and refer to our Glossary of Charts at the back of this report for a description of each chart and what it measures. A chart title listed in red indicates that indicator is signaling recession.