Asset Allocation Weekly (September 27, 2019)

by Asset Allocation Committee

Over the past few months, we have been on “recession watch.” Our position is that the odds of a downturn are elevated but it is too soon to fully position for a downturn. The inversion of yield curves is a reliable recession warning. On the other hand, the economic data continues to signal a slow U.S. economy but not one seeing negative growth. As long as the economy continues to expand, it does not make sense to underweight equities.

However, there is another possibility to consider. Investors appear to have become overly cautious recently.

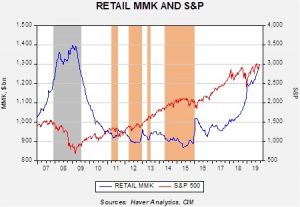

This chart shows retail money market levels on a weekly basis along with the Friday closes of the S&P 500. The gray bars show recessions, whereas the orange bars show periods when retail money markets (RMMK) fall below $920 bn. In general, when RMMK fall to $920 bn or below, the uptrend in equities tends to stall. It would seem there is a certain level of desired cash, and when that level falls below $920 bn, households try to rebuild cash by either slowing their purchases of equities or selling stocks to build liquidity.

The chart shows that, in early 2018, households began to aggressively build RMMK, which would coincide with rising trade tensions.

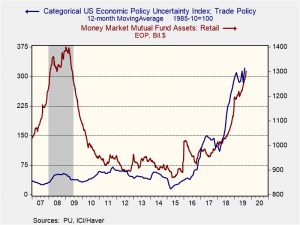

This chart shows RMMK with the 12-month average of the Policy Uncertainty Index for trade policy. The fit is rather obvious. If the U.S. and China come to a short-term agreement that reduces trade worries, it might free up significant liquidity that would find its way into equities. The potential for such flows, coupled with the usual positive seasonal trend in Q4, could lead to a strong close in equities for 2019. This doesn’t mean that investors should not continue to watch for recession signals, but de-risking portfolios too quickly may very well be counterproductive.