Asset Allocation Weekly (September 23, 2016)

by Asset Allocation Committee

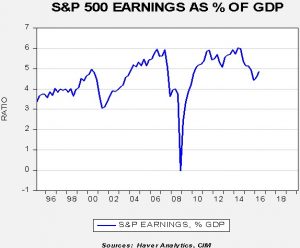

Profit margins are off their highs but have started to improve.

This chart takes total S&P 500 operating earnings as a percentage of GDP. Excluding the financial crisis, operating earnings have been running between 5% and 6% of GDP for most of the past decade and a half. In the middle of last year, this percentage fell below 5% and has remained below that threshold for the past four quarters. Falling energy prices appear to be the culprit for the drop in margins.

We have a model for this series that is critical to our forecasts for S&P earnings. It includes unit labor costs, net exports as a percentage of GDP, LIBOR, fed funds, national income accounts profits as a percentage of GDP, a national corporate cash flow estimate from the Financial Accounts of the U.S.,[1] the EUR/USD exchange rate and oil prices. Based on these variables (and the forecasts coming from the Philadelphia FRB’s Survey of Professional Forecasters), we estimate S&P 500 earnings as a percentage of GDP.

Here is our updated model.

By Q1 2017, margins should rise back to 5%. Given the current divisor, S&P earnings for this year are expected at $107.09, and $113.89 for 2017.[2] These are much lower than what is being discussed in the financial press, mostly due to the wide divergence between Thomson-Reuters and S&P’s earnings numbers.[3]

The key to the forecast is that the dollar will gradually weaken as the terminal rate is lowered for fed funds and as oil prices recover to $52 by mid-2017. If the dollar unexpectedly strengthens, which would also lower oil prices, we would need to adjust our forecasts lower. Of course, this also means that earnings will exceed our current estimates if the dollar weakens more than we expect (EUR/USD > $1.14) and/or oil prices rise more than forecast. The actual recovery in margins is a welcome sign for earnings, although we believe that most of this good news is already reflected in current prices. However, the good news is that, barring a recession, we should avoid a major market correction.

______________________

[1] Also known as the Flow of Funds report.

[2] This change reduces our estimate for 2016 from $107.82, but increases our forecast for 2017 from $109.32.