Asset Allocation Weekly (October 5, 2018)

by Asset Allocation Committee

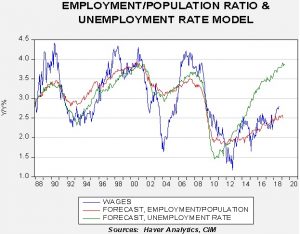

As the unemployment rate declines, there is a worry that wage growth may accelerate and lead to a wage-price spiral, forcing the FOMC to raise rates rapidly. Although possible, the key issue is slack in the labor market. Based on the unemployment rate, there would appear to be little; based on the employment/population ratio, employers should still be able to find workers without having to raise wages to attract them.

This chart shows yearly wage growth for non-supervisory workers. We forecast the results from two models of wages, one using the unemployment rate and the other using the employment/population ratio. Until the latest recovery, both models worked reasonably well; however, in the current recovery, there is a significant divergence. The model using the unemployment rate suggests wage growth should be closer to 4%. Using the employment/population ratio, wages should be growing around 2.5%, which is about in line with actual wage growth. This analysis would suggest there is probably more slack in the economy than the unemployment rate would indicate.

However, just because this pattern has been in place for several years doesn’t mean it will continue. One potential signal that the labor market is “running short of workers” would be if the unemployment rate remains low while non-farm payroll growth slows. To see if slowing payrolls occurs when the unemployment rate is low, we compared five periods since the 1950s when the unemployment rate was under 4.5% for an extended period. We compared payrolls to their maximum to see if payrolls turn down while unemployment is low.

There were four periods in the past that met this criteria.

The 1950-53, the 1955-57 and the 1998-2001 periods all had payrolls decline from their maximum even with low unemployment. However, it should also be noted that in all cases the unemployment rate began to rise as well. In other words, a decline in payrolls doesn’t necessarily offer any better signal than simply watching the unemployment rate. In the 1966-70 period, payrolls continued to rise even though the unemployment rate began to rise. Of course, we have the current event, which still shows rising payrolls.

So, what does this mean for markets? This analysis shows that slowing payrolls won’t necessarily offer a better signal for weakening labor markets than rising unemployment. And, for now, the employment/population ratio is a superior measure of slack. Based on this analysis, there is probably more room for additional increases in the labor force before wage growth accelerates.