Asset Allocation Weekly (March 17, 2017)

by Asset Allocation Committee

The FOMC has moved on rates; as expected, the Fed lifted its target fed funds rate to a range between 75 bps and 100 bps. The projections are for a 1.50% rate by the end of 2017 and a 2.25% rate by the end of 2018.

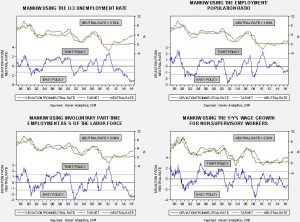

In this week’s report, we want to examine the current neutral policy rates that are generated by our variations of the Mankiw Rule. The Mankiw Rule attempts to determine the neutral rate for fed funds, which is a rate that is neither accommodative nor stimulative. The Mankiw Rule is a variation of the Taylor Rule. The latter measures the neutral rate using core CPI and the difference between GDP and potential GDP, which is an estimate of slack in the economy. Potential GDP cannot be directly observed, only estimated. To overcome this problem with potential GDP, Mankiw used the unemployment rate as a proxy for economic slack. We have created four versions of the rule, one that follows the original construction by using the unemployment rate as a measure of slack, a second that uses the employment/population ratio, a third using involuntary part-time workers as a percentage of the total labor force and a fourth using yearly wage growth for non-supervisory workers.

When we create each model, a deviation from the neutral rate is generated and this deviation is compared to the distribution of deviations. In general, one standard error should capture 66% of the deviation from forecast, assuming normally distributed deviations. When the deviation is inside of one standard error, it is generally within the acceptable range.

The charts above show our four variations of the Mankiw Rule. We have published the neutral rates for each model on each chart. Two of the variations, using the unemployment rate and involuntary part-time employment, are well outside the lower standard error line, suggesting easy policy. However, the variations using the employment/population ratio and wage growth for non-supervisory workers is at or within one standard error, which indicates that policy is closer to neutral.

So, what does the FOMC think is the appropriate variation? Given their forecast of a 1.50% rate by year’s end, we would argue that they are probably leaning toward the most dovish variation, the one using the employment/population ratio. As we argued earlier,[1] the employment/population ratio has been a better guide to wage growth than the unemployment rate. If this is correct, the longer term expectation for a policy rate of 2.25% is based on expectations that core CPI will rise or there will be continued improvement in the employment/population ratio. If neither occur, we could be at the terminal rate by year’s end.

Overall, this means the FOMC, while raising rates, still has a mostly dovish bent. By choosing the most dovish variation of the Mankiw Rule, we are likely closer to the end of this rate cycle, assuming that core CPI remains mostly steady and the employment/population ratio doesn’t unexpectedly rise. Such a stance is bullish for equities; however, it may be bearish for the dollar which may bring some adjustments to our current asset allocation mix.

____________________________

[1] See Asset Allocation Weekly, 2/10/2017.