Asset Allocation Weekly (June 5, 2020)

by Asset Allocation Committee

Last week, we discussed how equity markets, because of their anticipatory nature, tend to bottom in advance of the end of recessions. Assuming that condition continues, if our expectations for a short recession (but probably a long recovery) are correct, it would make sense that the equity market would have already bottomed. That historical pattern, coupled with extraordinarily supportive monetary policy, is supporting equity values.

The view of the economy for most Americans is the job market. In general, the common belief is that a good economy is one with a good job market. Economists tend to take a broader view and assume that the economy is more than just jobs. And so, when overall economic activity recovers, recessions are declared over. However, there are numerous cases where the economy and equity markets are doing fine, while the labor markets are still sluggish.

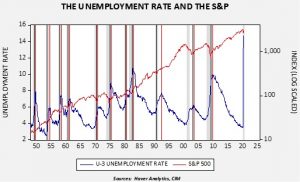

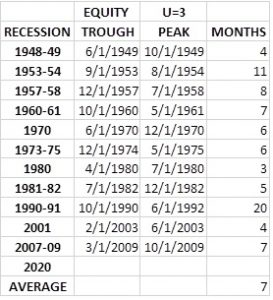

This chart shows the S&P 500 with the unemployment rate. We have placed black vertical lines at the trough of the equity index (using S&P 500 monthly averages) and a red line at the peak of unemployment. Here is a table of the results.

This table shows that equities trough about seven months before the peak of the unemployment rate. Thus, if the unemployment rate has peaked the turn in equity markets seen in recent weeks would be consistent with that pattern. The full recovery in the labor markets will take much longer, but we do expect labor market conditions will steadily improve.