Asset Allocation Weekly (July 12, 2019)

by Asset Allocation Committee

The recent testimony from Chair Powell to Congress made it quite clear that the U.S. central bank is likely to cut rates at the end of July. For the equity markets, the key issue is whether the shift away from tightening to easing will be enough to avoid recession. If the rate cut(s) in the coming months reduce the odds of recession, we could see the expansion continue and the Fed may have engineered a rare “soft landing.” On the other hand, it is quite possible that monetary authorities have raised rates too much and have waited too long to ease policy; if so, then a recession may be unavoidable.

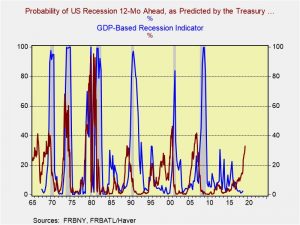

This chart shows two business cycle indicators, one from the New York FRB and the other from the Atlanta FRB. The former predicts the business cycle a year ahead and is based on the yield curve; the latter is coincident and based on GDP. We overlay the two, using the New York number as a warning and the Atlanta index as confirmation. The New York number has crossed the 30 threshold, which has been a signal of recession in the past with no false positives. And, even rate cuts haven’t prevented recession once the 30 threshold has been crossed. At the same time, we have not seen confirming data in the national accounts (GDP) data. Thus, recession may be in the cards, although the risk isn’t imminent; the downturn may still be two years away and it is possible it could be avoided. After all, every cycle is unique.

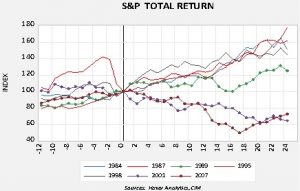

This chart shows the dilemma for equity investors. In this chart we examine the average total return for the S&P 500 on a yearly basis, with the data indexed to the first rate cut, a year in advance of the cut and two years subsequent. The data shows that equities tend to perform very well if recession is avoided, roughly earning 20% in the first year after the cut and nearly 50% over two years. However, if a recession occurs, declines in excess of 20% are possible.

Although the NY Fed’s indicator has a strong track record, each business cycle is different, and it is possible that a recession can be avoided. This analysis does suggest caution, although most safety assets have performed very well already, thus it may be too soon to fully de-risk portfolios. In the immediate term, however, there is little cause to exit the equity markets, but vigilance is clearly necessary.