Asset Allocation Weekly (August 16, 2019)

by Asset Allocation Committee

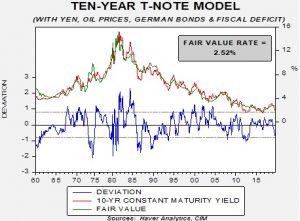

As the 10-year T-note yield tumbles, we are reaching a point where the market looks overvalued based on current fundamentals.

Our yield model uses fed funds and the 15-year average of the yearly change in CPI[1] along with the JPY/USD exchange rate, oil prices, the yield on 10-year German bunds and the fiscal deficit as a percentage of GDP. The current yield on the 10-year T-note, dipping below 1.70%, puts the deviation from fair value at nearly a standard error below fair value. Not every deviation from fair value is resolved through higher interest rates; sometimes the fair value yield declines. The last time we saw this sort of event occur was in 2012 during the Euro crisis and the U.S. Treasury downgrade. That proved to be an unsustainable low in yields. We also saw a dip in early 2008; that issue was resolved by falling T-note yields due to the financial crisis.

Isolating fed funds and assuming the rest of the variables remain steady shows that the bond market has factored in a fed funds of 10 bps, or essentially a return to ZIRP. To be fair, it is also possible that the financial markets are lowering estimates of inflation. The 5-year/5-year TIPS calculation[2] puts the forward inflation rate at 1.80%; our long-term average calculation is around 2.08%. Applying that inflation rate expectation into the model means the current T-bond yield has discounted a 50 bps fed funds rate.

In any case the bond market is essentially making the case that a recession is likely. If a recession is avoided, we would expect to see a significant rise in long-duration yields. For now, the uncertainty surrounding trade and weakening global growth will probably continue to support a long-duration position. But, given the mercurial nature of the trade discussions, a rapid reversal is not out of the question and thus requires close monitoring.

[1] This variable acts as a proxy for inflation expectations.

[2] This series is a measure of expected inflation (on average) over the five-year period that begins five years from today.