Asset Allocation Weekly (April 29, 2016)

by Asset Allocation Committee

We recently completed our quarterly rebalancing process in our asset allocation models. One of our key assumptions is that the economy will avoid recession but growth will remain sluggish. Recently, two reliable recession indicators, one from the Philadelphia FRB and the other from the Chicago FRB, have confirmed our expectations.

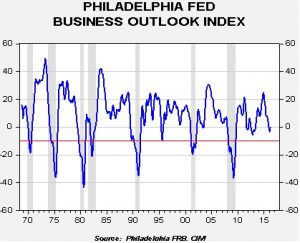

First, shown below is the Philadelphia FRB’s manufacturing index, which is a survey of manufacturing firms in the Northeast:

This index signals below-trend growth with a reading below zero, and indicates a recession with a reading under -10. We smooth the data with a six-month moving average. The current reading is +0.08, suggesting, at best, growth is at trend. Note that the readings have been rather weak in this recovery. In fact, the average index value (on a six-month average basis) for this recovery is the second lowest on record, with only the recovery between the 1980 and 1981-82 recessions being slower.

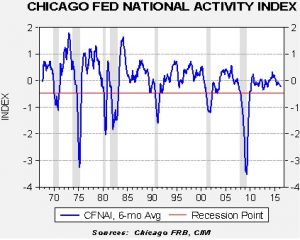

The Chicago FRB National Activity Index, which is a broad-based compilation of national economic indicators, shows a similar pattern.

Similar to the Philadelphia FRB manufacturing index, a reading below zero indicates below-trend growth. The data clearly shows the economy is weak but not recessionary.

We expect the economy to continue on this path. Until household debt falls to more manageable levels, consumption will likely remain sluggish which will tend to weigh on the economy. This forecast for the economy means that:

- Inflation should remain low;

- The risk in long-duration interest rate instruments is low;

- Monetary policy should remain accommodative, even with the Federal Reserve moving on a tightening path;

- Equity markets can support a higher than normal P/E.

These expectations have been incorporated into our asset allocation models. A shift to either recession or faster economic growth would require adjustments but, at this juncture, neither appears likely. Until a shift in stance occurs, our current allocations will likely remain in place.