Asset Allocation Quarterly (Second Quarter 2024)

by the Asset Allocation Committee | PDF

- Our forecast does not include a recession during the three-year period.

- The US economy is expected to be relatively strong throughout the forecast period.

- We expect heightened geopolitical tensions to persist as the deglobalization trend continues.

- Inflation is likely to remain higher due to structural forces such as tight labor market conditions and shortened supply chains caused by deglobalization.

- Monetary policy is expected to remain tighter for longer given elevated inflation and low unemployment rates. While hikes are unlikely, monetary easing may be pushed out further and the terminal rate will likely be higher than observed in previous easing cycles.

- Our fixed income focus is on the intermediate segment in expectation of a positively sloped yield curve, albeit one that is relatively flat compared to recent cycles.

- Our sector and industry outlook favor a Value bias as well as quality factors.

- International developed equities present an attractive risk/return opportunity.

- Gold and silver exposures were maintained.

ECONOMIC VIEWPOINTS

The US presidential election season is starting to take over the airwaves and usually brings concern over the general direction of politics and the economy. Given that this important part of the democratic process involves intense emotions among voters, one might expect the election’s outcome to significantly influence market sentiment and performance. Yet, historical data contradicts this statement. Instead, markets have typically shown a tendency to remain flat in the first half of the election year and rally in the months just before the election. Importantly, markets are good at discounting expected outcomes, but they do not handle uncertainty and rapid change well. Congress is expected to remain divided with slim margins, thus major changes in overall legislative action is unlikely.

We will focus more on the election in the coming quarters, but for now, we continue to closely watch inflation, labor markets, and fundamental valuations of each asset class. Inflation remains front of mind as the Federal Reserve’s communication moves from “transitory” to “speed bump” inflation. As we’ve written before, we see structural forces positioned to keep inflation higher than pre-pandemic levels. Factors contributing to higher inflation include supply chain rearrangement with reshoring and friend-shoring of industrial capacity, elevated geopolitical tensions, and developed world aging demographics.

Labor markets have remained surprisingly strong with the unemployment rate currently at 3.8%. While wage growth rate has slowed, the most recent median wage level grew 4.7% year-over-year. Technological advancements, most notably AI, could change labor’s significance, but we believe there will be minimal impact during our forecast period. On the other hand, the aging workforce and uncertainty of immigration numbers will have more impact on whether the labor markets remain tight.

Inflation, labor markets, and economic growth are important indicators in their own right, but their combined effect is amplified by the monetary policy response. As higher-than-expected inflation and the strong labor market continues, our expectation is for the fed funds rate to stay higher for longer. While our forecast does not include policy tightening, we believe that the easing timeline and magnitude have been delayed. We don’t expect the FOMC to lower rates to the levels seen in recent easing cycles. We also expect the Fed to hold policy steady through the election cycle.

STOCK MARKET OUTLOOK

We anticipate a compelling economic backdrop over the forecast period. In turn, this will be supportive for risk assets. Our expectation is for the domestic market rally to broaden across market capitalizations. The large cap rally is already widening beyond the Magnificent 7, whose stocks are off their recent highs. We are not forecasting a breakdown in the largest stocks, but rather a measured and sustainable broadening of valuations that more accurately reflect business fundamentals. This glide-path should be supported by the high levels of cash currently held on the sidelines.

We continue to favor a Value style bias across all market capitalizations. Value equities still offer appealing fundamental valuations compared to historical averages, stable earnings growth, and less exposure to sectors we consider overvalued. Independent of whether an ETF is categorized as Value or Growth, our analysis focuses on the ETF’s underlying holdings to determine which ETF we anticipate will perform in line with our forecast. Within large caps, we maintain an overweight position in Energy due to geopolitical tensions in the Middle East and sustainable energy transition policies, thereby creating an opportunity within the sector. Additionally, we maintain our factor exposure to the military-industrial complex through two positions in military hardware and cyber defense. The deglobalization seismic shift continues to fuel additional conflicts that had been controlled through soft power over the past few decades of global economic growth and collaboration.

We still view valuations of small and mid-cap stocks as attractive, coupled with respectable earnings power. However, the recent mid-cap price appreciation has led us to dampen our prior overweight to the asset class. Separately, with our expectation for monetary policy to remain tighter for longer, small cap equities might face steeper financing conditions, introducing further volatility in the asset class that we do not view as appropriate for the more conservatively oriented portfolios. For the more risk-accepting portfolios, to mitigate this risk, we maintain our quality factor exposures within the mid-cap and small cap allocations, which screen for indicators such as profitability, leverage, and cash flow.

We maintain our allocation to Uranium Miners, bolstered by ongoing global initiatives to develop and utilize nuclear energy. The evolving landscape of baseload energy production, coupled with policy shifts, have highlighted nuclear energy as a key player in the energy transition. Ambitious green energy policies are driving substantial goals for reducing fossil fuel usage, yet the current green energy technologies face challenges in generating energy at the required scale and consistency. Furthermore, a persistent supply constraint of uranium over the last decade underscores a compelling supply/demand imbalance. This scenario presents a significant opportunity for strategic exposure to the uranium sector, aligning with our long-term investment outlook.

International developed equities remain constructive given relative valuations. Most equities in the developed world ETF are large global market leaders that possess competitive advantages, yet these companies are trading at valuation discounts to domestic large cap companies. Given the attractive valuations and high dividend yields, we have added international developed in the lower-risk portfolios. We maintain a country-specific exposure to Japan as shareholder-friendly reforms continue to take effect and as capital flows continue moving into Japan, which could potentially lead to multiple expansion.

BOND MARKET OUTLOOK

We anticipate that the path to a positively sloped, though relatively flat, Treasury curve by the end of the forecast period may be uneven given our expectations of heightened inflation volatility. In the near term, with inflation above the Fed’s preferred 2% level, tight labor markets, a data-dependent Fed, upcoming domestic elections, and the US Treasury’s need for heavy issuance of debt, we concur with the market’s assessment that the Fed will be content to leave its fed funds rate higher for longer. These influences alone portend a volatile period for bonds, especially among longer maturities.

As with last quarter, an inverted yield curve leads us to emphasize the intermediate segment of the curve due to its modest rate stability and resultant limited market risk and opportunity costs.

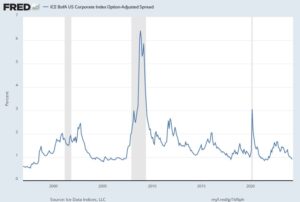

Among sectors, we find advantages in mortgage-backed securities (MBS), particularly highly seasoned pools with lower coupons, relative to Treasurys. Extension risk is more limited in these pools and recent spreads are attractive from a historical perspective. By contrast, investment-grade corporates are currently trading at historically tight spreads of less than 100 bps to Treasurys, approaching the record from 1998. Accordingly, we employ corporate bonds more liberally in the short-term segment and maintain our overweight to MBS in the intermediate-term bond sleeve of the strategies.

Looking at speculative-grade bonds, while spreads have tightened post-COVID, they remain above historically tight levels and still offer attractive yields. Although caution is appropriate in the broader speculative bond segment, we find continued advantage in the higher-rated BB segment given that credit fundamentals remain relatively healthy and the vast majority of bonds in this segment are trading at discounts to par.

OTHER MARKETS

Among commodities, we retain the position in gold as both a hedge against elevated geopolitical risks and an opportunity given increased price-insensitive purchasing by international central banks. In the current deglobalization environment, international central banks are seeking to buy gold as a reserve asset in fear of the weaponization of the dollar. Silver is maintained in the more risk-tolerant portfolios for its low price relative to gold. Real estate remains absent in all strategies as demand is still in flux and REITs continue to face a difficult financing environment.