Asset Allocation Quarterly (Second Quarter 2023)

by the Asset Allocation Committee | PDF

- Our forecast includes a normal recession, likely beginning later this year. We also expect a recovery during our three-year forecast period.

- The path of the Fed’s monetary policy will have an outsized effect on markets. Though market expectations are varied, we expect a measured path for fed funds.

- Bond exposures are in the short-term segment as our forecast contains a flat yield curve stemming mostly from lower rates in the one-to-three-year segment.

- Domestic and international developed equity exposures remain elevated across the strategies given our expectations for a recovery and the potential for expansion within our forecast period.

- In U.S. equities, we lean toward mid-caps as valuations look particularly attractive. We maintain our value bias and cyclical sector overweights and we introduce a quality factor.

- Gold exposure is maintained for its benefits as a low-correlation asset along with its potential to act as a haven during economic turmoil, hedge against geopolitical risk, strength during periods of U.S. dollar weakness, and reserve asset for global central banks.

ECONOMIC VIEWPOINTS

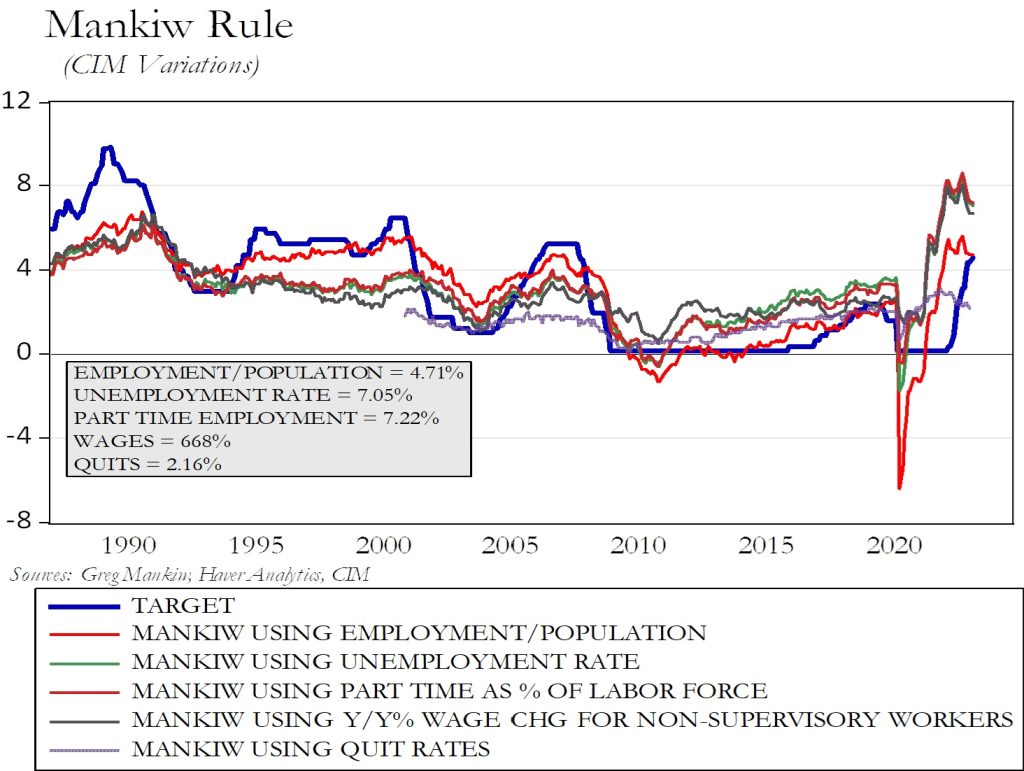

The first quarter ended with spiking market volatility caused principally by a banking crisis that included the failure of Silicon Valley Bank, the country’s 16th largest bank. An uneasy calm entered the markets following the swift actions by the Federal Reserve and FDIC to control potential bank runs as well as the contagion fears that surrounded the industry. The Fed’s indication that it will backstop all deposits regardless of size has appeared to resolve problems associated with a bank run. We do not foresee a rapid deterioration of the banking industry or further bank failures, though increased regulation is expected. A near-certain likelihood of recession is discounted into the markets. This combined with the surprising nature of the banking crisis has many investors waiting for potential volatility explosions from other unforeseen sources. Perhaps most importantly, underlying economic fundamentals disagree on whether the Fed has tightened monetary policy to an appropriate level and should pause its rate hikes to maintain a healthy economic environment, as the accompanying chart of the Mankiw Rule indicates.

While the future fed funds rate anticipated by the market is more wide-ranging than usual, we do not expect rapidly changing monetary policy over our three-year forecast period but rather a measured change in the fed funds rate. From an investor perspective, with fixed income yields currently at attractive levels there is little urgency for investors to move into risk assets. However, if the Fed eases in response to the banking crisis and/or a weakening economic climate, fixed income investments will likely no longer earn a relatively attractive yield.

Notable market swings going forward are likely as investors ponder the direction of domestic and overseas monetary policy. The Fed has raised rates to combat inflation, which has slowly come down from its pandemic highs. However, we do not believe that monetary policy alone created inflation and therefore the Fed has limits to its abilities to control it. Rather, the root of inflation lies mainly with deglobalization and changing supply-chain economics, dynamics which have long-cycle effects on the economy. Therefore, we have entered a higher inflation regime than we saw during ZIRP. Inflation will likely continue to moderate from recent highs, as we have seen in recent months, but we expect it to remain toward the higher end of the Fed’s estimated range. Since monetary policy was not the sole cause of inflation, Fed rate changes are not likely to be effective against controlling inflation but may risk damaging economic growth. This is an issue that we are watching closely.

STOCK MARKET OUTLOOK

A recession is well-anticipated by market participants and therefore also generally discounted into current pricing. Despite the U.S. economy entering a higher inflation regime, domestic large cap stocks have continued appreciating since last autumn. Concentration remains high in the S&P 500 Index, with five names delivering most of the price appreciation year-to-date. These stocks are in the Technology sector, whose companies tend to be more cyclical and have historically underperformed in a higher inflation environment. The S&P 500 has also maintained a premium relative to lower capitalization U.S. stocks as well as international stocks despite economic worries and concentration risk. For these reasons, we view domestic large cap stocks as less attractive compared to lower-capitalization stocks. We reduced the overall large cap exposure, while maintaining the Aerospace & Defense position and cyclical sector overweights. Deglobalization and re-militarization of foreign countries is a sustainable long-term trend likely to continue for years. We maintain our sector overweights to Mining, Energy, and Industrials in most strategies. Mining and Energy sectors are likely to benefit from electrification/green energy policies as electrification is metals-heavy.

Mid-cap equities, specifically, are at historically wide valuation discounts to large cap stocks, which we find attractive. Lower current valuations provide a measure of protection against volatility that might occur during economic weakness and potential Fed actions. The underlying fundamentals are supportive of mid-cap equity earnings during the forecast period. We introduced a quality factor in our mid-cap exposure, which mirrors the investment structure on the large cap side. The quality factor screens for profitability, leverage, and cash flows, which should support the group through economic volatility.

We continue leaning into a value bias across all market capitalizations. We view the sustainability of earnings growth as more attractive in equities categorized as value and the fundamental multiples of P/E, P/B, and P/CF are modest compared to historical data. In addition, value style has a lower exposure to sectors that we view as overpriced. Although the total return for value has vastly outdistanced growth over the past year, outperformance cycles tend to be multi-year events and, consequently, we anticipate that we are in the early stages of a value outperformance cycle.

We retain an overweight in international equities due to favorable relative valuations of international developed stocks versus U.S. counterparts, constructive policies from most developed market central banks, and the prospect of a weakening U.S. dollar. Though we also expect positive returns on emerging market stocks over the forecast period, its exposure is limited to only the most risk-accepting strategy, Aggressive Growth, given the potential geopolitical risks from China and its heavy weight, in excess of one-third, in the emerging markets indexes.

BOND MARKET OUTLOOK

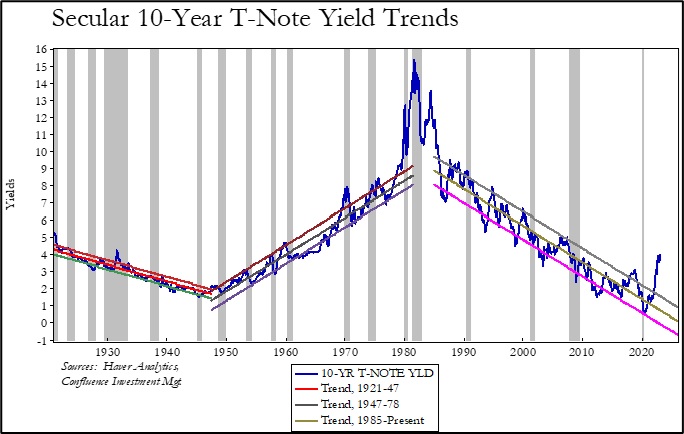

While a recession is in our forecast, we are not expecting the Fed to react as aggressively as it has in prior recessions during this century, where it reduced fed funds to the zero bound. Rather, while it is a near certainty that the Fed would curtail its current QT balance sheet reduction of $95 billion per month, it is more likely that the Fed would initiate targeted programs, much as it did in March 2020. Our base case is that the Fed reduces fed funds in small increments when faced with a recession as long as policymakers believe that inflation has the potential to be rekindled. Over our three-year forecast period, we anticipate the U.S. Treasury yield curve will transform from its current steep inversion to a more traditional slope, albeit relatively flat. It has become popular for managers to extend duration when the yield curve inverts, and this has mostly worked in the secular bull market for bonds that has existed since 1984. However, we are not of the opinion that this type of bond market environment will exist over our forecast period, which leads to four words in our industry that induce fear: “this time is different.” Accordingly, the cyclical positioning of bonds in the strategies is all loaded in the short-end of the curve, with the exception being the strategy designed for Income, which still incorporates an unchanged 10-year laddered maturity structure, yet incorporates a tilt to one-to-three-year Treasuries.

Among investment-grade corporate bonds, we expect only modest widening of spreads over the forecast period as the past few years have not led to excessive accumulations of debt. Nevertheless, we acknowledge the sizable increase over the past year in the cost of capital for companies that are issuing debt, either for new projects or for refinancing. This naturally leads to the expectation that these firms will experience pressure on earnings and their ability to support bond covenants, particularly for companies that are rated B or lower.

OTHER MARKETS

Although REITs have suffered dramatic erosion in prices over the past year relative to the broad equity market, they remain excluded from the strategies. The avoidance of the sector over the near-term was encouraged by negative pressures on demand for office and retail space, compounded by the difficulty in arranging financing through regional banks stemming from deposit outflows. In contrast, broad-based commodities have produced outsized returns over the past two years as a result of healthy demand which led to inflated prices. We removed the broad-based commodity exposure due to the recession in our forecast beginning later this year. However, we retained the allocation to gold across the strategies due to our belief that it can act as a haven during economic contractions, hedge against geopolitical risk, strength during periods of U.S. dollar weakness, and reserve asset for global central banks.