Asset Allocation Quarterly (First Quarter 2026)

by the Asset Allocation Committee | PDF

- Recession likelihood is low over our three-year forecast period.

- Economic growth continues near trend, with policy spurring business investment.

- Fed policy will lean dovish, supporting risk markets.

- Inflation likely to remain in the 2.5-3.5% range, above the Fed’s long-term target.

- Risk markets are expected to enter a rotation as market leadership broadens.

- Passive flows endure as a structural tailwind for US equities, disproportionately benefiting large caps over smaller market capitalizations.

- International developed equities are positioned for stronger relative results, bolstered by fiscal support abroad, valuation advantages, and US dollar weakness.

- Gold should benefit from steady central bank buying and continued pressure on the US dollar.

ECONOMIC VIEWPOINTS

We expect US GDP growth near its long-run trend over the forecast period, with recession risk remaining low, but not zero. The key reason is the policy mix. Monetary policy is likely to lean more dovish as growth cools, with supportive fiscal policy through individual and corporate tax advantages, ongoing spending, and investment initiatives. The expansion can endure even in the absence of above-trend growth, provided policy conditions remain conducive. Our base case is a steady, policy-supported environment.

The labor market is transitioning from a period of acute tightness following the pandemic toward gradual moderation, and we expect further softening as firms unwind the labor-hoarding behavior that emerged during the post-pandemic recovery. Rather than widespread, high-profile layoffs, this adjustment is more likely to occur through slower hiring, reduced job openings, and tighter control of headcount growth. The slowdown has coincided with elevated uncertainty over trade policy, which has weighed on corporate hiring and capital expenditure plans at the margin, while accelerating AI adoption is increasingly influencing staffing needs in certain white-collar functions. Labor market conditions also remain uneven across sectors. In an environment where job creation is declining in nearly all other sectors, health care and related services continue to be reliable sources of employment growth, with particular resilience in leisure and hospitality. Nevertheless, conditions have deteriorated for new entrants — particularly recent college graduates — where unemployment and underemployment have risen. In addition, government funding risk and the potential for shutdown-related disruptions represent an additional source of uncertainty that could further restrain hiring through reduced visibility and delayed spending. These crosscurrents are likely to contribute to higher volatility in both economic data and financial markets over the forecast period.

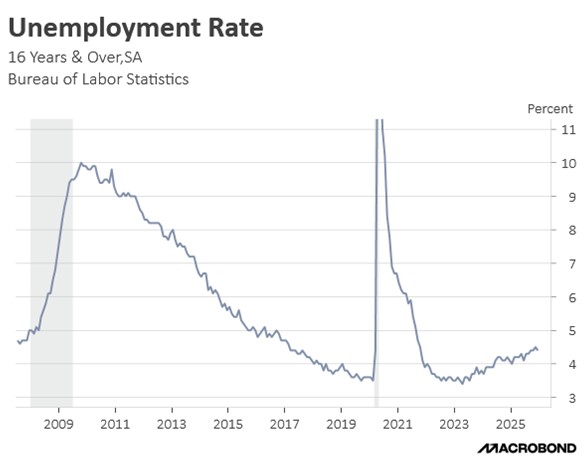

The unemployment rate shown in this first chart has moved modestly higher from its cycle low and has continued to drift upward over the past year. While labor market conditions are relatively healthy by longer-term standards, the upward trend suggests a gradual downshift consistent with slower hiring and reduced labor hoarding. In our view, the latest data supports the outlook for continued, incremental softening rather than an abrupt deterioration.

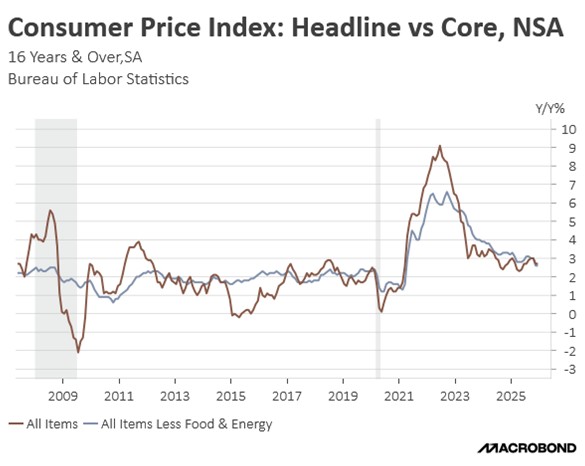

Inflation is expected to remain above the Federal Reserve’s 2% target over the forecast horizon, with annual price increases settling in the range of 2.5-3.5%. Persistent higher inflation is likely to be driven by factors such as sticky inflation in services, demographic constraints on labor supply, and elevated fiscal support. Services inflation is expected to moderate more slowly than goods inflation due to its more wage-sensitive and labor-intensive nature.

In addition, tighter immigration policy may constrain labor force growth over time, placing upward pressure on wages even as overall demand cools. Firms are also expected to test pricing power in select categories, while geopolitical challenges and recurring supply-chain disruptions present intermittent upside risks through shipping and input costs. Taken together, recent data reports are consistent with a gradual increase in the unemployment rate alongside a CPI trend that has moderated from peak levels but remains above target.

STOCK MARKET OUTLOOK

We see the potential for a broadening in equity market performance, with returns likely to become less concentrated among mega-cap technology businesses. Valuations across leading technology franchises are elevated, and an environment characterized by continued expansion is consistent with improving breadth and renewed interest in other underappreciated sectors and international markets. Therefore, the “other 493” exhibit valuation appeal after prolonged relative underperformance. However, structural support continues for the largest capitalizations, including the concentration of passive flows in index heavyweights.

Overall, we remain constructive on US large cap equities, while reducing mid-cap exposure given the more persistent influence of index-driven flows at the top of the market. Within US large caps, lower-risk portfolios maintain a value-oriented tilt, while higher-risk portfolios emphasize growth. To reinforce the growth allocation, we added an overweight to the Communication Services sector. We continue to hold dividend-oriented ETFs across both large and mid-cap allocations as dividend income can serve as a reliable cushion in the higher-volatility environment we expect. Within sector positioning, we retain exposure to advanced defense and security-related technologies amid ongoing geopolitical tensions. We continue to exclude US small caps, which may face headwinds and margin compression due to tariff-related cost pressures, higher financing costs, and limited pricing power.

The current macro environment suggests increased scope for US dollar softness, which supports the case for international diversification and improves the relative return outlook for foreign assets. Accordingly, we maintain and have selectively increased our allocation to international developed equities. Within this asset class, we continue to hold broad-based, Europe-focused, and small cap value positions, which may benefit from trade realignment and regional fiscal initiatives. We also added exposure to global metals and gold miners, reflecting our expectation that mining companies will participate in the upside as demand for key metals strengthens. In this economic environment shaped by a fracturing global order, heightened geopolitical uncertainty, and growing reassessment of reserve-asset reliability, gold and related assets continue to attract demand that renders historical valuation anchors less informative and provides an asymmetrical lift to the metal’s upward trend. At the same time, miners of industrial metals are positioned to benefit from strategic reshoring efforts, defense and infrastructure spending, and energy-transition investment, where constrained supply and sustained policy-driven increase the likelihood of durable pricing support across key inputs.

BOND MARKET OUTLOOK

The fixed income outlook incorporates a gradual policy pivot despite persistent elevated inflation running close to 3%. Monetary policy is likely to become even more accommodating over the coming year given expectations of softening labor market conditions. As discussed, the Fed seems poised to lower rates further. Nevertheless, the broader rate environment is extremely unlikely to return to the low-rate conditions of the prior decade. Fiscal-driven issuance of debt and tariff-related inflation risks should keep longer-term yields elevated, supporting a gradual steepening of the yield curve as term premia rebuild and foreign demand for U.S. Treasuries moderates.

Within fixed income, we shortened our duration modestly, focusing on intermediate duration as this posture lowers exposure to declining short-term yields as the Fed eases. Although credit fundamentals remain generally intact, corporate spreads are still historically tight, thus we continue to underweight corporate bonds due to the potential risk of not being compensated by current spreads. Investment-grade spreads are expected to widen modestly over the forecast horizon. We continue to emphasize US Treasurys and seasoned mortgage-backed securities (MBS) for stability and income, while maintaining selective exposure to high-quality speculative-grade bonds.

We continue to hold gold across all strategies, viewing it as a strategic asset. Central banks remain steady buyers, underscoring gold’s role as both a store of value and an inflation hedge. Ongoing geopolitical tensions and the global shift to diversify away from US dollar dependence are likely to keep demand firm, reinforcing the importance of gold within a diversified, risk-aware allocation. Although gold has proven to be a beneficial holding in the strategies, as it continues to mark historic highs, we are continuing to monitor its ongoing appeal.

OTHER MARKETS

We retain allocations to gold across all strategies, reflecting its ongoing role as a store of value and an inflation hedge in an increasingly dynamic geopolitical environment. Continued foreign central bank purchases, together with a broader trend toward reserve diversification away from US dollar dependence, are likely to sustain demand and reinforce gold’s importance within a diversified, risk-managed allocation. This quarter, we initiated an allocation to platinum within the more risk-tolerant portfolios, given favorable supply-demand fundamentals and an attractive valuation profile. Platinum also offers macro leverage to industrial demand and supply-chain constraints in a higher-inflation, more volatile global environment.