Asset Allocation Quarterly (First Quarter 2020)

- The U.S. election season and the more dovish composition of the Federal Reserve Board of Governors should ensure policy accommodation continues in the near-term.

- The recent resolution of trade policies with China and the prospect for finalization of USMCA produces an environment where corporate capital can be deployed with less uncertainty.

- Although we hold a somewhat sanguine view of the U.S. economy over our three-year cyclical forecast period, we recognize there is the increased potential for a policy mistake that could lead to economic difficulty.

- Each strategy reflects a neutral posture, with all risk assets continuing to reside in the U.S. and an equity style exposure of 60% value/40% growth, with an emphasis on larger market capitalizations.

- The potential for elevated volatility in global equity markets encourages an allocation to long-term U.S. Treasuries and gold.

ECONOMIC VIEWPOINTS

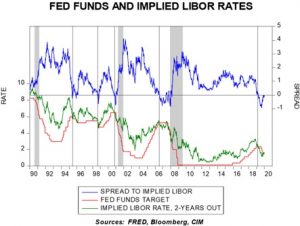

The recently signed initial trade deal with China, as well as the expectation for enactment of the new North American Trade Pact [USMCA], have helped propel U.S. equities to all-time highs. The trade resolutions hold the potential to encourage businesses to deploy capital toward long-term projects. As evidence, the recently released Q4 2019 Duke University CFO Global Business Outlook finds 12-month capital spending expectations increasing to 4.7% from 0.6% last quarter and R&D spending increasing to 2.7% from 0.6% the prior quarter.[1] Among consumers, the University of Michigan Index of Consumer Sentiment has similarly ratcheted up from 95.5 at the beginning of last quarter to its recent level of 99.1.[2] The business outlook and consumer sentiment figures have also been influenced by the accommodative posture of the U.S. Federal Reserve. The anticipation of two dovish nominees to the Fed’s Board of Governors encourages the expectation of continued accommodation through the U.S. election season. The relationship of the fed funds rate versus the implied LIBOR rate two years out underscores the notion that the Fed has reduced rates and stretched its balance sheet to the degree necessary to accommodate favorable economic conditions.

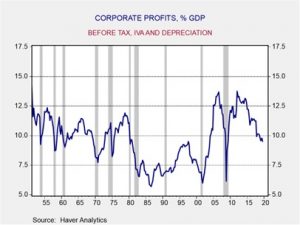

Despite the current rosy economic backdrop, there remain several lingering concerns. The first concern regards corporate profitability. Although broad indices have been propelled higher, corporate earnings have trended lower as the effects of the Tax Cuts and Jobs Act of 2018 roll off, making year-to-year comparisons more challenging. As this chart indicates, prior to taxes, inventory valuation adjustments [IVA] and depreciation, corporate profits as a percentage of GDP have been declining.

A second concern involves the rally in equities to spur hitherto reluctant retail investors to experience the fear of missing out [FOMO] and lead to performance chasing. While investors pulled $600 billion out of U.S. equity funds and separately managed accounts in 2019, over the past month the trend has reversed and flows have turned markedly positive, according to Morningstar’s asset flow data. Should this be the first salvo in a rush to invest, a true melt-up in equity markets could occur. If history is any guide, FOMO is notorious for leading to self-destructive investor tendencies. The third concern is that the Fed, in conjunction with the U.S. Treasury, begins to use exchange rates as a policy tool. Although this would make future tariff threats more potent, adjustments in terms of trade have deleterious ramifications for corporate and investor behavior.

Although these factors of concern are present, they do not reflect our base case for continued economic health and extension of the record economic expansion. Rather, they are intended to underscore the importance of continually monitoring data to ascertain whether our asset allocations are appropriate or in need of adjustment. While diversification among asset classes is a hallmark of modern portfolio theory, allocations based upon stagnant assumptions may yield spurious results. Accordingly, expected returns, risk, and yields require regular updates to provide proper diversification among asset classes, which is the crux of our asset allocation process.

[1] https://www.cfosurvey.org/wp-content/uploads/2019/12/2019-Q4-US-Key-Numbers.pdf

[2] http://www.sca.isr.umich.edu/

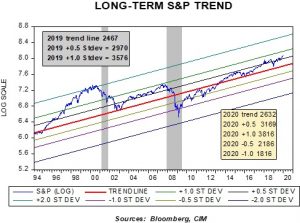

STOCK MARKET OUTLOOK

While we hold a favorable view of the equity markets near-term, we recognize that beyond the next 12 months pressures may continue to mount in terms of corporate earnings growth. In addition, should the potential for investors to yield to FOMO be realized, a market melt-up could ensue. In such an event, valuations would become extremely stretched, leading to the potential for a subsequent significant retrenchment in equity prices. Finally, a politicized Fed in conjunction with the U.S. Treasury to incorporate exchange rates as a policy tool would have serious implications for corporate and investor behavior. Although we have a neutral allocation to U.S. equities, our concentration in each of the strategies is on large capitalization, higher quality segments of U.S. stocks. Within large cap sectors, we established an overweight to Communication Services and retain the overweights to Technology and Health Care.

The concentration on higher quality also leads to a continuation of the skew to value relative to growth, as well as the retention of a quality factor geared toward companies that meet the required criteria of profitability, quality of earnings, and low leverage. The particular elements of the quality factor include return on equity, as a measure of profitability, changes to net operating assets over the past two years as a criterion for earnings quality, and the ratio of debt-to-book value of equity to determine financial leverage.

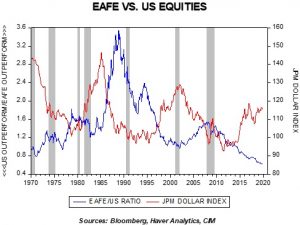

Beyond the U.S., despite attractive valuations and solid fundamentals among many non-U.S. companies, the weighting remains void until a durable catalyst for U.S. dollar weakness is recognized. As that occurs, tailwinds associated with a decline in the U.S. dollar will be extremely beneficial for U.S.-based investors.

BOND MARKET OUTLOOK

The Fed’s increasingly accommodative posture combined with the global appetite for yield will likely lead to a continuation of a normally sloped and range-bound yield curve over the course of the next several quarters. Over our three-year forecast period, we regard long-term Treasuries as relatively attractive given the global yield appetite and the potential for gravitational pull exerted by the sheer amount of global bonds outstanding with negative yields. Additionally, should we experience more volatile markets for global equities, longer term U.S. Treasuries should prove resilient. Although nearly $5 trillion of corporate debt will be maturing before 2023, according to Moody’s, our caution is directed toward speculative grade, or high yield, corporate bonds where we expect spread widening to occur.

The duration of bond holdings in the strategies remains relatively long, stemming from our forecast for an accommodative Fed, a lack of inflationary pressure, and global demand for bonds. In the strategies with income objectives we retain the laddered structure as the core beyond the short-term segment in these strategies.

OTHER MARKETS

The combination of our forecast for rates, the lack of excesses in the real estate segment, and the more diversified pool of REIT enterprises leads to our constructive view on the segment. As a result, REITs are included across the array of the strategies.

The prior elevated allocation to gold is retained given its ability to offer a hedge against geopolitical risks combined with the safe haven it can afford during an uncertain climate for both equities and the U.S. dollar.