Asset Allocation Bi-Weekly – The FOMC in 2024 (October 9, 2023)

by the Asset Allocation Committee | PDF

The Federal Reserve’s Federal Open Market Committee (FOMC) votes on monetary policy. The FOMC consists of seven governors, the New York FRB president, and a rotating roster of four regional presidents who serve a one-year term on the committee. This rotation feature means that the policy leanings of the FOMC could change each year. In our observations, though, the changes from year to year are not typically monumental, but at the margin, the composition of the committee might trigger more rapid policy shifts or changes in the number of dissents to policy decisions.

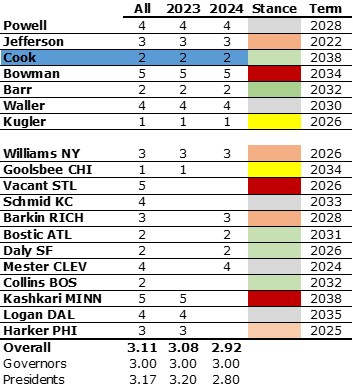

This table shows the breakdown of the FOMC:

(Sources: Federal Reserve, Bloomberg, Confluence)

Using Bloomberg’s assessment of policy leanings,[1] there are five categories of voters, ranging from Uber Hawk to Uber Dove. We then assign numbers, ranging from one to five, with higher numbers signaling hawkishness. Overall, the average is moderate, with presidents being slightly more hawkish than governors . This year, the FOMC was a bit more dovish than the average of all potential voters. However, note that in 2023, hawks outnumbered doves five to four. Next year, the serving presidents are much more dovish. The average falls from 3.2 to 2.8, with doves outnumbering hawks five to four. The higher number of doves may make the “higher for longer” story harder to maintain.

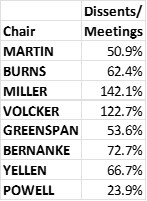

One of the unusual characteristics of the Powell Fed has been the low number of dissents.

(Sources: Federal Reserve, Confluence)

(Sources: Federal Reserve, Confluence)

This table measures the number of dissents relative to the number of meetings that a Fed chair has presided over. Clearly, Chair Powell has had the most unified FOMC in history. However, this upcoming year might be a challenge for Powell as his stated goal of keeping policy tight will be coming up against an FOMC that is more dovish than usual. If he maintains his dissent record, it will suggest his powers of persuasion are strong. It’s important to note that there is an unofficial rule that four governors dissenting at a meeting should trigger the resignation of the chair.[2] There are three dovish governors, so a moderate would have to vote against the chair in order to hit the critical fourth vote. We note that the last governor dissent was in 2005, so they have become rare. Thus, even one dissent would likely be newsworthy.

Overall, the composition of the FOMC in 2024 will lean dovish, while Chair Powell appears to be holding a hawkish line. At the last meeting, the FOMC dots plot took away two rate cuts from the 2024 projection. It remains to be seen whether those dots signaling a retreat from rate cuts are going to be voters next year. We may have a Fed that turns out to be more dovish than currently expected.

[1] Note that Governor Cook, who has recently been appointed, is colored in blue. This is because Bloomberg hasn’t given her an assessment yet.

[2] This is not a hard and fast rule, but a chair that is in the minority of the governors has probably lost the mandate to govern. For background, see Mallaby, Sebastian. (2016). The Man Who Knew: The Life and Times of Alan Greenspan. New York, NY: Penguin Books, pp. 311-315.