Asset Allocation Bi-Weekly – The Inflation Adjustment for Social Security Benefits in 2024 (November 6, 2023)

by the Asset Allocation Committee | PDF

Social Security was the second-largest contributor to the increase in the fiscal deficit in 2023 (behind only net interest on debt), accounting for $134 billion. Much of the increase in entitlement spending was due to the 8.7% surge in cost-of-living adjustments (COLAs), which was the largest jump since 1981. The purpose of the increase was to compensate entitlement recipients for rising inflation, which peaked at 9.2% in September 2022. However, the inclusion of the COLA has made it difficult for lawmakers to help rein in the country’s burdensome fiscal deficit.

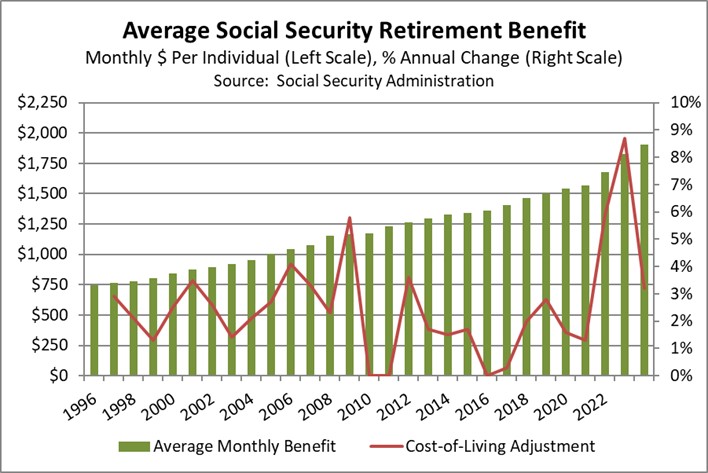

In mid-October, the Social Security Administration announced that Social Security retirement and disability benefits will jump 3.2% in 2024, bringing the average retirement benefit to an estimated $1,907 per month (see chart below). That means the average Social Security benefit will increase by $80 per month in 2024, slightly below the historical average increase of 3.8% and down from an increase of $146 last year. The benefit rise was right in line with expectations, given that it is computed from a special version of the Consumer Price Index (CPI) that is widely available.

Media commentators often fret that the Social Security COLA could be “eaten up” by rising prices in the following year, or that the benefit boost could provide a windfall if price increases were to slow down. In truth, the COLA merely aims to compensate beneficiaries for price increases over the past year. It’s designed to maintain the purchasing power of a recipient’s benefits given past price changes. The coming year’s price changes will be reflected in next year’s COLA, because high inflation in the current year generally leads to more spending in the following year.

While the tax base is adjusted to compensate for spending increases, the rate does not match the COLA adjustment. For example, the maximum amount of earnings subject to the Social Security tax was hiked to $168,600, up 5.2% from the maximum of $160,200 in 2023. This discrepancy in the percentage increase in Social Security benefits compared to the percentage increase in taxes collected is related to the way these items are calculated. Unlike benefits, the increase in the taxable income is calculated by a national average wage index, which looks at movement in pay. As a result, the increase in the taxable income is used to offset the increase in benefit expenses, especially when the labor market is tight.

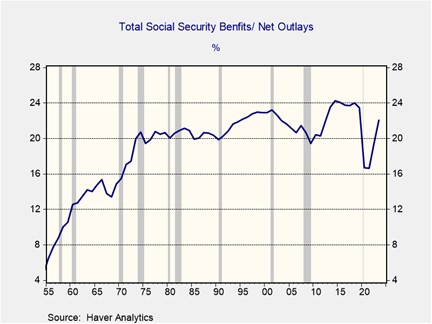

For the overall budget, the inflation-adjusted nature of Social Security benefits is particularly important. Since so many members of the huge baby boomer generation have now retired, and since more and more people are drawing disability benefits than in the past, Social Security income has become a bigger drag on the federal deficit (see chart below). In 2023, Social Security retirement and disability benefits accounted for roughly 22.1% of federal net outlays. Having such a large part of the budget subject to automatic cost-of-living adjustments helps ensure that a big part of the deficit will be sensitive to changes in inflation, albeit with some lag.

Although socially sensitive, lawmakers must address Social Security’s financial challenges. Politicians have several tactics to reduce the program’s burden on the deficit without cutting benefits, such as raising the retirement age, increasing the Social Security tax rate, and/or using an average rate of inflation over a given period. While unlikely in the next few years, resolving Social Security problems will probably become more of an issue as millennials and Gen Z form more of the voting bloc. Working out the Social Security problem would make the deficit more sustainable and is likely to put downward pressure on Treasury yields, but it could also limit spending in sectors popular with the elderly, such as healthcare and travel, which could stifle economic growth.