Asset Allocation Bi-Weekly – When the Financial System Finds a Cockroach (November 3, 2025)

by Thomas Wash | PDF

No one likes finding a cockroach, especially in a place that should be clean, like the financial system. Last month, JPMorgan CEO Jamie Dimon issued a warning, suggesting that isolated loan failures — the “cockroaches” — are pointing to a much broader credit risk problem. He specifically flagged risky loan assets held by specialized lenders such as TriColor, stating that their poor performance is likely evidence of a generalized decay in loan quality across the consumer sector.

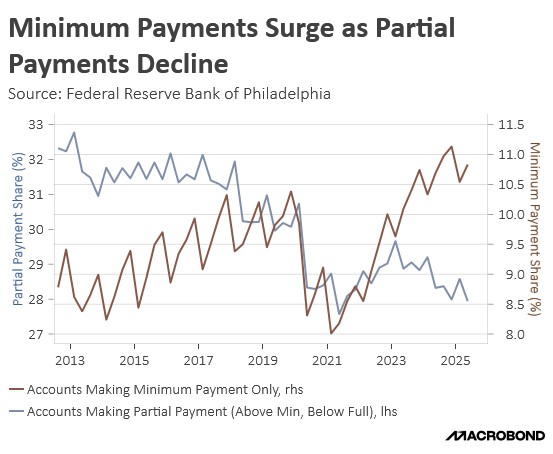

The deterioration in loan quality appears to reflect a mounting consumer debt burden that is now leading to significant household financial strain. Credit card delinquencies have surged to their highest level since the 2008 financial crisis, underscoring this pressure. In response, lenders are tightening underwriting standards and curbing new card issuance, particularly to subprime borrowers. This defensive shift indicates that the rise in defaults is largely concentrated among existing borrowers rather than driven by a fresh wave of risky lending. Yet, there is more to the story.

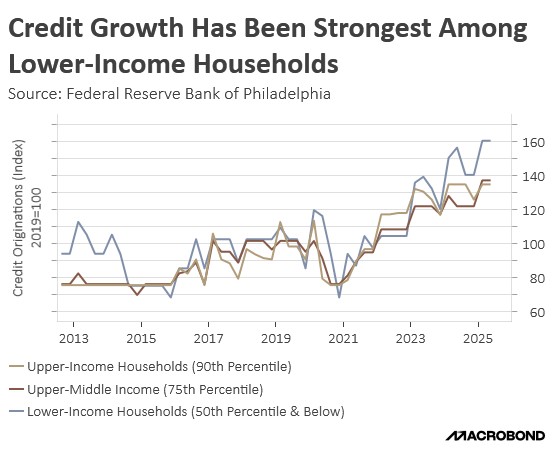

The recent rise in delinquencies can be partially traced to the massive expansion of consumer credit since 2019, especially among lower-income households. Credit availability for the bottom half of cardholders has surged nearly 60%, allowing many to maintain consumption amid persistent inflation. While this expansion has inevitably increased overall debt burdens, it has also enabled households to preserve spending power by spreading purchases into smaller, more manageable payments rather than paying the full cost upfront, even as real incomes have struggled to keep pace.

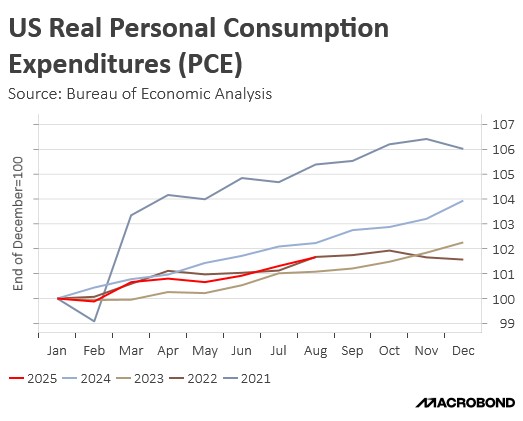

This surge in consumer credit has been a key mechanism sustaining consumption during recent periods of economic uncertainty. Despite repeated recession warnings over the last three years (citing the 2022 market contraction, 2023 failure of Silicon Valley Bank, and fleeting 2024 Sahm Rule alarm), aggregate consumption has remained remarkably resilient. While recent tariffs have slowed consumption compared to the previous year, the overall pace remains consistent with the strong trend that was set over the last four years.

While pockets of consumer weakness are evident, the broader systemic risk still appears to be limited. Subprime borrowers, despite the expansion of credit, hold a relatively small share of total household debt. According to Moody’s Analytics, subprime loans stood at $2.63 trillion in September, or about 15.3% of household debt. That’s a far cry from 2007 when subprime exposure reached $3.38 trillion and accounted for 28.2% of the total. The current, much smaller concentration suggests that today’s risks are more contained.

Furthermore, the immediate impact of weakness in the consumer credit market on the broader economy is likely to be muted. This continued stability in the economy is rooted in the labor market, where unemployment remains relatively low. Firms have largely retained staff, even while curtailing new hiring. The persistence of high employment means households should still be able to meet the minimum payments on credit cards and other consumer loans, suggesting their financial perseverance may last longer than many observers anticipate.

In addition, the overall US economy and total consumption expenditures are currently disproportionately dependent on high-income households. For example, the top 20% of earners account for approximately 40-50% of all consumer spending (depending on the specific measure and source). This significant concentration means that while low-income households may be forced to reduce spending due to financial strain, the overall momentum of the economy can be sustained by the resilience of the wealthiest earners.

As noted by JPMorgan, the appearance of “cockroaches” in consumer credit confirms a structural weakness. However, we conclude that this distress is a medium-term challenge, not a short-term systemic threat. This assessment is rooted in three factors: the resilience of the high-income consumer, the contained nature of subprime debt, and the strength of the jobs market. We therefore remain confident in projecting continued economic momentum and even an acceleration in economic growth next year, which should directly support strong corporate earnings and sustained broad-based support for equity markets.