Asset Allocation Bi-Weekly – The Case for New Home Sales (May 22, 2023)

by the Asset Allocation Committee | PDF

A common topic among the financial markets is the impact of rapid monetary policy tightening. After years of accommodative monetary policy, the spike in inflation caused by the pandemic has continued to persist. To address the inflation issue, the FOMC has lifted the policy target rate at the fastest pace in over 40 years. Rapid increases in the policy rate can often cause problems in the financial system which then filter into the real economy, and although unfortunate, such disruptions are often necessary in order to weaken demand and reduce inflation.

However, not all disruptions are created equal. In general, policymakers want to achieve lower inflation with the least disruption possible. This goal often means that policymakers want to avoid disturbing key asset markets, which, if adversely affected, could trigger widespread financial stress. The events surrounding the mortgage crisis in 2008 are a clear example of what not to do.

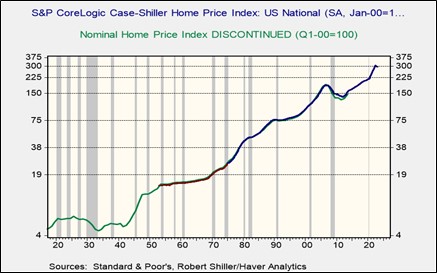

When we wrote our 2023 Outlook, one of the risks we cited was falling nominal home prices. The two worst financial crises in the past 90 years were both preceded by falling nominal home prices. We are currently seeing a modest decline in home prices.

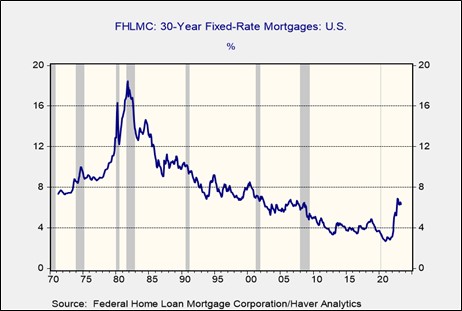

During the pandemic, working from home coupled with low mortgage rates led to strong home sales and swiftly rising home values. Rapid policy tightening has led to a jump in mortgage rates, which normally places downward pressure on home prices.

However, the impact from housing on the economy and financial system, so far, has been rather modest. On its face, this seems odd. The rise in interest rates should reduce the value of homes; after all, if it costs more to finance a home, then the value of that home should decline at some point.

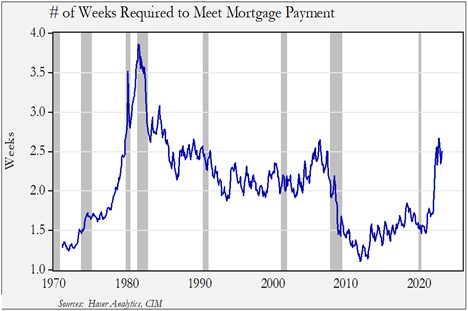

The chart above shows the number of weeks that a worker earning the average weekly wage for a non-supervisory position must allocate to service a mortgage at the going mortgage rate and the median existing home price. This series is a way of capturing affordability. The chart shows that during the Volcker Shock, a non-supervisory worker had to contribute almost a month’s worth of work to service a mortgage. After the shock, though, the market settled into a range of 2.0 to 2.5 weeks. Homes became remarkably affordable after the Great Financial Crisis, but the recent spike in interest rates has caused the number of weeks needed to afford a home to increase to the top of the range seen from 1985 through 2007.

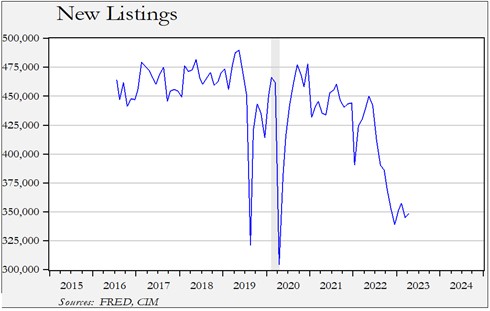

So, why haven’t home prices fallen to reflect the higher interest rates? Essentially, it appears that homeowners are reluctant to sell and give up their current low mortgage rates. Goldman Sachs reports that 99% of homeowners have a mortgage rate of 6% or less, whereas the current mortgage rate is 6.48%. This means that almost any homeowner that is selling a house to buy another one would need to be willing to accept a higher mortgage rate. The same research shows that 72% of homeowners have a rate of 4% or less, and 28% are at 3% or less. With labor markets remaining strong, there is little forced selling, and therefore we have seen a drop in listings.

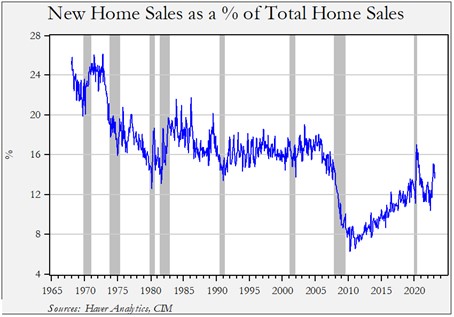

The data in the above chart, which originates from Realtor.com, shows that since mid-2022, new listing numbers have plunged. However, there is still strong demand for homes, especially since the millennial generation is hitting its home-buying years and is a large cohort. So, with current homeowners staying put, an opportunity for homebuilders has emerged as new homes may be the best alternative. We note that new home sales as a percentage of total sales have been rising.

New home sales relative to total sales dropped after the 2007-09 recession but steadily recovered, although the amount remained below the 16% level that was roughly the average from 1990 to 2005. New home sales spiked during the pandemic, and then declined, but have started to recover again.

What does all this tell us? New home sales relative to total sales have improved but remain below historical averages. Since the vast majority of existing homeowners with mortgages have interest rates below current mortgage rates, there is a clear disincentive to list one’s home for sale. To meet demand, homebuilders have an opportunity to build homes for new buyers. This situation has boosted the shares of homebuilders. Although this recent rally may extend, the risk to the position is a rise in unemployment that would be significant enough to trigger forced liquidations. Since we expect a recession over the next six to nine months, there is a risk that new homes could be facing competition from existing homes later this year.